OpenAI Strategic Position: A SWOT Analysis (Free PDF)

A strategic analysis of OpenAI's competitive position. Learn what drives their success and what threatens it. Free SWOT analysis PDF guide included.

When you look at OpenAI today, you see a company that moved fast and won the initial race.

ChatGPT launched in late 2022 and changed how people think about AI.

But winning the first round doesn't guarantee you'll win the fight.

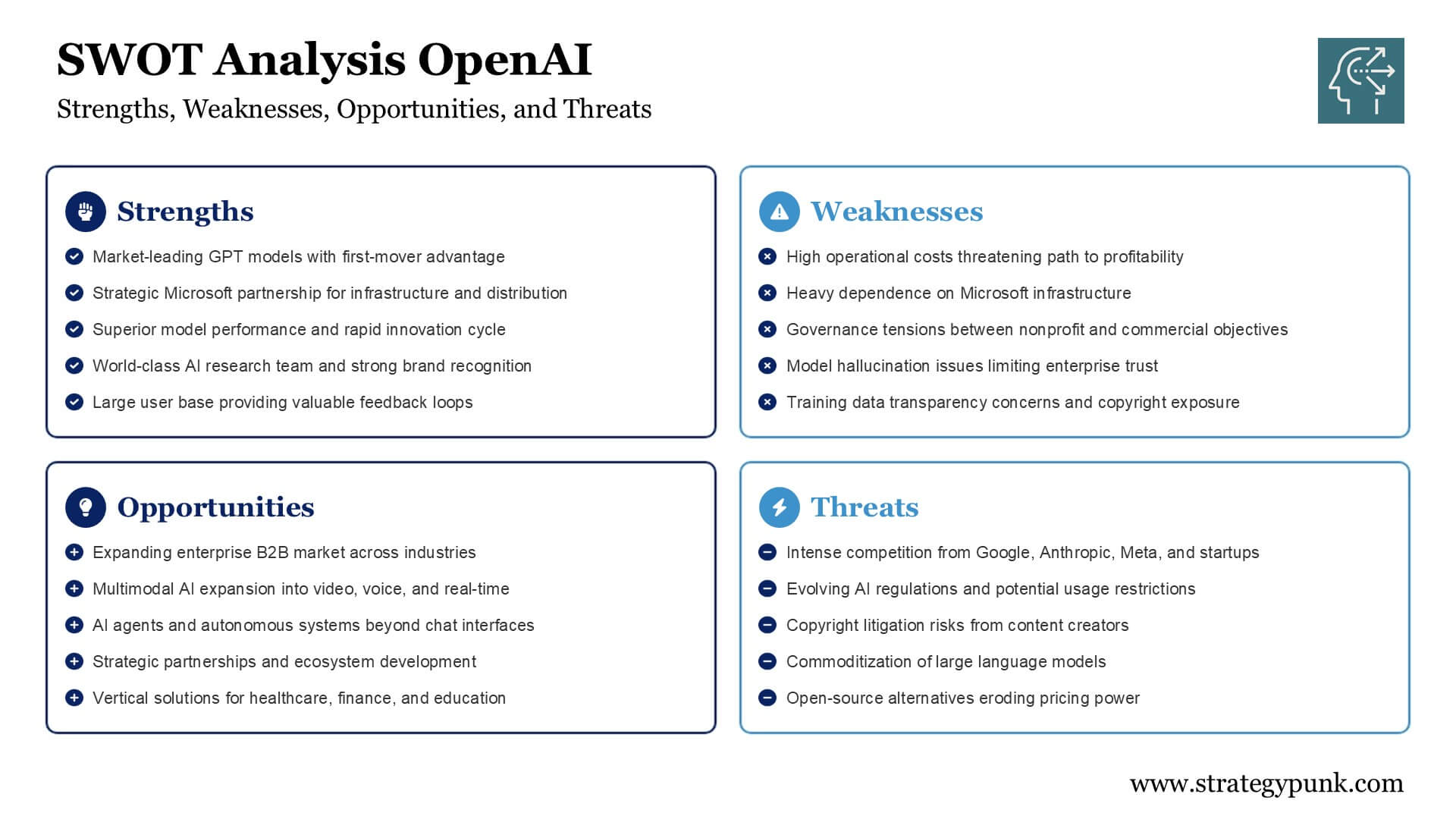

SWOT Analysis OpenAi

The Foundation: What OpenAI Built

Key Strengths:

- Market-leading GPT models with first-mover advantage

- Strategic Microsoft partnership for infrastructure and distribution

- Superior model performance and rapid innovation cycle

- World-class AI research team and strong brand recognition

- Large user base providing valuable feedback loops

OpenAI got three things right from the start.

