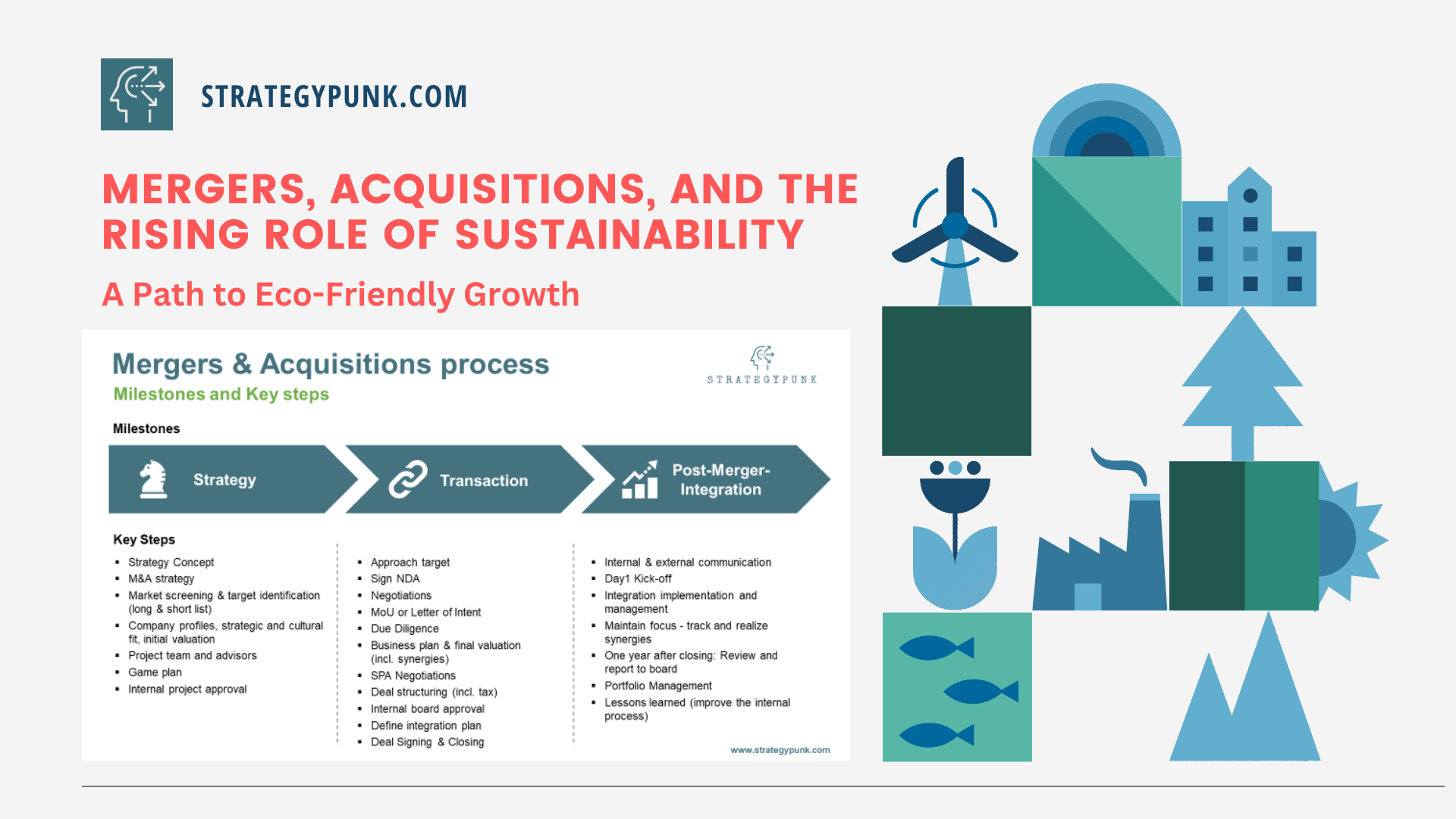

Mergers, Acquisitions, and the Rising Role of Sustainability

ESG is reshaping M&A, affecting deal valuation, investor demands, regulatory compliance, and integration strategies. Learn more...

When we say "mergers and acquisitions," what's the first thing that comes to mind? Probably not sustainability. But that's changing and fast.

M&A traditionally evokes thoughts of financial statements, asset valuations, and strategic synergies.

However, a new factor is steadily gaining prominence in this arena: sustainability, specifically companies' Environmental, Social, and Governance (ESG) sustainability scores.

How is ESG impacting the M&A process?

ESG (Environmental, Social, and Governance) factors are increasingly critical in mergers and acquisitions (M&A). This trend is driven by growing awareness of sustainability issues, changing consumer behavior, regulatory shifts, and the strategic imperative to future-proof businesses.

