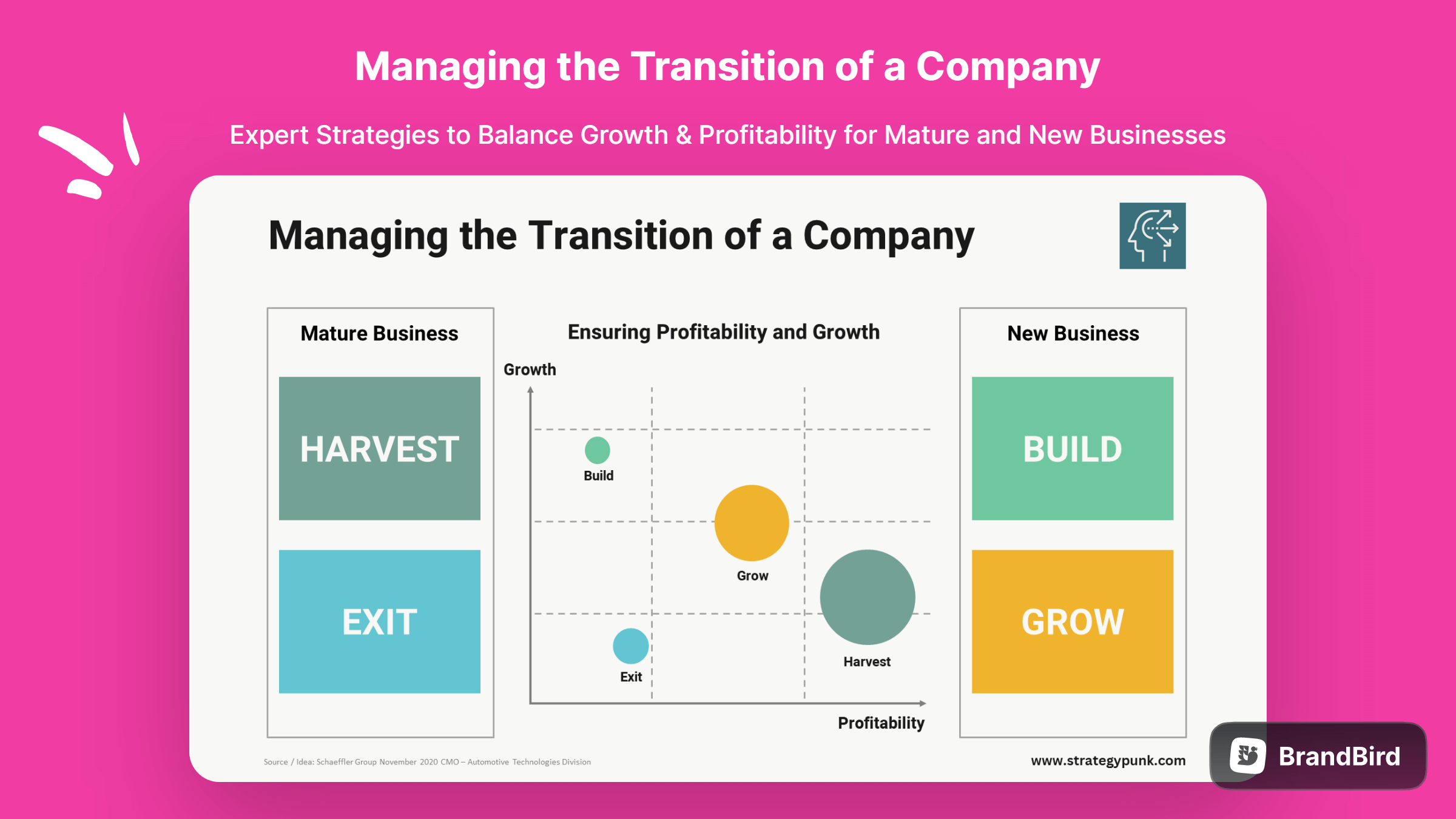

Managing Business Transition: Expert Strategies to Balance Growth & Profitability for Mature and New Businesses

Discover expert strategies for managing company transitions, and balancing growth and profitability in mature and new businesses. Download our Business Transition Strategy Template.

