Strategic Insights 2024: A SWOT Analysis of Nestle (Plus Free PPT)

Explore Nestle's strategic outlook with our SWOT analysis for 2024. This PowerPoint template highlights key areas for growth and challenges.

What comes to mind when you hear the name Nestle?

For many, it's images of chocolate bars, coffee drinks, and other iconic food products.

However, Nestle is far more than just a snack food company. It's a global powerhouse with over 2000 brands in almost every food and beverage category.

As one of the world's largest food and drink corporations, Nestle plays a significant role in keeping the world fed and hydrated. Its reach is staggering, with operations in 187 countries and over 328,000 employees.

So, what's the key to Nestle's enduring success? And what challenges and opportunities lie ahead?

We must take a deep, strategic look under the hood to find out. This article will conduct an in-depth SWOT analysis to uncover Nestle's core strengths, weaknesses, opportunities, and threats in 2024.

Introduction to Nestle

Nestle S.A. is a Swiss multinational food and drink conglomerate headquartered in Vevey, Switzerland. It was founded in 1866 by Henri Nestlé and is one of the oldest food companies in the world.

Nestle owns over 2000 individual brands across a wide range of product categories, including baby food, bottled water, cereals, chocolate and confectionery, coffee, culinary products, dairy, frozen food, ice cream, pet food, snacks, and more.

Its well-known brands include Nescafe, Nespresso, KitKat, Smarties, Nesquik, Stouffer's, Lean Cuisine, Purina, and Dreyer's.

A Brief Look at the History of Nestle

Nestle's origins date back to 1866 when German-born pharmacist Henri Nestlé developed a breakthrough infant food product. His "Farine Lactée" (flour with milk) was a nutritious alternative for mothers who could not breastfeed.

In 1905, Nestle merged with the Anglo-Swiss Condensed Milk Company to form a joint operation called the Nestle and Anglo-Swiss Condensed Milk Company. Over the next century, Nestle grew rapidly through acquisitions and expansion into new product categories.

Major milestones included the company's first chocolate acquisition in 1904, its entry into the U.S. market in 1900, and the launch of iconic brands like Nescafe (1938), Nesquik (1948), and Nespresso (1986). Through its strategic brand acquisitions and global expansion policy, Nestle became the largest food company in the world by the 1980s.

What is the business model of Nestle?

Nestle operates an innovative "hybrid" business model that combines aspects of the consumer packaged goods (CPG) industry with food service and ingredient supply models.

On the CPG side, Nestle manufactures and markets its branded food and beverage products through retail channels like supermarkets, convenience stores, and e-commerce platforms. It also supplies ingredients and prepared foods to food service operators like restaurants, cafeterias, and caterers.

In addition, Nestle produces ingredients, flavorings, and solutions for other food and beverage manufacturers through its FoodServices division. This unique hybrid model gives Nestle multiple revenue streams and a diverse base of customers spanning individual consumers, retailers, restaurants, and other food companies.

Financials of Nestle 2023

Nestle's financial performance in 2023 demonstrated its strength and resilience despite challenging global economic conditions:

- Total revenue: CHF 94.6 billion (up 8.4% from 2022)

- Operating profit: CHF 17.5 billion

- Net profit: CHF 11.8 billion

- Operating cash flow: CHF 15.1 billion

- Total assets: CHF 150.2 billion

- Market capitalization: CHF 320 billion (as of Dec 31, 2023)

The company saw strong organic growth across most product categories and geographic regions. Its three best-performing businesses were Purina PetCare, Nestle Health Science, and coffee products led by Nespresso and Nescafe.

Emerging markets like China, Southeast Asia, and Latin America were key growth drivers.