Let's explore these critical impact dimensions on the M&A process in detail.

- Due Diligence: The first point of impact comes in the due diligence phase of M&A. Companies are now carefully analyzing potential targets' ESG performance and risks. A target company with poor ESG credentials may be viewed as a liability, given the potential for reputational damage, regulatory penalties, or operational disruptions. Therefore, a strong ESG record can significantly enhance a company's attractiveness as an acquisition target.

- Valuation: ESG factors are increasingly integrated into the valuation models used in M&A transactions. Firms with robust ESG practices may command a premium in the market. Conversely, companies with ESG risks might be devalued, reflecting the potential costs of addressing these issues post-acquisition.

- Investor Pressure: Investors are becoming more sustainability-focused and demanding that companies they invest in consider ESG factors. This influences M&A activity, as firms must consider ESG compatibility when contemplating acquisitions, lest they alienate their socially conscious investors.

- Regulatory Compliance: Regulatory bodies worldwide are tightening ESG reporting and compliance requirements. Acquiring a company with poor ESG standards could lead to significant costs for bringing the acquired entity into compliance, impacting the overall transaction economics.

- Strategic Alignment: Companies recognize that incorporating ESG factors into their strategy can lead to long-term competitive advantages. Acquiring firms with strong ESG practices can enhance a company's brand, improve stakeholder relations, and drive innovation.

- Post-acquisition Integration: Once the deal is closed, ESG considerations are crucial in integration planning and execution. The acquiring company needs to align the acquired entity's ESG policies, practices, and reporting with its own, which can be a complex and resource-intensive process.

Companies that effectively navigate these ESG challenges and opportunities can gain a competitive edge, drive sustainable growth, and create long-term shareholder value.

However, this impact's full extent and nuances may vary by industry, geography, and specific company circumstances.