Introduction

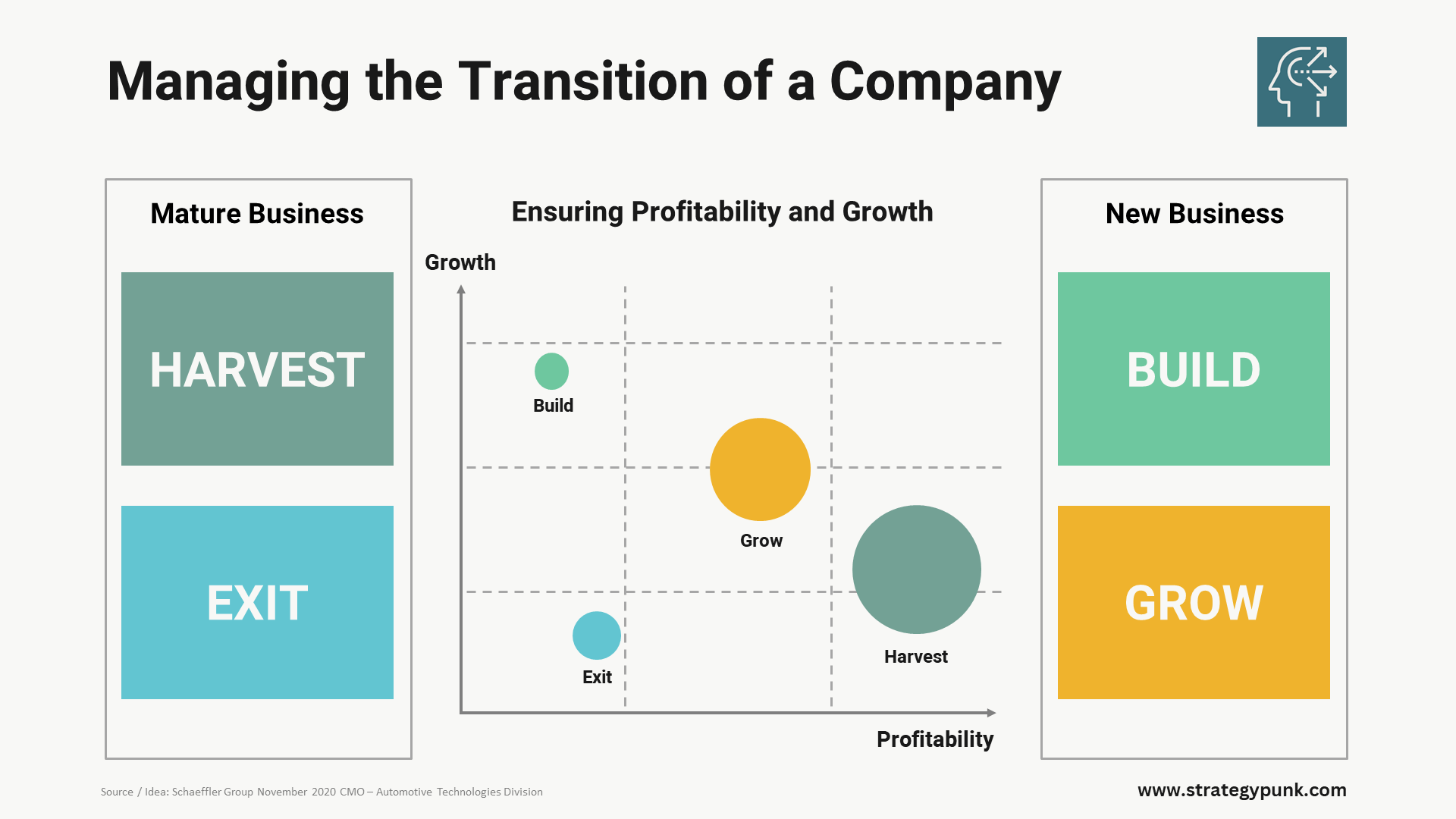

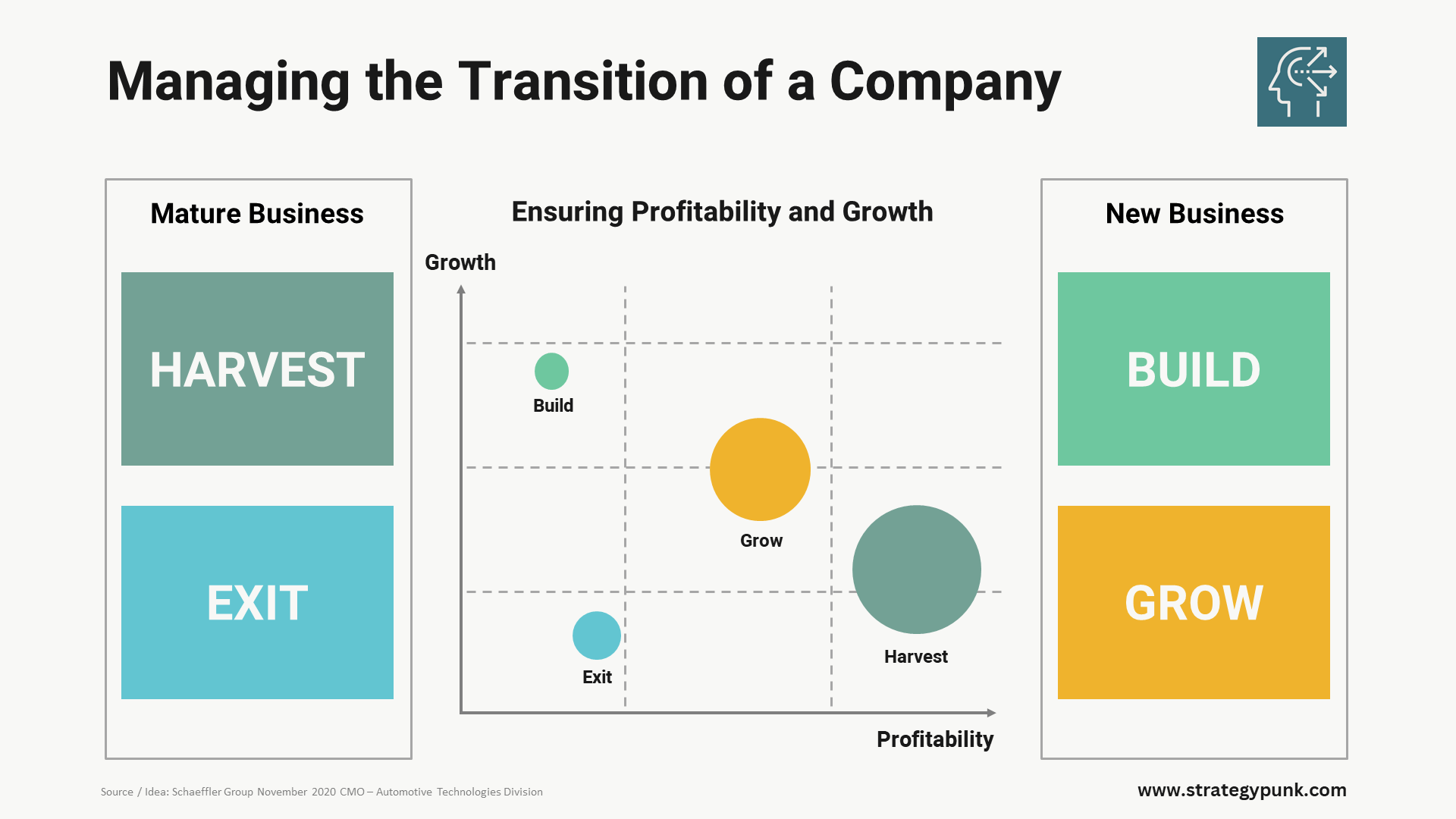

Managing a company's transition from a mature business to a new growth phase can be challenging. The company needs to ensure its mature business's profitability while investing in new business areas to achieve substantial growth. This is where the four quadrants model of harvest, build, grow, and exit can be helpful.

The harvest quadrant focuses on maximizing profits from the mature business by reducing costs and optimizing operations. The build quadrant involves investing in new business areas and developing new products or services. The grow quadrant focuses on scaling up the new business areas to achieve substantial growth. Finally, the exit quadrant involves divesting from non-core or underperforming business areas.

This model allows companies to effectively manage the transition from a mature business to a new growth phase. It will enable them to balance the need for profitability with investing in new areas to achieve substantial growth. Companies can ensure a smooth transition and long-term success by strategically allocating resources to each quadrant.

Understanding the Four Quadrants: Harvest, Build, Grow, and Exit

Managing a company's transition from a mature business to a new growth phase requires a clear understanding of the four quadrants: Harvest, Build, Grow, and Exit. Each quadrant represents a different phase in the company's lifecycle and requires a different approach to ensure profitability and strong growth.