In-depth SWOT Analysis of Nestle 2024

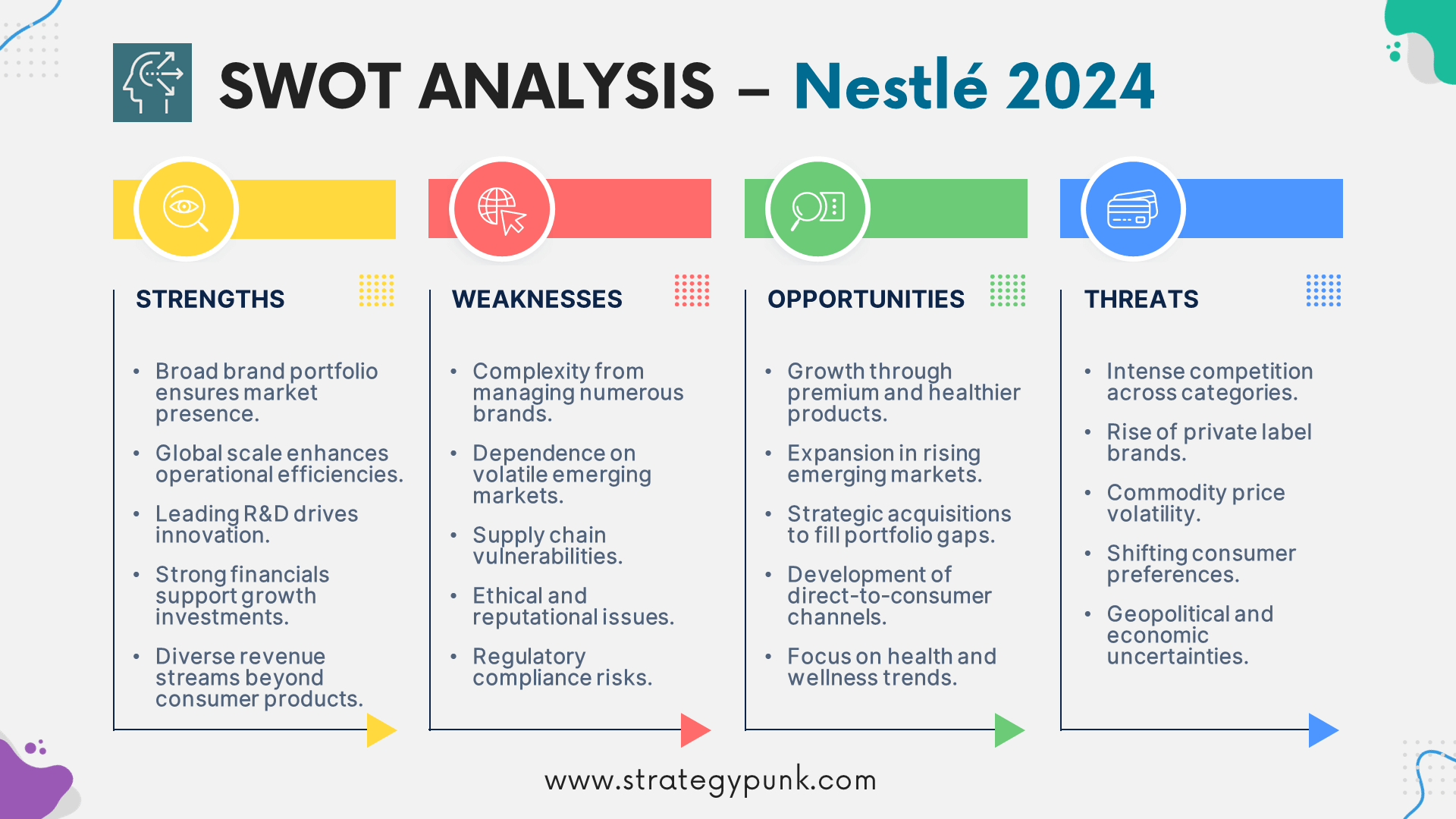

Now let's dive into Nestle's specific strengths, weaknesses, opportunities, and threats based on the latest data and trends:

Nestle's Strengths

- Brand Portfolio: With over 2000 individual consumer brands, Nestle has one of the food industry's strongest and most diversified brand portfolios. This reduces risk and gives the company a presence in virtually every consumer segment.

- Global Scale and Reach: Nestle's unmatched global production and distribution network spans 187 countries. This scale creates operational efficiencies and allows Nestle to capitalize on growth opportunities anywhere quickly.

- R&D Capabilities: Nestle operates the world's largest private food and nutrition research organization with over 5000 people involved in research. This drives a constant pipeline of innovation across categories.

- Financial Strength: Nestle's balance sheet is extremely strong, with over CHF 15 billion in operating cash flow in 2023. This gives the company ample resources to invest in growth through R&D, M&A, marketing, and capacity expansion.

- Diversified Revenue Streams: In addition to its CPG business, Nestle generates revenue from food service, ingredient supply, and other B2B channels.

Nestle's Weaknesses

- Complexity: Nestle is a highly complex organization with over 2000 individual brands and operations. This can create inefficiencies, communication silos, and challenges in maintaining brand consistency.

