M&A and Strategic Partnerships: PowerPoint Evaluation tool

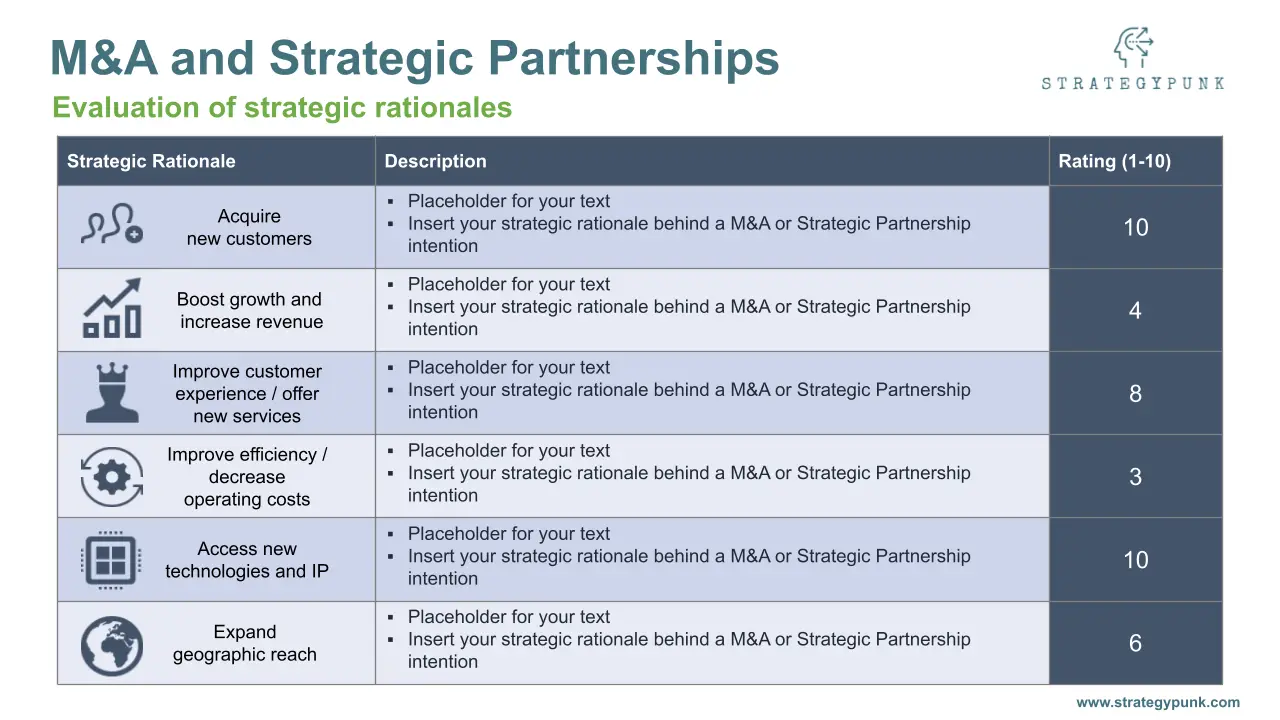

M&A and Strategic Partnerships: Free PowerPoint Evaluation tool. Simple evaluation tool to describe and rate the strategic rationales of M&A projects or strategic partnerships.

A simple evaluation tool to describe and rate the strategic rationales of M&A projects or partnerships.

What is the difference between M&A and Strategic Partnerships?

Mergers and Acquisitions (M&A) consolidate companies or assets through mergers, acquisitions, and takeovers. In an M&A transaction, one company acquires or merges with another, transferring ownership and control.

On the other hand, Strategic Partnerships refer to a type of collaboration between two or more companies where they join forces to achieve a common business goal. In a strategic partnership, the companies maintain their identities and ownership but work together on mutually beneficial projects or initiatives.

In summary, M&A involves a transfer of ownership and control, while strategic partnerships involve collaboration between independent companies.