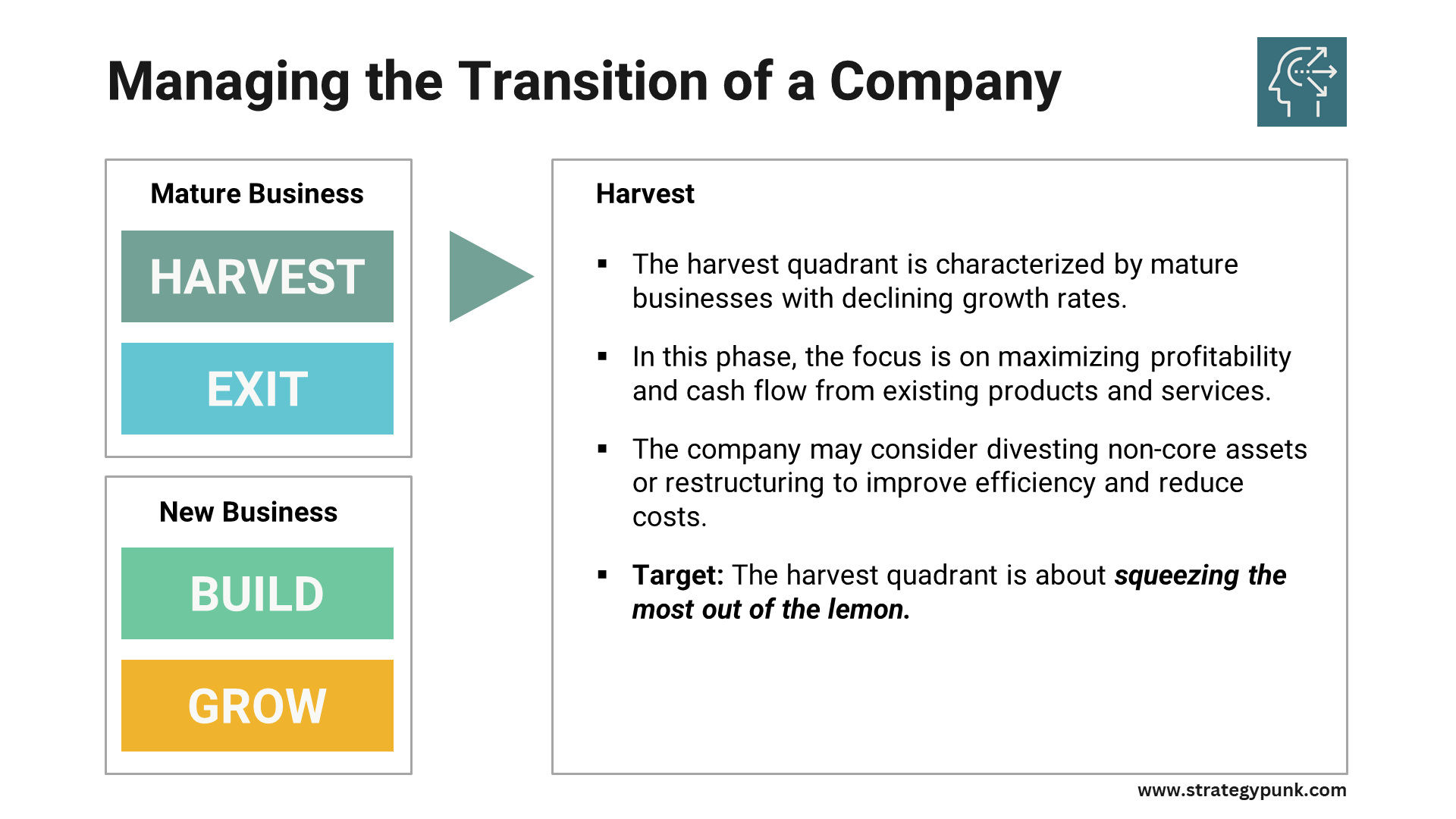

Harvest

Mature businesses with declining growth rates characterize the harvest quadrant. In this phase, the focus is on maximizing profitability and cash flow from existing products and services. The company may consider divesting non-core assets or restructuring to improve efficiency and reduce costs. According to SOMAmetrics, the harvest quadrant is about "squeezing the most out of the lemon."

