Xpeng SWOT Analysis: Free PPT Template and In-Depth Insights (free file)

Unlock key insights into Xpeng with our free SWOT analysis PPT template. Dive deep into its business dynamics at no cost.

The Electric Vehicle Revolution is Charging Up

Electric vehicles (EVs) are no longer a futuristic concept—they are the present and future of transportation. As climate change and sustainability concerns intensify, consumers and governments embrace EVs as a greener alternative to gas-guzzling vehicles. China, the world's largest automotive market, is at the forefront of this seismic shift.

One company riding this electrifying wave is Xpeng - an ambitious Chinese innovative EV startup determined to redefine mobility.

Let's look in-depth at Xpeng's strengths, weaknesses, opportunities, and threats as it navigates the competitive EV landscape.

Introduction to Xpeng

Founded in 2014, Xpeng is a leading Chinese intelligent electric vehicle company headquartered in Guangzhou. It designs, develops, manufactures, and markets intelligent EVs with cutting-edge technology.

Xpeng's mission?

To drive the innovative EV transformation through innovation, shaping the mobility experience of the future. It aims to optimize this experience by in-house developing advanced driver-assistance systems, intelligent in-car operating systems, and core vehicle components like powertrains and electrical architectures.2

A Brief Look at the History of Xpeng

Xpeng began in 2014 when former Alibaba executive He Xiaopeng founded the company.

In 2018, it unveiled its first production model, the G3 SUV, followed by the P7 sedan in 2019. 2020 marked a pivotal year as Xpeng launched its US IPO, raising over $1.5 billion. The company then expanded its lineup with the P5 sedan in 2021 and the G9 SUV in 2022, solidifying its position in China's booming EV market. 2

What is the business model of Xpeng?

Xpeng's business model revolves around designing, manufacturing, and selling premium smart EVs with cutting-edge technology and connectivity features. I

t targets China's rapidly growing base of tech-savvy, middle-class consumers seeking a blend of performance, intelligence, and sustainability.

Unlike traditional automakers, Xpeng develops its core technologies in-house, including advanced driver-assistance systems (ADAS), intelligent operating systems, powertrains, and electrical architectures. This vertical integration approach optimizes the user experience and differentiates Xpeng's offerings.

The company sells its vehicles directly to consumers through its online and physical sales networks, bypassing the traditional dealership model. It also operates a self-owned charging station network to support its growing customer base. 4

Financials of Xpeng 2023

In 2023, Xpeng reported impressive financial results, reflecting the strong demand for its intelligent EVs:

- Total revenues reached RMB30.68 billion ($4.32 billion), a significant increase from previous years. 2

- Vehicle deliveries hit 141,601 units, up 17.3% year-over-year. 2

- Gross margin stood at 1.5% for the entire year. 2

- Cash reserves totaled RMB45.70 billion ($6.44 billion) as of December 31, 2023. 2

Despite supply chain challenges and COVID-19 disruptions, Xpeng's financial performance demonstrates its ability to scale production and meet growing customer demand in the competitive Chinese EV market. 24