- Reliance on Emerging Markets: Nestle's growth comes from emerging markets like Asia and Latin America. While this represents an opportunity, it exposes the company to economic and political risks in these regions.

- Supply Chain Challenges: Nestle sources ingredients from all over the world, and It faces increasing supply chain complexity, costs, and sustainability pressures. Disruptions can significantly impact operations.

- Ethical Concerns: Nestle has faced Nestle sourcing ingredients from all over the world and Itcriticism over the years regarding its marketing of infant formula, water privatization practices, environmental impact, and other ethical issues. This can damage the company's reputation and brand image.

- Regulatory Risks: As a global food company, Nestle must navigate a complex web of regulations around food safety, labeling, marketing, and more. Regulatory changes or violations can bring significant financial and legal consequences.

Nestle's Opportunities

- Premiumization Trends: Global demand for premium, natural, and healthier food/beverage options is growing. Nestle can capitalize on this by innovating and marketing more premium products across categories.

- Expansion in Emerging Markets: Rising incomes and population growth in emerging markets like Asia, Africa, and Latin America represent a major growth opportunity for Nestle's consumer brand portfolio.

- Acquisitions and Consolidation: The food industry is ripe for further consolidation. Nestle has the resources to acquire innovative brands and companies to accelerate growth and fill portfolio gaps.

- Direct-to-Consumer Channels: Like many CPG companies, Nestle has an opportunity to build more direct-to-consumer sales channels like e-commerce and subscription models to boost margins and build consumer relationships.14

- Focus on Health and Wellness: The growing interest in health, wellness, and nutrition plays into Nestle's core strengths. Expanding its portfolio of healthy brands and products is a significant opportunity.

Nestle's Threats

- Competition: While Nestle is the largest food company, it faces intense competition across categories from significant players like PepsiCo, Kraft Heinz, Danone, General Mills, and others who are constantly innovating.

- Private Label Brands: The rise of private label/store brand products in many markets poses a threat, as they offer lower-cost alternatives to major consumer brands like Nestle.

- Commodity Price Volatility: Nestle sources large volumes of agricultural commodities and ingredients globally, Making it vulnerable to price swings that can impact profitability.

- Changing Consumer Preferences: Rapidly evolving consumer preferences around health, sustainability, and ethical sourcing pose an ongoing threat that requires continuous innovation and portfolio evolution.

- Geopolitical and Economic Risks: As a globally diversified company, Nestle's performance can be impacted by geopolitical tensions, trade policies, economic downturns, and other macroeconomic factors beyond its control.

Nestle SWOT Analysis Summary

Internal Factors

Strengths: Nestle's vast brand portfolio, global scale, R&D capabilities, financial stability, and diversified revenue streams give it tremendous competitive advantages.

Weaknesses: The company's complexity, emerging market risks, supply chain challenges, ethical concerns, and regulatory exposures are potential areas of vulnerability.

External Factors

Opportunities: Premiumization trends, emerging market growth, M&A, direct-to-consumer, and health/wellness products offer further growth and innovation pathways.

Threats: Intense competition, private labels, commodity volatility, shifting consumer demands, and economic/geopolitical risks could negatively impact Nestle's performance.

Nestle's Strategies for Success

based on Nestle's SWOT Analysis

To build on its strengths and capitalize on opportunities while mitigating weaknesses and threats, Nestle should pursue strategies like:

- Continued investment in R&D to drive innovation and meet evolving consumer demands around health, premiumization, and sustainability.

- Strategic acquisitions to accelerate growth in emerging markets, fill portfolio gaps and acquire innovative brands/capabilities.

- Enhancing direct-to-consumer channels like e-commerce and subscriptions to boost margins and build consumer relationships.

- Optimizing its vast global supply chain through technology, vertical integration, and sustainable sourcing practices.

- Proactive brand portfolio management to prune underperforming brands and reallocate resources to high-growth categories and markets.

- Leveraging its nutrition research capabilities to expand its health science and wellness product offerings.

- Maintaining financial discipline and a strong balance sheet to support investments in growth while returning capital to shareholders.

With its unmatched global scale, iconic brands, and a laser focus on strategic priorities, Nestle is well-positioned to continue delivering value to consumers and shareholders for decades.

Frequently Asked Questions on Nestlé

What is Nestle's biggest strength?