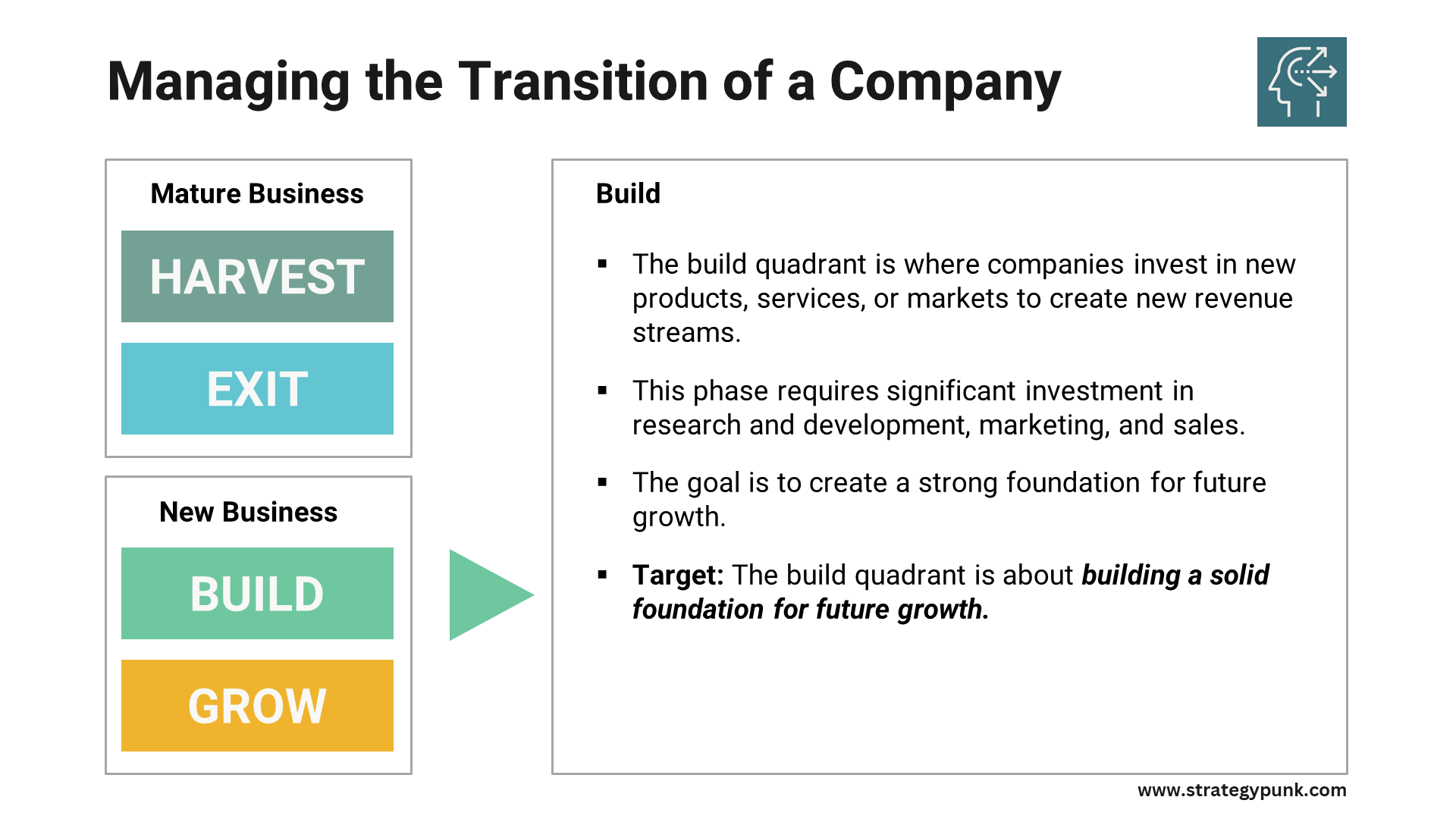

Build

In the build quadrant, companies invest in new products, services, or markets to create new revenue streams. This phase requires significant investment in research and development, marketing, and sales. The goal is to create a strong foundation for future growth. According to Succeed As Your Own Boss, the build quadrant is about "building a solid foundation for future growth."