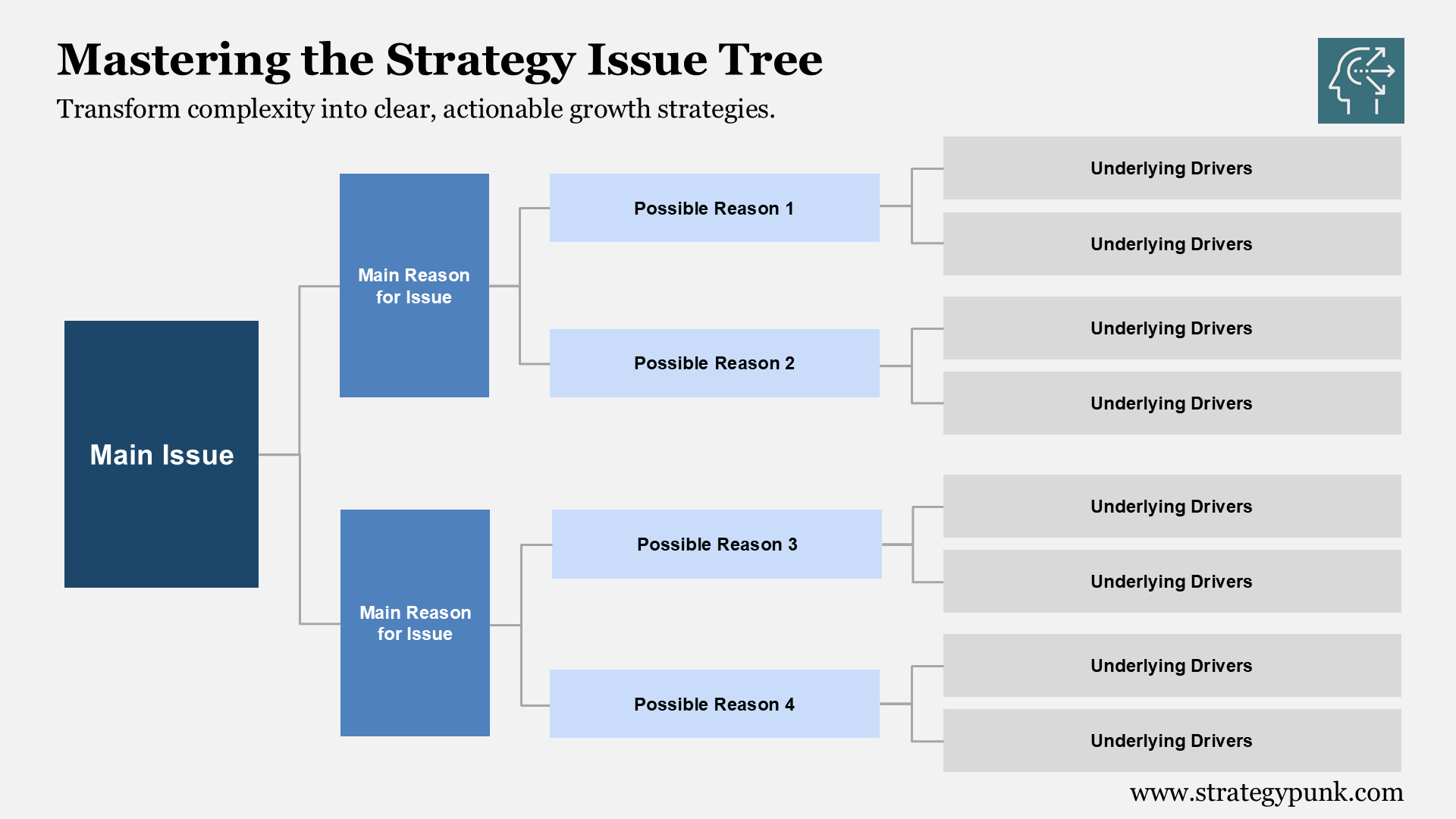

What are the three stages of M&A?

The three stages of M&A typically include Strategy, Transaction, and Integration.

- Strategy: In this stage, the acquiring company formulates its M&A strategy, including identifying target companies or assets, determining the rationale for the acquisition, and determining how the purchase will fit into the company's overall strategic objectives.

- Transaction: In this stage, the acquiring company and the target company negotiate the terms of the acquisition, including the purchase price, financing arrangements, and other terms and conditions. This stage may also involve due diligence, such as reviewing the target company's financial statements, contracts, and other business operations.

- Integration: In this stage, the acquiring company integrates the target company into its operations. This may involve consolidating duplicate functions, transferring employees, and aligning processes, systems, and culture. This stage aims to realize the full potential of the acquisition, including any synergies and cost savings identified in the strategy stage.

See our blog post: Mergers & Acquisitions Process: Guide and free template for more details.

What are the key elements of a Strategic Partnership?

The critical elements of a strategic partnership can vary depending on the specific block, but they typically include the following seven characteristics:

- Shared Goals: Strategic partnerships are formed to achieve specific, mutually beneficial goals. Both partners must clearly understand these goals and be committed to working together to achieve them.

- Clear Roles and Responsibilities: Both partners must clearly understand their roles and responsibilities. This includes what each partner will contribute and what they expect to receive in return.

- Open Communication: Strategic partnerships require open and ongoing communication between the partners. This includes regular meetings, status updates, and discussions about issues.

- Trust and Transparency: Trust and transparency are crucial to a successful strategic partnership. Both partners must be transparent about their operations, intentions, and decisions and must be able to trust each other to follow through on their commitments.