Nestle's biggest strength is its vast portfolio of over 2000 iconic brands spanning virtually every food and beverage category. This reduces risk and gives the company an unmatched presence in consumer markets worldwide.

What is Nestle's most significant weakness?

Nestle's biggest weakness is its size and complexity as a company operating in 187 countries. This can create inefficiencies, branding inconsistencies, and challenges in maintaining agility.

What are the most significant opportunities for Nestle?

Significant opportunities include premiumization trends, emerging market growth, strategic acquisitions, direct-to-consumer channels, and the rising focus on health/wellness products that align with Nestle's core capabilities.

What are the biggest threats facing Nestle?

Key threats include intense competition, the rise of private label brands, commodity price volatility, rapidly shifting consumer preferences, and geopolitical/economic risks inherent to its globally diversified business model.

Nestle SWOT Analysis PowerPoint Template

free and fully editable PPT template

A SWOT analysis evaluates the strengths, weaknesses, opportunities, and threats impacting a company.

This free editable PowerPoint template provides a SWOT analysis framework to evaluate Nestle's internal strengths and weaknesses and external opportunities and threats.

A free downloadable PowerPoint template summarizing Nestle's SWOT analysis is available at the link below:

Nestle SWOT Analysis PDF Template

Nestle SWOT Analysis PowerPoint Template

Feel free to customize the template by adding your content, images, and visuals.

Discover more

New! SWOT Framework & Free PPT Template - 2024 Edition

Dive into the 2024 Edition of our SWOT Analysis guide, complete with a free PowerPoint template. This resource covers the essentials of conducting a SWOT analysis, its benefits, and practical application tips, including a case study on Mercedes Benz.