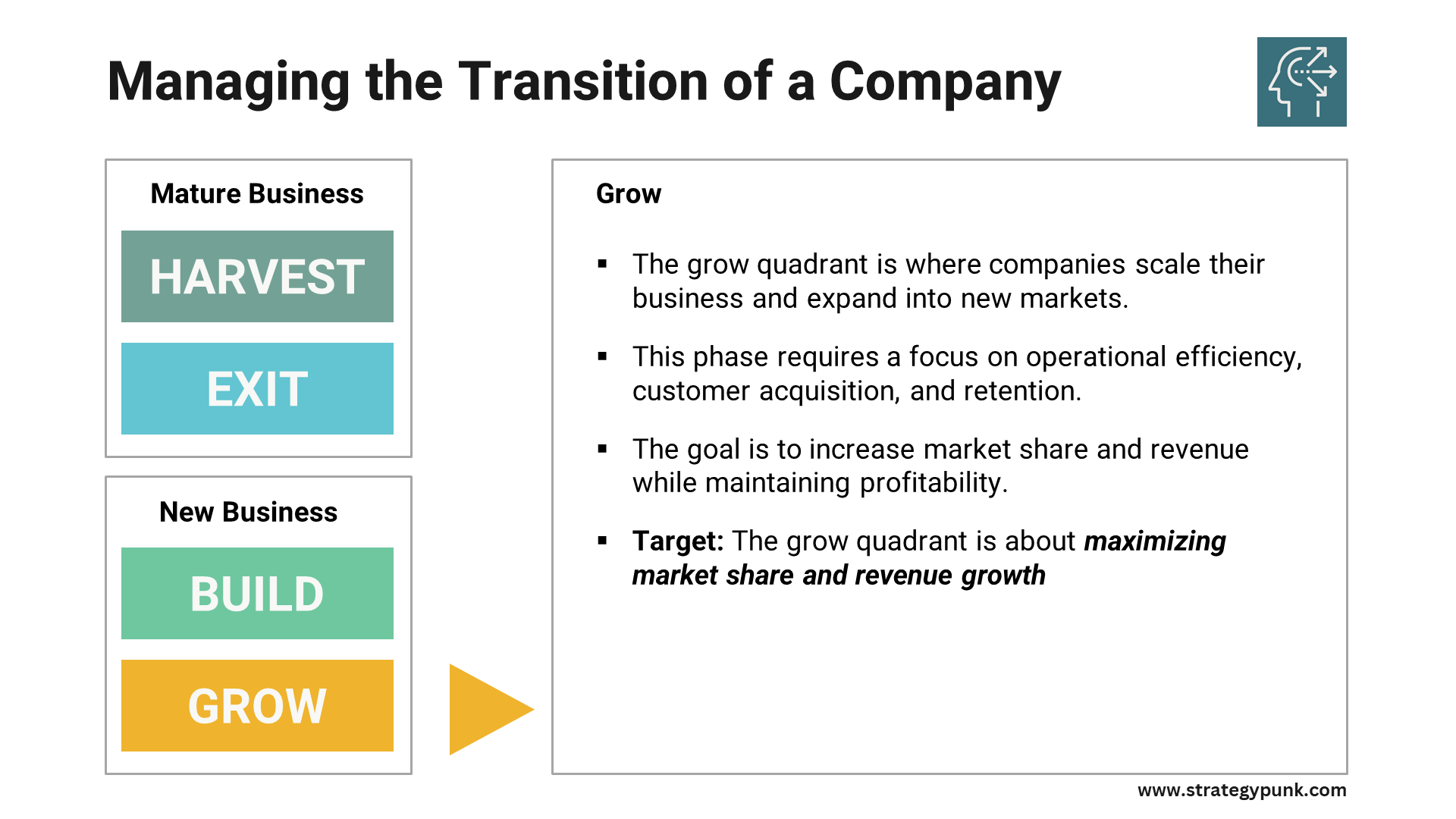

Grow

The growth quadrant is where companies scale their business and expand into new markets. This phase focuses on operational efficiency, customer acquisition, and retention. The goal is to increase market share and revenue while maintaining profitability. PK Marketing says the growth quadrant is about "maximizing market share and revenue growth."

Exit

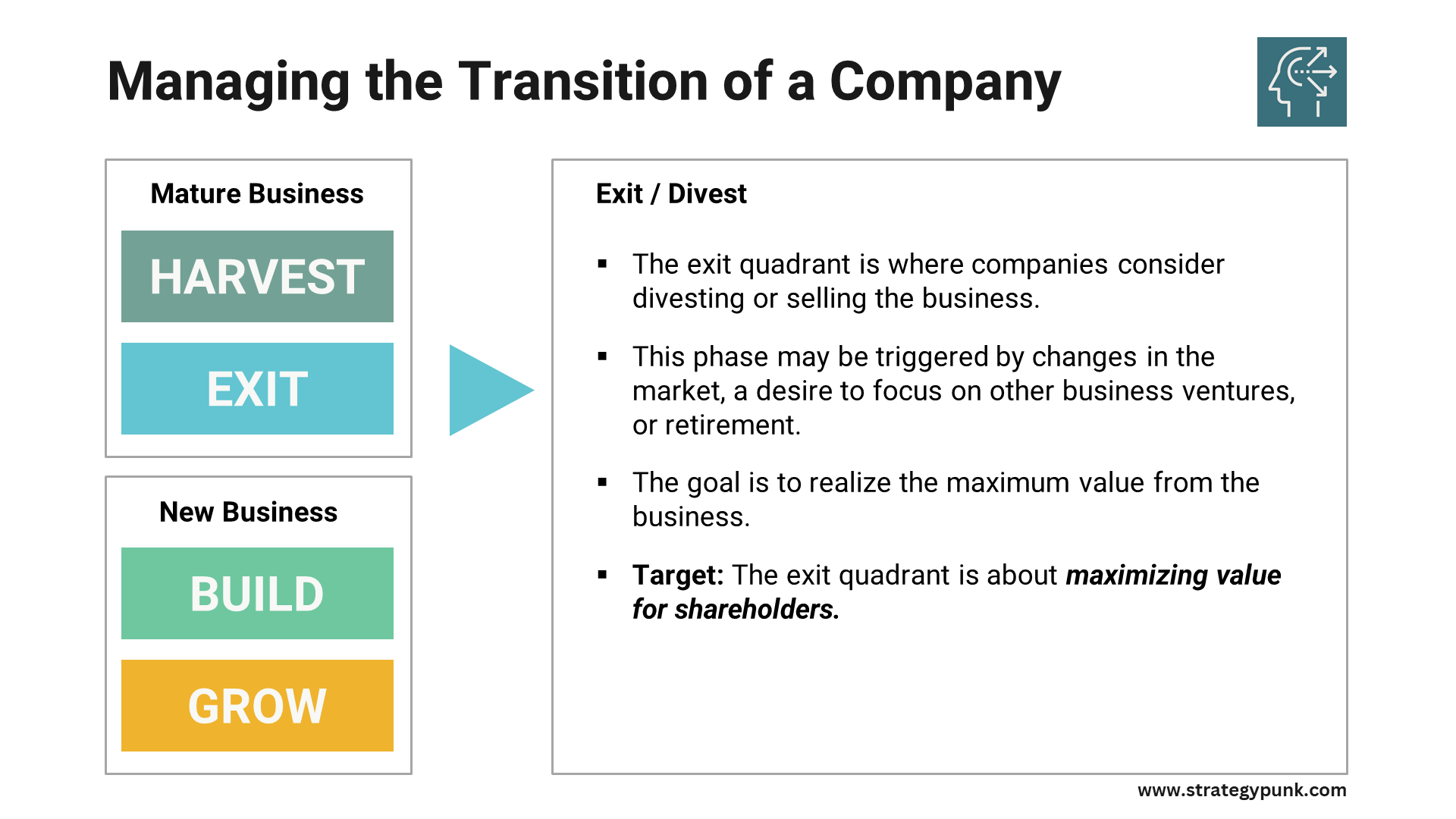

The exit quadrant is where companies consider divesting or selling the business. This phase may be triggered by changes in the market, a desire to focus on other business ventures or retirement. The goal is to realize the maximum value from the business. According to Caryn Marooney, the exit quadrant is "maximizing value for shareholders."