- Aligned Incentives: Both partners must have aligned incentives and a shared understanding of the partnership's benefits and risks. This helps ensure both partners are motivated to work together towards their goals.

- Flexibility: Strategic partnerships require flexibility, as circumstances and business conditions may change. Both partners must be open to making changes to the collaboration as needed to ensure its continued success.

- Exit Strategy: A well-drafted strategic partnership agreement should include a clear exit strategy for both partners. This outlines the process for ending the partnership if it no longer benefits one or both partners.

These 7 elements provide a framework for a successful strategic partnership and can help ensure that both partners can work together effectively to achieve their shared goals.

M&A and Strategic Partnerships are compelling and vital strategic levers for scaling, extending market reach, and accessing new technologies and capabilities. They are an essential part of a company’s growth strategy.

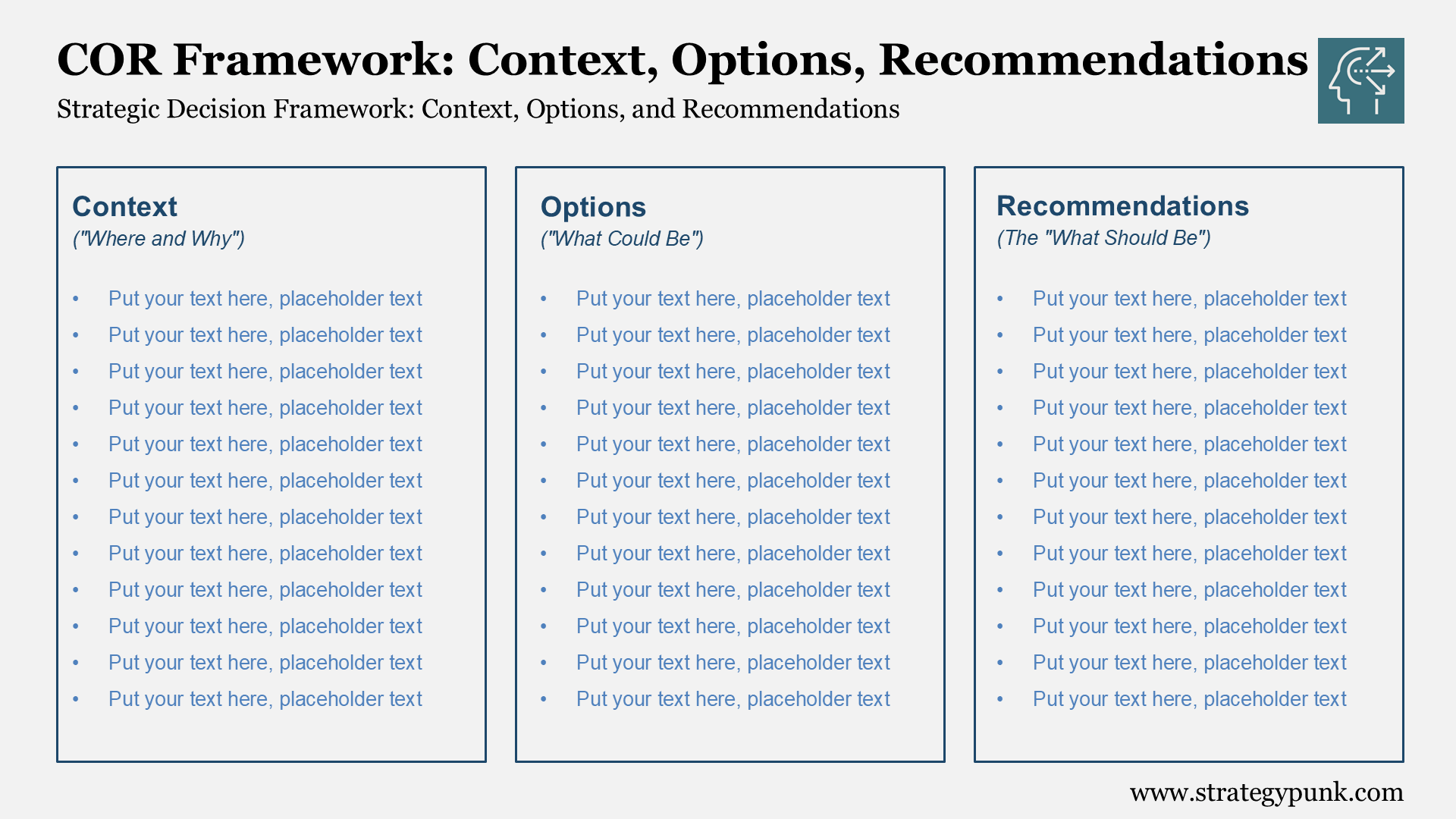

This tool helps make a deal work, especially in the early decision phase. A precise evaluation and strategic rationale for acquisition and partnership are crucial to identifying the right target, defining goals, and setting negotiation boundaries.