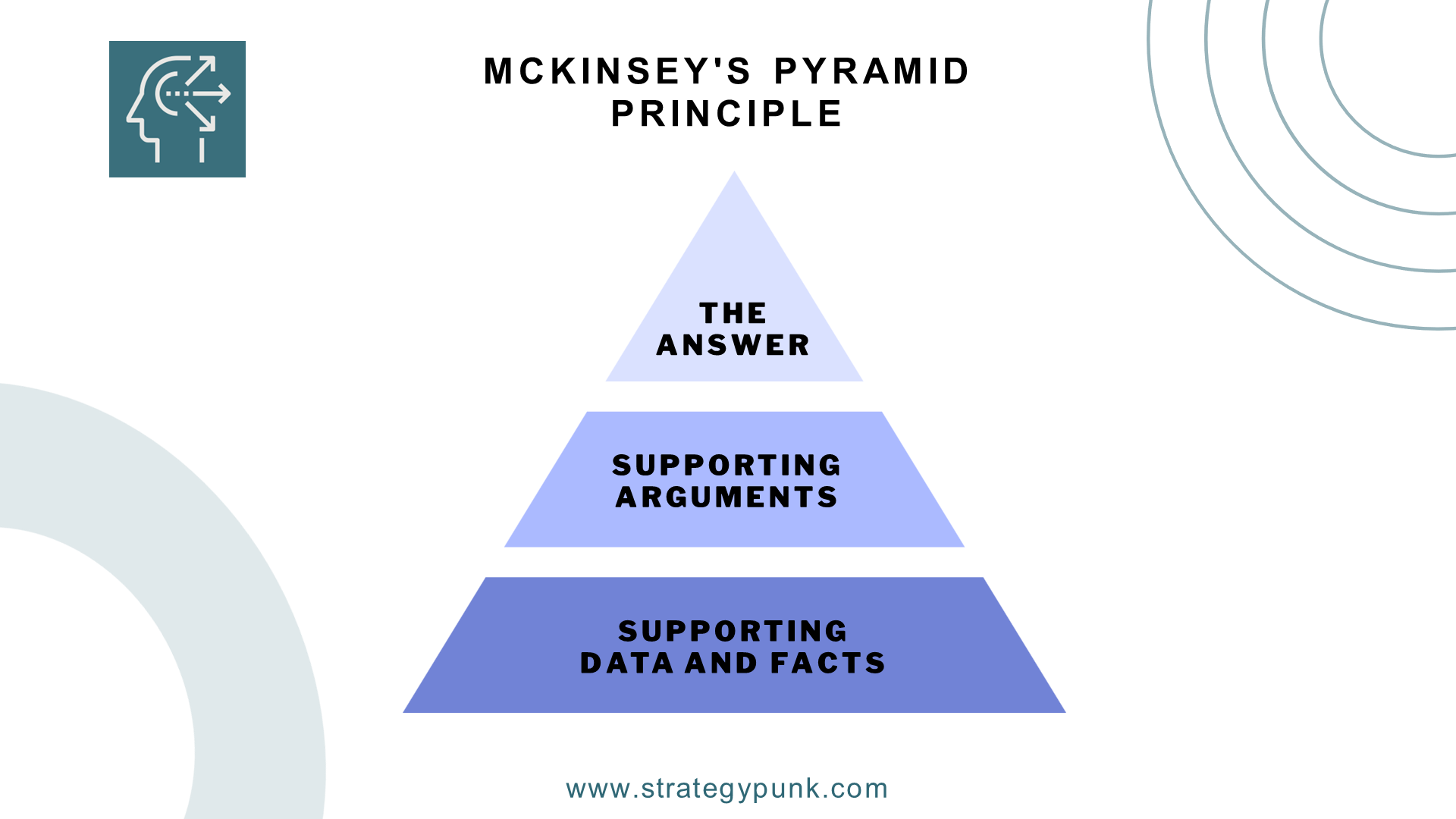

McKinsey Pyramid Principle: The Ultimate Guide to Effective Arguments

The McKinsey Pyramid Principle is pivotal in structuring arguments, making data understandable, and driving informed decisions in fast-paced business environments. This methodology uses a top-down approach to ensure concise, logical, and impactful presentations.

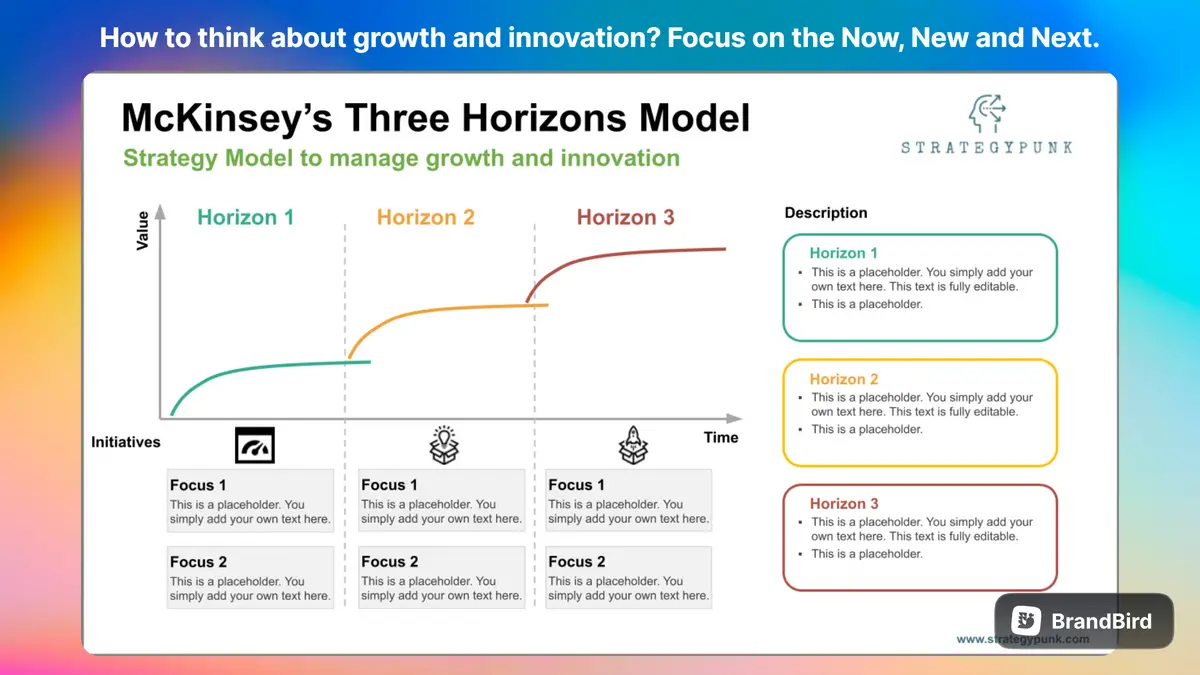

McKinsey's 3 Horizons Framework: Free PowerPoint Template

How do you think about growth and innovation? Focus on the Now, New, and Next. Free slide deck in PowerPoint and Google Slides format.