Understanding the four quadrants is essential for managing a company's transition from a mature business to a new growth phase. Each quadrant requires a different approach to ensure profitability and strong growth. By identifying which quadrant the company is in, leaders can make informed decisions and take the necessary actions to ensure success.

Managing the Harvest Quadrant

The harvest quadrant is when a company has reached its maturity and focuses on maximizing profits by selling the company or its assets. This stage is critical as it determines the success of the company and its future growth.

The following are some strategies that can be used to manage the harvest quadrant:

- Focus on core business: During the harvest quadrant, it is essential to focus on the core business and divest non-core assets. This will help maximize profits and ensure the company is in a strong position for sale.

- Streamline operations: To maximize profits, it is essential to streamline operations and reduce costs. This can be achieved through process improvement, automation, and outsourcing.

- Manage cash flow: Cash flow management is critical during the harvest quadrant. The focus should be maximizing cash flow and reducing debt to make the company more attractive to potential buyers.

According to IntechOpen, harvesting involves recovering the value by selling the company or its assets. It is essential to clearly understand the value of the company and its support to ensure that they are sold at the right price.

Another strategy that can be used during the harvest quadrant is to focus on the customer. According to SOMAmetrics, companies focusing on the customer during the harvest quadrant are more likely to maximize profits and ensure a successful sale. This can be achieved through customer retention strategies and exceptional customer service.

Finally, it is essential to have a clear exit strategy during the harvest quadrant. According to Hartford, having a clear exit strategy will help ensure the company is sold at the right time and for the right price. This can be achieved through careful planning and consultation with financial advisors and other experts.

Managing the Build Quadrant

When a company is in the Build quadrant, it is focused on building and expanding its new business. This is a crucial phase for the company's long-term success, setting the foundation for future growth.

Here are some critical strategies for managing the Build quadrant:

- Invest in Research and Development: To build a strong new business, a company must invest in research and development to create innovative products and services that meet the needs of its target market. This requires significant time and resources, but it is essential for long-term success.

- Focus on Customer Acquisition: In the Build quadrant, a company must acquire new customers for its new business. This requires a strong marketing strategy that targets the company's ideal customer and communicates the unique value proposition of the company's products or services.

- Build a Strong Team: Building a solid team is essential for success in the Build quadrant. The company must hire talented individuals who are passionate about the company's mission and have the skills necessary to drive growth and innovation.

According to SOMAmetrics, the Build quadrant has high investment and growth potential. However, it is also a risky phase, as the company is still building its new business and has yet to achieve profitability. Therefore, it is essential for the company to closely monitor its financials and make adjustments as necessary to ensure that it stays on track to achieve profitability in the future.

Another critical strategy for managing the Build quadrant is establishing partnerships and collaborations. According to the Foresight Report, partnerships can help companies access new markets, technologies, and resources that they may need help to access. By partnering with other companies or organizations, a company can accelerate its growth and increase its chances of success in the new business.

Managing the Build quadrant requires strategic planning, strong leadership, and a willingness to take risks. Investing in research and development, focusing on customer acquisition, building a solid team, monitoring financials, and establishing partnerships can increase its chances of success in the Build quadrant and set the stage for long-term growth and profitability.

Managing the Grow Quadrant

When a company is in the growth quadrant, it is essential to expand the business and increase market share. This can be achieved through a combination of organic growth and acquisitions. It is essential to have a clear growth strategy that considers the company's strengths and weaknesses and the competitive landscape.

One key aspect of managing the grow quadrant is to focus on innovation. This can involve developing new products or services, or improving existing ones. Staying ahead of the competition is crucial to continuously innovating and improving the customer experience.

Another critical aspect of managing the grow quadrant is to focus on customer acquisition and retention. This can be achieved through targeted marketing campaigns and by providing excellent customer service. Understanding your target market's needs and preferences and tailoring your products and services is essential.

According to SOMAmetrics, managing the growth quadrant requires a focus on scaling the business and increasing market share. This can be achieved through a combination of organic growth and acquisitions. It is essential to have a clear growth strategy that considers the company's strengths and weaknesses and the competitive landscape.

One effective way to manage the growth quadrant is to develop a strong sales team. This can involve hiring and training salespeople and providing them with the tools and resources they need to succeed. It is essential to have a transparent sales process in place, as well as metrics for measuring success.

Managing the Exit Quadrant

Exiting a business is a complex process that requires careful planning and execution. The exit quadrant is the final stage of the Four Quadrants Model of High Growth, which involves selling the company or transferring ownership to another entity. This section will discuss the key factors to consider when managing the exit quadrant.

Factors to Consider

When managing the exit quadrant, it is essential to consider the following factors:

- Valuation: The company's value must be determined to ensure it is sold relatively. This can be done by conducting a business valuation or seeking the advice of a professional.

