Decoding Mergers and Acquisitions: A Basic Overview

Dive into the exhilarating realm of mergers and acquisitions (M&A) with us! Discover key players, varied deal structures, and reasons behind M&A decisions. Bonus: A free PowerPoint Template for your M&A endeavor!

Welcome to the exciting world of mergers and acquisitions (M&A)!

Let's begin by understanding that M&A refers to companies buying and selling each other. We see this happening when, for instance, the owner of company A decides they'd like to trade their business responsibilities for a more relaxed lifestyle.

There are different deal structures in M&A.

These include asset sales, where a business's physical and intangible assets are sold off; equity sales, where the buyer acquires the industry by purchasing its equity; and mergers, where two companies combine and one ceases to exist. These structures show up at different stages of the market, each with its specific advantages and challenges.

So, why do people engage in M&A?

Sellers may want to exit their business for various reasons, such as tiredness, poor prospects, or difficulty staying competitive. On the other hand, buyers often view acquisitions as a shortcut to entering new markets or expanding their existing business. Consider Facebook buying WhatsApp as an example!

Now, who are the key players in the M&A market?

Business brokers and investment bankers work in marketing the company. These professionals play a role similar to real estate agents, helping businesses find potential buyers. They create a confidential information memorandum, contact potential buyers, and may even run auctions.

Corporate lawyers also play a crucial role in M&A. They help draft contracts, conduct due diligence, and advise on deal structures and risks. They are responsible for translating verbal agreements into documented, legal terms.

Other significant contributors to the process include business appraisers, accountants, tax advisors, and integration consultants. They all have specialized roles that help ensure a successful merger or acquisition.

Finally, while M&A might sound glamorous, it requires careful planning and execution.

The M&A process can be challenging and rewarding for each player involved, with life-changing consequences. Whether you're considering selling, buying, or simply interested in the process, the world of M&A is filled with fascinating stories.

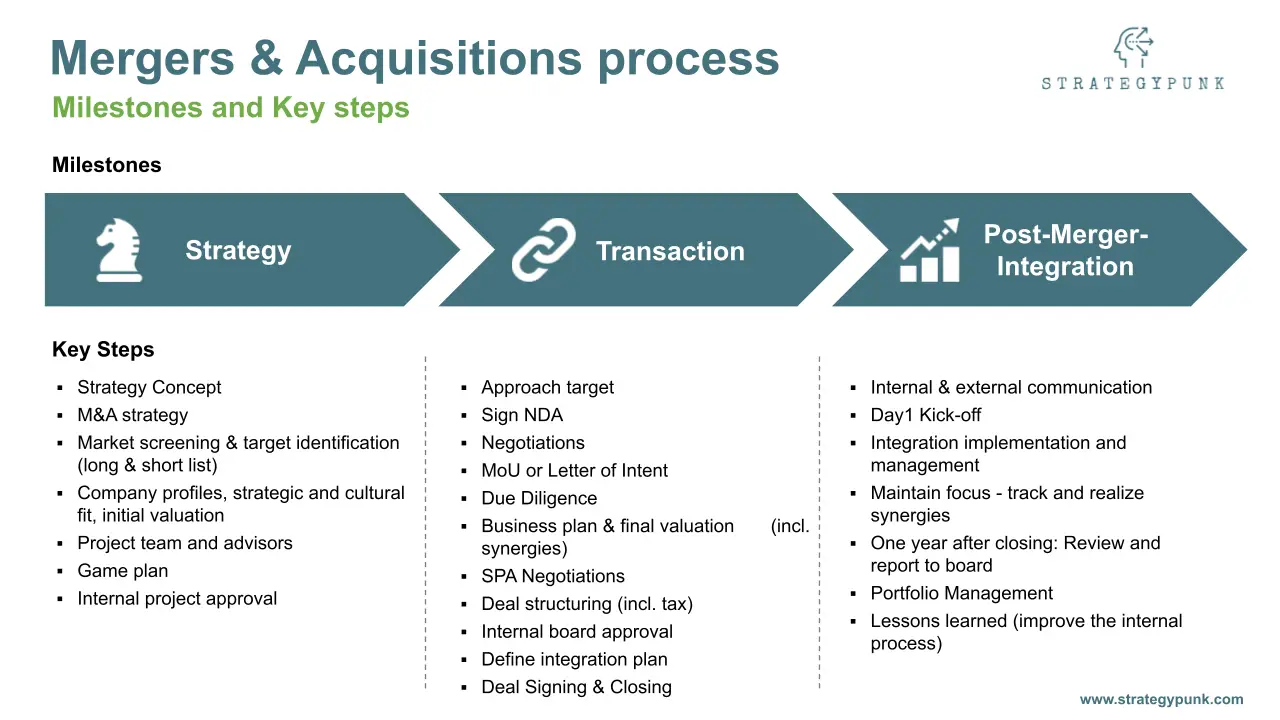

Our process for mergers and acquisitions and our complimentary PowerPoint Template serves as a solid foundation. It will help you efficiently through your M&A endeavor.

The M&A process guide and free template includes

Summary

- Mergers and acquisitions (M&A) involve companies buying and selling each other.

- There are three main types of deal structures in M&A: asset sales, stock or equity sales, and mergers.

- Mergers are less common and typically occur at the higher end of the market, driven by tax considerations or the ease of combining two companies.

- Sellers may choose M&A to take chips off the table, compete more effectively, or secure their future in a challenging market.

- The key players in M&A include business brokers, investment bankers, corporate lawyers, accountants, tax advisors, and consultants.

- Use the StrategyPunk M&A Process to support you through implementing your M&A endeavor.