SWOT Analysis of Alphabet Inc (FREE Templates)

Explore Alphabet's SWOT Analysis for key insights. Download our free PDF and PPT templates to enhance your strategic planning.

Ever wondered what makes Google's parent company tick?

Let's break down Alphabet Inc.'s SWOT analysis in plain English. Whether you're a business student working on a case study or a professional keeping tabs on tech giants, this post will give you the insights you need. The SWOT analysis is based on the Q1-Q3 2024 earnings.

Get your free PDF and PowerPoint downloads of this SWOT analysis at the end of this post!

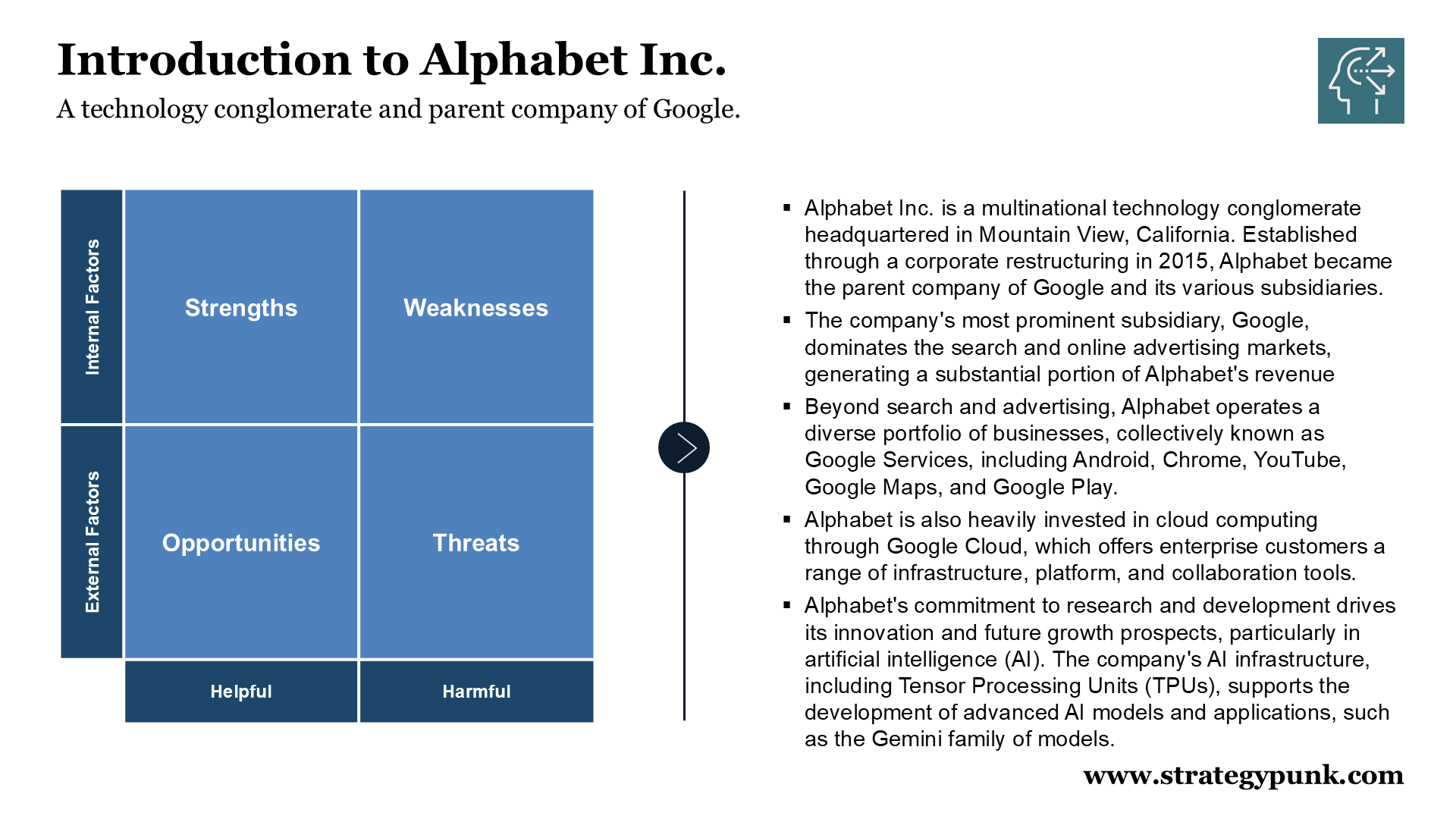

What is Alphabet Inc.?

Before we dive in, let's get something straight: Alphabet Inc. isn't just Google.

Alphabet Inc., Google's parent company, is a beacon in the technology industry. Founded in 2015 as a restructuring of Google, Alphabet oversees a collection of companies that include Google, YouTube, and various "Other Bets" ventures.

Its influence spans global search, advertising, cloud computing, and artificial intelligence (AI) innovation.

SWOT Analysis of Alphabet Inc.