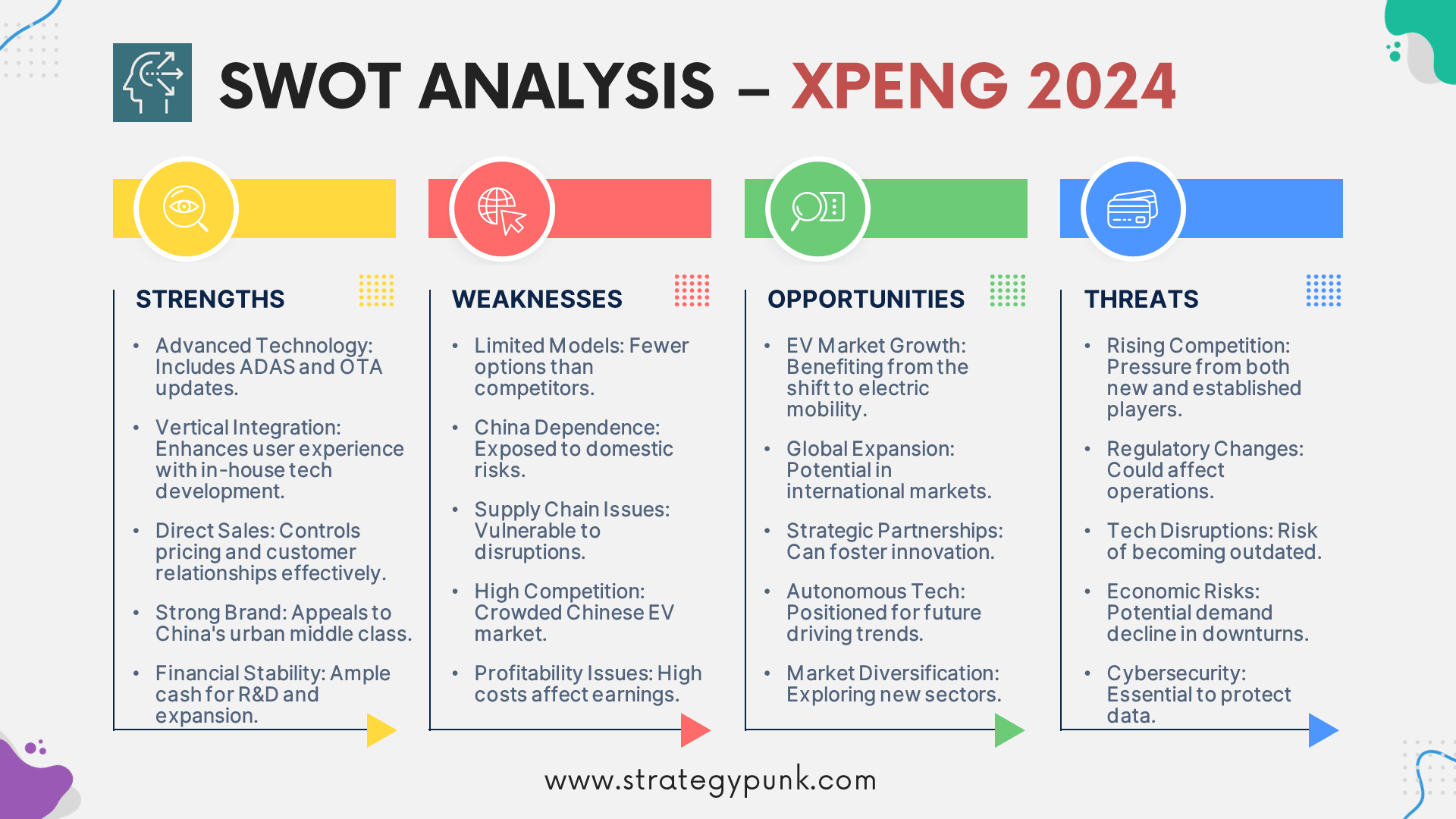

In-depth SWOT Analysis of Xpeng 2024

To better understand Xpeng's position and prospects, let's dive into a comprehensive SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis for 2024.

Xpeng's Strengths

- Cutting-Edge Technology: Xpeng's vehicles have advanced features, such as ADAS, intelligent operating systems, and over-the-air updates, appealing to tech-savvy consumers.

- Vertical Integration: Xpeng can optimize the user experience and differentiate its offerings by developing core technologies in-house.

- Direct Sales Model: By bypassing traditional dealerships, Xpeng can more effectively control pricing, branding, and customer relationships.

- Strong Brand Equity: Xpeng has cultivated a premium, tech-forward brand image resonating with China's urban middle class.

- Robust Financial Position: With substantial cash reserves, Xpeng can invest in R&D and expansion and weather market fluctuations.

Xpeng's Weaknesses

- Limited Product Portfolio: Xpeng currently offers a relatively small range of models compared to established automakers. 4

- Dependence on China Market: Most of Xpeng's sales come from the Chinese market, exposing it to domestic economic and regulatory risks. 23

- Supply Chain Vulnerabilities: Like other automakers, Xpeng is susceptible to supply chain disruptions and shortages of critical components. 24

- Intense Competition: The Chinese EV market is highly competitive, with numerous domestic and international players vying for market share. 4

- Profitability Challenges: Despite solid revenue growth, Xpeng has not achieved consistent profitability due to high R&D and operational costs. 2

Xpeng's Opportunities

- Rapidly Growing EV Market: The global shift towards electric mobility presents immense growth opportunities for Xpeng, especially in China. 4

- International Expansion: While currently focused on China, Xpeng could leverage its technology and brand to expand into other markets. 1

- Strategic Partnerships: Collaborating with tech giants, suppliers, or other automakers could unlock synergies and accelerate innovation.

- Autonomous Driving: Xpeng's investments in ADAS position it well to capitalize on the future of autonomous driving technology.

- Diversification: To drive growth, Xpeng could explore adjacent markets, such as energy solutions, mobility services, or software platforms.

Xpeng's Threats

- Intensifying Competition: Established automakers and well-funded EV startups are intensifying competition in the Chinese and global markets.

- Regulatory Risks: Changes in government policies, subsidies, or emissions standards could impact Xpeng's operations and profitability. 24

- Technology Disruptions: Rapid advancements in EV technology, batteries, or autonomous driving could render Xpeng's offerings obsolete.

- Economic Uncertainties: A slowdown in the Chinese or global economy could dampen consumer demand for Xpeng's premium EVs. 24

- Cybersecurity Risks: As a tech-focused company, Xpeng must safeguard against potential cybersecurity threats and data breaches.