First, they shipped the GPT models before anyone else could catch up. That lead time matters. Users came to them first, which means they got data, feedback, and market position while others were still planning their launch.

Second, the Microsoft partnership gave them compute power and distribution. Microsoft invested billions and integrated ChatGPT into their products. That's access to enterprise customers that most startups can't buy.

Third, their research team produces results. The gap between GPT-3 and GPT-4 showed they could iterate. The models keep getting better, which keeps users coming back.

The Problem: Economics Don't Work Yet

Key Weaknesses:

- High operational costs threatening path to profitability

- Heavy dependence on Microsoft infrastructure

- Governance tensions between nonprofit and commercial objectives

- Model hallucination issues limiting enterprise trust

- Training data transparency concerns and copyright exposure

Here's where it gets messy. Running these models costs money. A lot of money. Each query burns compute resources. Scale that to millions of users and the bills add up fast.

OpenAI depends on Microsoft for infrastructure. That creates risk. If the relationship changes, if costs go up, if Microsoft decides to compete harder with their own models, OpenAI has limited options.

Then there's the governance structure. OpenAI started as a nonprofit focused on safe AI. Now they need to make money. Those two goals conflict. The board drama in late 2023 showed how unstable that setup can be.

The models still make mistakes. They hallucinate facts. They produce wrong answers with confidence. Enterprise customers need reliability. Until OpenAI solves accuracy at scale, they can't fully capture the B2B market.

Where Growth Could Come From

Key Opportunities:

- Expanding enterprise B2B market across industries

- Multimodal AI expansion into video, voice, and real-time

- AI agents and autonomous systems beyond chat interfaces

- Strategic partnerships and ecosystem development

- Vertical solutions for healthcare, finance, and education

The consumer market was phase one. Phase two is business customers. Every company wants to use AI now. OpenAI can sell APIs, custom models, and consulting. That's where the margins exist.

Multimodal is the next frontier. Text was first. Now images, then video, then real-time voice. Each new capability opens new use cases. Each new use case means new revenue.

AI agents represent a bigger shift. Instead of just answering questions, the models could take actions. Book flights, write code, analyze data, manage workflows. That's worth more than chat.

Industry solutions matter too. A generic model serves everyone poorly. A model trained on medical data, financial regulations, or legal documents serves those industries well. Vertical products command higher prices.

What Could Go Wrong

Key Threats:

- Intense competition from Google, Anthropic, Meta, and startups

- Evolving AI regulations and potential usage restrictions

- Copyright litigation risks from content creators

- Commoditization of large language models

- Open-source alternatives eroding pricing power

Competition is coming from everywhere. Google has the resources and the talent. Anthropic has former OpenAI researchers and serious funding. Meta open-sourced their models. Startups are building specialized tools.

Regulation is uncertain. Europe is writing AI laws. The US will follow. China has its own rules. Training data rules could change. Usage restrictions could limit growth. Compliance costs money.

Copyright cases are piling up. Authors, artists, and publishers are suing. They claim OpenAI trained on their work without permission. These cases could cost billions or force changes to how models get trained.

The technology itself might commoditize. If smaller models get good enough, if open source catches up, if compute costs drop, then the moat shrinks. OpenAI would compete on price, which means lower margins.

What This Means for Strategy

OpenAI shows you how first mover advantage works and where it fails. They got users first. They built brand recognition first. They set the standard for what AI chat should look like.

But being first doesn't protect you from economics. Their cost structure needs to improve. Their dependence on one partner needs to decrease. Their governance needs stability.

The path forward requires execution in three areas. First, drive down costs per query through better models and better infrastructure. Second, capture enterprise customers who pay premium prices. Third, expand into new modalities and use cases before competitors own those markets.

Companies studying this should note what matters. Technical excellence got OpenAI here. Business model execution will determine if they stay here. Brand and user base create momentum but not protection.

The following two years will show whether OpenAI can turn market position into market dominance or whether they simply opened the door for others to walk through.

Want the complete analysis at a glance?

OpenAi SWOT Analysis PDF summary

Download our free OpenAi SWOT Analysis PDF summary. Get your copy and level up your strategic thinking.