- Timing: The timing of the sale is crucial to ensure that the company is sold at the right time to maximize profits. Market conditions, industry trends, and the company's financial health can influence this.

- Buyer: The buyer must be carefully selected to ensure they have the financial resources and expertise to manage the company effectively. This can involve conducting due diligence and negotiating with potential buyers.

- Legal Considerations: The sale's legal aspects must be carefully considered to ensure that the transaction is legally binding and protects the interests of all parties involved. This can include drafting a purchase agreement and seeking legal advice.

Strategies for Exiting

Several strategies can be used to exit a business:

- Sell to a strategic buyer: This involves selling the company to a competitor or another company in the same industry. This can provide access to new markets and customers and may result in a higher sale price.

- Sell to a financial buyer: This involves selling the company to a private equity firm or other financial institution. This can provide access to capital and expertise to support growth and expansion.

- Initial Public Offering (IPO): This involves listing the company on a stock exchange and selling shares to the public. This can provide access to capital and increase the visibility and credibility of the company.

It is essential to carefully consider each strategy and select the most appropriate for the company and its goals.

Overall, managing the exit quadrant requires careful planning and execution to ensure that the company is sold at a fair price and that all parties' interests are protected. By considering the key factors and selecting the most appropriate strategy, companies can successfully exit and move on to new opportunities.

Challenges in Managing the Transition of a Company

Managing a company's transition can be challenging, as it involves balancing the needs of the mature business with the growth of a new business. Here are some of the challenges that companies may face:

- Resistance to change: Employees and stakeholders may resist change, especially if they have been with the company for a long time. It is essential to communicate the reasons for the transition and involve them as much as possible.

- Managing cash flow: As the company transitions, it may experience cash flow challenges due to investments in new businesses or divestments in a mature industry. Having a clear plan for managing cash flow during this period is vital.

- Retaining key employees: As the company transitions, key employees may leave due to uncertainty or lack of alignment with the new direction. It is essential to identify and retain key employees who are critical to the success of the transition.

- Managing risk: The transition may involve entering new markets or developing new products, which can be risky. Conducting thorough market research and developing a clear risk management plan is essential.

According to a study by the OECD, managing a company's transition requires a strategic approach that balances short-term and long-term goals. The study recommends companies adopt a portfolio approach, working different business units as separate portfolios with other objectives and strategies. This approach allows companies to allocate resources and manage risk more effectively.

Another challenge in managing a company's transition is deciding when to exit a mature business. According to a report by Amazon S3, companies may exit a mature business for various reasons, such as declining profitability or lack of strategic fit. It is vital to have a clear exit strategy and plan for divesting assets or selling the business.

In conclusion, managing a company's transition requires careful planning, communication, and execution. Companies must balance the needs of the mature business with the growth of new business, manage cash flow, retain critical employees, manage risk, and have a clear exit strategy. Adopting a portfolio approach and allocating resources strategically can help companies manage the transition more effectively.

Source: OECD-G20-Paper-Innovation-and-Green-Transition.pdf, Managing growth, and transition - Amazon S3

Conclusion

Managing a company's transition is a complex process that requires careful planning and execution. The four quadrants of the high growth model - harvest, build, grow, and exit - provide a valuable framework for companies to effectively manage their mature and new businesses.

The harvest quadrant is essential for companies to maximize the profitability of their mature businesses. By optimizing their operations and reducing costs, companies can generate cash flow that can be reinvested in their new businesses. This quadrant is critical for maintaining the financial health of the company.

The build quadrant is where companies invest in developing new products or services. By leveraging their existing capabilities, companies can create new revenue streams that will drive growth in the future. This quadrant is essential for companies to stay competitive and relevant.

The growth quadrant is where companies focus on scaling their new businesses. By investing in marketing and sales, companies can increase their customer base and generate more revenue. This quadrant is critical for companies to achieve sustainable growth and profitability.

The exit quadrant is where companies divest their non-core businesses or assets. By selling off these businesses, companies can generate cash that can be reinvested in their core businesses or used to pay off debt. This quadrant is essential for companies to optimize their portfolio and focus on their core competencies.

In conclusion, managing a company's transition is a challenging but necessary process. By using the four quadrants model of high growth, companies can ensure the profitability of their mature businesses and the strong growth of their new businesses. Companies must balance their short-term and long-term goals and make strategic decisions that will drive their success in the future.

Other Useful Templates and Guides to Manage Your Business Transition

Navigate the Road to Success: Strategic Roadmap Template (Free PowerPoint)

Strategic Focus Framework: The Key to Business Success (Free PPT Template)

Business Transition Strategy Template

Free and fully editable PowerPoint Template

Ready to master the art of business transitions? 🔄

Download our FREE, fully editable Business Transition Plan Template!

I'd like to hear your expert strategies to balance growth & profitability for both mature and new businesses.

Log in to access the link to the PowerPoint and PDF template below. 🔓🌟