Strengths

Google's parent company, Alphabet, demonstrates remarkable market dominance and financial prowess across multiple technology sectors, particularly in search, advertising, cloud computing, and AI development.

These strengths are built on consistent innovation, global reach, and strategic diversification.

- Strong Financial Performance: Alphabet has consistently shown robust financial results. With significant revenue growth and expanding operating margins, the company demonstrates its ability to generate substantial profits. This financial strength allows for reinvestment into future growth and expansion.

- Market Leadership in Search and Advertising: Alphabet holds a dominant market share in search and online advertising and benefits from a stable revenue stream. This leadership position enables the company to influence industry trends and maintain a competitive edge.

- Growing Cloud Business: Google Cloud has been on an upward trajectory, surpassing $10 billion in quarterly revenue and achieving $1 billion in quarterly operating profit. This growth reflects success in attracting enterprise customers and meeting the rising demand for cloud services.

- Innovation in AI: Alphabet's commitment to AI is evident through its development of AI infrastructure like Tensor Processing Units (TPUs) and AI-powered products such as Search Generative Experience (SGE) and AI Overviews. This focus positions the company to capitalize on opportunities in the rapidly evolving AI landscape.

- Diversified Business Portfolio: Beyond search and advertising, Alphabet's portfolio includes YouTube, Google Cloud, and various innovative projects under Other Bets. This diversification mitigates risks associated with reliance on a single market and opens avenues for exploring new growth areas.

- Global Reach: Operating globally, Alphabet generates revenue from diverse geographical regions. This extensive presence offers access to a wide customer base and reduces dependence on specific markets.

Weaknesses

Despite its massive success, Alphabet faces notable internal challenges that could impact its long-term stability and growth potential.

The company's heavy reliance on advertising revenue and ongoing regulatory battles represent significant vulnerabilities that require careful management.

- Dependence on Advertising Revenue: Much of Alphabet's revenue stems from advertising. This reliance makes the company vulnerable to fluctuations in advertiser spending and shifts in the advertising landscape due to economic downturns or regulatory changes.

- Regulatory Scrutiny and Legal Challenges: Alphabet faces heightened regulatory scrutiny and ongoing legal challenges, especially related to antitrust concerns and search distribution practices. These issues can lead to costly legal battles, potential fines, restrictions on business practices, or damage to the company's reputation.

- Competition in Cloud Computing: Despite strong growth, Google Cloud competes intensely with established players like Amazon Web Services (AWS) and Microsoft Azure. This competition could limit Alphabet's market share and profitability in the cloud sector.

Opportunities

The technological landscape presents numerous growth opportunities for Alphabet, particularly in emerging markets and AI applications.

The company's strong financial position enables it to pursue strategic acquisitions and develop new revenue streams through innovative products and services.

- Expansion of AI Applications: AI has transformative potential across industries. Alphabet's investments in AI infrastructure and research provide an advantage in developing new AI-powered products and services. This presents opportunities to enter new markets and enhance revenue streams.

- Growth in Emerging Markets: Developing economies offer significant growth prospects. As internet access and smartphone adoption increase in these regions, demand for Alphabet's products and services will likely rise.

- Strategic Acquisitions and Partnerships: Alphabet can acquire promising startups or form strategic partnerships by leveraging financial resources. These moves can enhance technological capabilities, expand market reach, or provide a competitive edge.

- Monetization of New Products and Services: Alphabet has a history of launching innovative offerings, some still in the early monetization stages. As these products mature and gain user adoption, they hold the potential to generate substantial revenue.

Threats

External factors pose significant risks to Alphabet's business model, from economic uncertainties to evolving consumer preferences.

The company must navigate these challenges while maintaining its competitive edge in a rapidly changing technological environment.

- Economic Slowdown: A global economic downturn could reduce advertiser spending, negatively impacting revenue from Alphabet's core advertising business.

- Changes in Consumer Behavior: Shifts such as increased use of ad-blockers or heightened privacy concerns could disrupt the advertising business model, necessitating adaptation to maintain revenue.

- Technological Disruptions: The tech industry evolves rapidly. Emerging technologies or platforms could challenge Alphabet's search or cloud computing dominance.

- Geopolitical Risks and Regulatory Changes: Political instability, trade disputes, or changes in data privacy regulations worldwide could adversely affect Alphabet's operations and financial performance.

Download Your Free Alphabet SWOT Analysis Templates

Alphabet stands tall as a tech leader but can't rest on its laurels. Its strength in AI and diverse portfolio give it an edge, but it'll need to watch its back in the fast-moving tech world.

Want to use this analysis for your work? Download the free PDF and PowerPoint versions below.

SWOT Analysis Alphabet AG PDF Template

To help you get started, we’re providing a free Alphabet SWOT Analysis PowerPoint Template.

This customizable template allows you to plug in your vision, must-win battles, initiatives, enablers, and foundation to create a strategy that resonates with your organization.

Download Your Free Alphabet SWOT Analysis PPT Template - please subscribe and log in; download the file below.