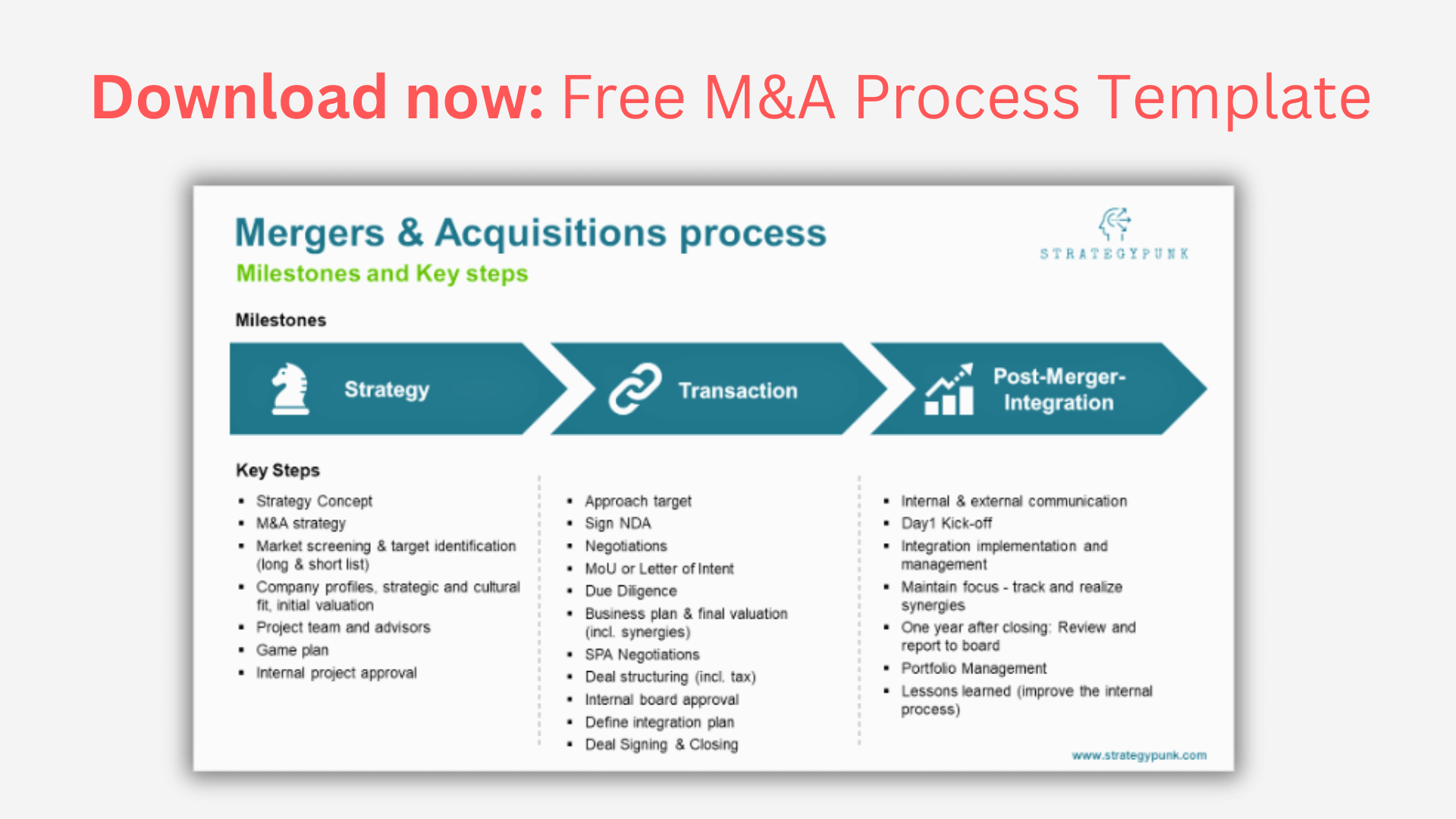

Download now: Free M&A Process Template.

What is Environmental Due Diligence in M&A?

Environmental due diligence in mergers and acquisitions (M&A) is like the thrilling detective work of the business world. Imagine yourself with a magnifying glass, sifting through a company's environmental record and spotting potential liabilities hiding in the shadows.

You're diving deep into the company's past, present, and future environmental impacts. From compliance with environmental laws to handling hazardous materials, the chase is on to uncover any lurking issues that could spell trouble down the line.

It's a comprehensive environmental health check that protects your investment and avoids costly ecological liabilities. It shields your company from unexpected setbacks, ensuring a smooth and successful merger or acquisition.

It's not just about ticking boxes; it's about safeguarding your future and contributing to a more sustainable world. So, whether buying or selling, remember - environmental due diligence is your secret weapon in the M&A game!

Sustainability Scores in M&A: The New Power Player

In recent years, the focus of M&A has extended beyond purely financial, and ESG sustainability scores have emerged as a significant consideration in this process. A study examining 100 leading pharmaceutical companies, accounting for 30% of all M&A transactions over a decade, demonstrated this new trend. The study found a direct and positive link between the M&A process and the company's performance.

It also found that the ESG score had a positive and immediate impact on company performance, suggesting that a high ESG score could lead to an increase in company performance【9†source】.

The Global Influence of Sustainability in M&A

The influence of sustainability on M&A isn't confined to a single sector. It's a global phenomenon, with multinational corporations significantly driving or hindering sustainability changes. When companies worldwide merge, their combined corporate sustainability (CS) strategies can evolve in new and intriguing ways. Factors such as a long-term perspective, a partnering approach, and an emphasis on learning can positively influence the integration process and the maturity level of the combined CS strategies.

The Current State of ESG Consideration in M&A

Despite the clear benefits, not all companies have fully embraced ESG considerations in their M&A processes. A recent survey showed that only 11% of M&A executives regularly assess ESG in their deal-making process. However, a positive trend exists: 65% of the executives surveyed expect their company's focus on ESG will increase soon. Certain forward-thinking companies have already incorporated ESG into their M&A process, making it a valuable tool for creating opportunities and gaining a competitive edge【16†source】.

The Multifaceted Value of ESG in M&A

The value that comes from incorporating ESG into M&A can take many forms. For instance, 68% of surveyed executives in the consumer products industry see ESG's importance in helping their brand image appeal to changing consumer preferences. For those in the energy sector, ESG initiatives are valuable for meeting the requirements or expectations of investors and financiers, thereby lowering the cost of capital. Across all industries, ESG measures can add value by managing costs (such as waste reduction) and attracting and retaining top talent, which is a critical goal in today's competitive talent market【17†source】.

Looking Forward: The Essential Role of Sustainability in M&A

The relationship between sustainability and M&A is becoming more intertwined. Sustainability has evolved from a peripheral consideration to an essential lens for decision-making in M&A. Its influence is felt across various industries and contexts, signaling a shift in how companies approach M&A.

While much remains to uncover about the evolving role of sustainability in M&A, one thing is clear: M&A decisions must consider the influence of sustainability factors. For companies and executives involved in M&A, gaining a solid understanding of ESG factors is now optional but a requirement for success in the current business landscape.

Sources

| Reference Number | Source |

|---|---|

| 9†source | "Sustainability Scores in M&A: The New Power Player" |

| 10†source | "The Global Influence of Sustainability in M&A" |

| 16†source | "The Current State of ESG Consideration in M&A" |

| 17†source | "The Multifaceted Value of ESG in M&A" |