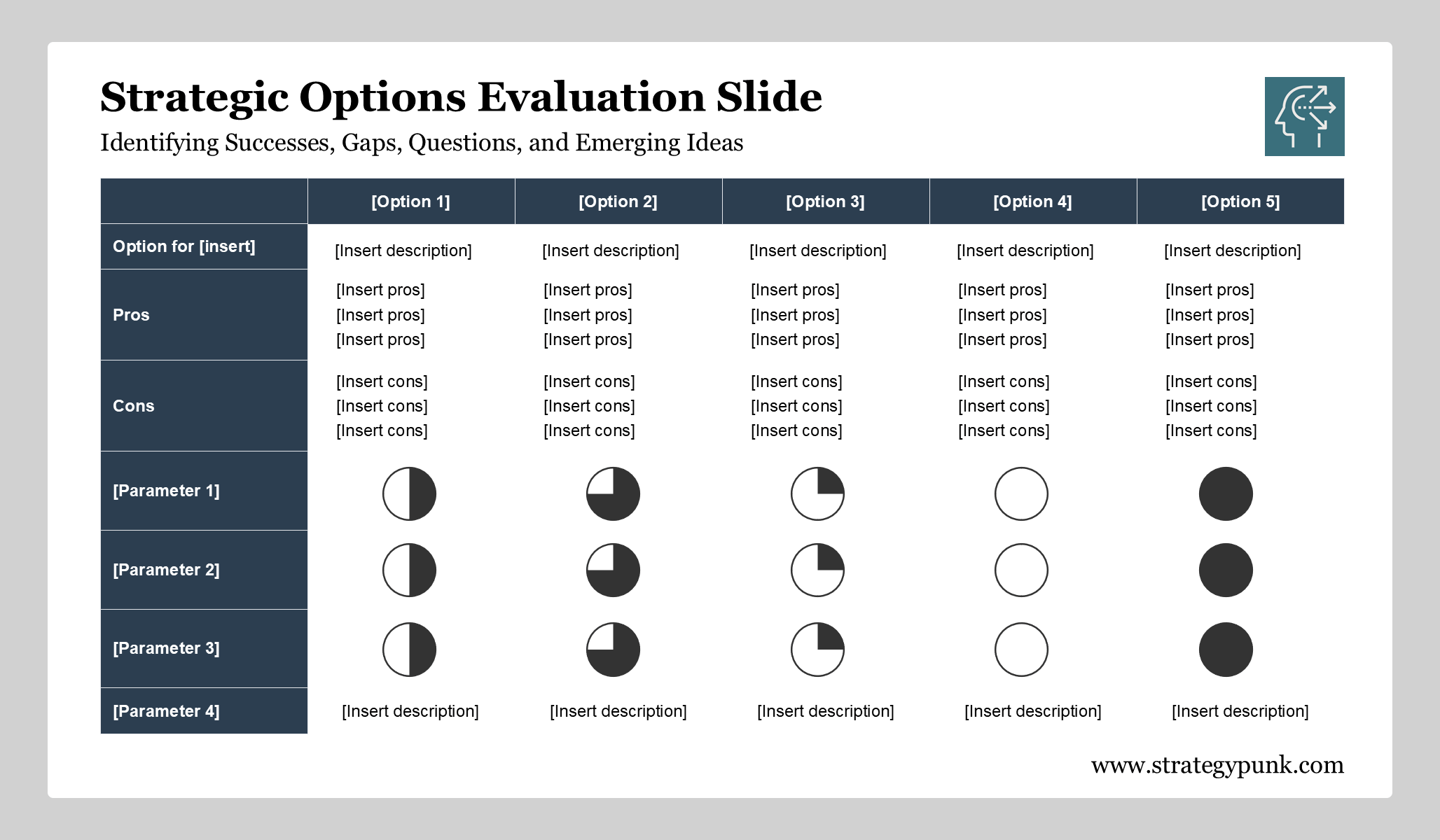

The methodic approach helps describe and rate the strategic rationale and benefits of your M&A project based on the six most essential causes of a deal or cooperation.

The most common strategic rationales and benefits for Mergers and acquisitions and strategic partnerships

- Acquire new customers

- Boost growth and increase revenue

- Improve customer experience and offer new services

- Improve efficiency and decrease operating costs

- Access new technologies and IP (Intellectual property)

- Expand the geographic reach

Please don't hesitate to add or change strategic rationales for your project.

Our Strategic Partnership Evaluation Tool aims to create a long-term, sustainable relationship that benefits all parties involved.