Xpeng SWOT Analysis Summary

Internal Factors

Xpeng's strengths lie in its cutting-edge technology, vertical integration, direct sales model, substantial brand equity, and robust financial position.

However, its weaknesses include a limited product portfolio, dependence on the Chinese market, supply chain vulnerabilities, intense competition, and profitability challenges.

External Factors

Externally, Xpeng faces opportunities in the rapidly growing EV market, potential international expansion, strategic partnerships, autonomous driving, and diversification.

Conversely, threats include intensifying competition, regulatory risks, technology disruptions, economic uncertainties, and cybersecurity risks.

Xpeng Strategies for Success

To capitalize on its strengths and opportunities while mitigating weaknesses and threats, Xpeng should consider the following strategies:

- Accelerate Product Lineup Expansion: Introduce new models across various segments to broaden its appeal and reduce reliance on a few key products.4

- Pursue Calculated International Expansion: Carefully evaluate and enter select overseas markets to reduce dependence on China and tap into global EV demand.

- Double Down on Technology Leadership: To stay ahead of the innovation curve, maintain aggressive R&D investments in ADAS, autonomous driving, and software.

- Forge Strategic Partnerships: Collaborate with tech giants, suppliers, or other automakers to access complementary technologies, resources, and markets.

- Optimize Cost Structure: Implement operational efficiencies, supply chain improvements, and economies of scale to enhance profitability and competitiveness. 3

- Enhance Cybersecurity Measures: Prioritize robust cybersecurity protocols and data protection to safeguard customer trust and sensitive information.

- Diversify Revenue Streams: Explore adjacent markets like energy solutions, mobility services, or software platforms to reduce reliance on vehicle sales.

Frequently Asked Questions

What is Xpeng's business model?

Xpeng designs, manufactures, and sells premium intelligent electric vehicles with cutting-edge technology like ADAS and innovative operating systems. It targets tech-savvy Chinese consumers through a direct sales model and operates its charging station network. 4

How does Xpeng differentiate itself from competitors?

Xpeng's key differentiators include its focus on advanced technology, vertical integration of core components, premium brand positioning, and direct sales approach bypassing traditional dealerships. 14

What are Xpeng's financial performance highlights?

In 2023, Xpeng reported total revenues of RMB30.68 billion ($4.32 billion), vehicle deliveries of 141,601 units, a gross margin of 1.5%, and cash reserves of RMB45.70 billion ($6.44 billion). 2

What are Xpeng's significant strengths and weaknesses?

Xpeng's strengths include cutting-edge technology, vertical integration, a direct sales model, substantial brand equity, and a robust financial position. Its weaknesses are a limited product portfolio, dependence on China, supply chain vulnerabilities, intense competition, and profitability challenges. 4

What strategies should Xpeng pursue for future success?

Xpeng's key strategies include expanding its product lineup, pursuing calculated international expansion, maintaining technology leadership, forging strategic partnerships, optimizing its cost structure, enhancing cybersecurity measures, and diversifying revenue streams.

Xpeng SWOT Analysis PowerPoint Template

free and fully editable PPT template

A SWOT analysis evaluates the strengths, weaknesses, opportunities, and threats impacting a company.

This free editable PowerPoint template provides a SWOT analysis framework to evaluate Xpeng's internal strengths and weaknesses and external opportunities and threats.

Xpeng SWOT Analysis PowerPoint Template

Xpeng SWOT Analysis PDF Template

Discover more

Clickworthy Resources

SWOT Analysis: Free PowerPoint Template

This PowerPoint slide deck contains five different layouts to complete a SWOT analysis.

New! SWOT Framework & Free PPT Template - 2024 Edition

Dive into the 2024 Edition of our SWOT Analysis guide, complete with a free PowerPoint template. This resource covers the essentials of conducting a SWOT analysis, its benefits, and practical application tips, including a case study on Mercedes Benz.

SWOT Analysis of Tesla: Free Templates and In-Depth Insights 2023

Delve into an in-depth SWOT analysis of Tesla, exploring the electric giant's strengths, weaknesses, opportunities, and threats. Uncover the driving forces behind Tesla's success.

BYD SWOT Analysis: Free PPT Template and In-Depth Insights 2024

Download the free BYD SWOT Analysis PowerPoint Template 2024.

Beyond Electric Dreams: Unveiling BYD Through PESTLE Analysis (FREE PPT)

Dive into the future with our FREE PPT on Beyond Electric Dreams: Unveiling BYD. Comprehensive PESTLE Analysis reveals BYD's potential & challenges.

Porter's 5 Forces Analysis for BYD: Free PPT Template and In-Depth Insights 2024

Download our free PowerPoint template for Porter's 5 Forces Analysis, specifically designed for BYD. Our 2024 guide will give you in-depth insights into the competitive landscape.