SWOT Analysis Kinnevik (based on Capital Markets Day 24)

Discover Kinnevik's strategic position with a SWOT analysis from Capital Markets Day 2024, highlighting key strengths, growth opportunities, and sector insights.

Kinnevik's Capital Markets Day, a key event in the investment calendar, is always insightful. It reveals the strategic vision, financial goals, and forward-looking agenda of one of Europe's most active investment firms, providing a comprehensive overview of Kinnevik's performance and future direction.

As a diversified investor in consumer-focused sectors, Kinnevik has a robust track record in fostering innovation and sustainable value. This successful track record serves as a testament to the firm's capabilities. However, the firm faces challenges, including market volatility and increased competition for high-growth investments.

This post will analyze Kinnevik’s position using a SWOT analysis, examining its strengths, weaknesses, opportunities, and threats based on this year’s Capital Markets Day. This will provide a clearer picture of where Kinnevik stands and its direction in the investment landscape.

Kinnevik's Key Investment Strategies and Evolution

Kinnevik, an 88-year-old investment firm, focuses on investing in high-potential companies across three sectors: healthcare, software, and climate tech. The firm's strategies have evolved to concentrate on these sectors, reflecting a shift from its previous investments in food and fintech, which have yielded lower returns.

Early Investment Strategy and Transformation

In early 2018, Kinnevik underwent a significant transformation, demonstrating its adaptability and forward-thinking approach. This involved a strategic shift in its portfolio and the distribution of more than 115% of its market cap to shareholders.

Key elements of this transformation included:

- Reshaping the Portfolio: Kinnevik divested from legacy companies and increased its investment in growth-oriented businesses, resulting in a portfolio now composed of 96% private shares.

- Focus on Core Companies: The firm identified and nurtured a group of "core companies" representing half of its portfolio and are anticipated to be the primary drivers of future value creation.

Sector-Specific Strategies

1. Healthcare:

- Focus: Kinnevik concentrates on innovative care delivery models and AI-powered drug discovery in the US, where healthcare innovation and spending are at the forefront.

- Approach: The firm employs three proven business models: Value-Based Care, Virtual Care, and Bio. Each targets specific channels and generates high gross margins.

- Performance: Kinnevik has achieved a 32% Inception IRR in healthcare, deploying SEK 10.4 billion and realizing SEK 8.5 billion in capital.

2. Software:

- Focus: Kinnevik prioritizes Vertical SaaS and the Consumerization of Enterprise software solutions. They target companies with high growth potential and clear paths to profitability.

- Rationale: The firm recognizes the significant growth opportunities in the enterprise software market, which is still largely dominated by legacy systems and has seen rapid value creation in private companies.

- Performance: Kinnevik has achieved a 28% IRR since inception in the software sector.

3. Climate Tech:

- Focus: The firm targets companies with proven technologies addressing high-emission industries with multi-trillion dollar market sizes.

- Investment Criteria: Kinnevik prioritizes companies with strong moats, near-term impact potential, and innovative teams capable of navigating complex industries.

- Approach: Kinnevik employs a dedicated team to conduct thorough due diligence, ensuring selective and meaningful investments in promising climate tech ventures.

Evolution of Investment Approach

Kinnevik's investment approach has evolved to leverage its strengths and adapt to market dynamics:

- Active Ownership: Kinnevik acts as an active partner, providing capital and operational support to its portfolio companies, encouraging long-term thinking and ambitious growth.

- Disciplined Capital Allocation: Kinnevik focuses on disciplined follow-on investments, primarily in core companies and new ventures demonstrating strong performance and potential.

- Adaptability and Resilience: Kinnevik's permanent capital structure and unrestricted investment mandate allow it to adapt to market fluctuations and capitalize on opportunities presented by market downturns.

Kinnevik's investment strategies have evolved to concentrate on high-growth, high-impact sectors. The firm utilizes an active ownership approach, prioritizes disciplined capital allocation, and maintains adaptability to navigate market changes. Its sector-specific strategies, focusing on core companies and strategic follow-on investments, are designed to drive long-term value creation and generate strong returns.

Kinnevik's Three Focus Sectors and Their Performance

Kinnevik concentrates its investment portfolio on three key sectors: healthcare, software, and climate tech. The sources provide insights into the performance of these investments since the start of 2018:

1. Healthcare (37% of Portfolio)

- Performance: Kinnevik has realized strong returns in the healthcare sector, achieving a 32% Inception Internal Rate of Return (IRR) since the start of 2018. This indicates the effectiveness of their investment strategies within this sector.

- Capital Deployed and Realised: The firm has deployed SEK 10.4 billion into healthcare investments and successfully realized SEK 8.5 billion. This demonstrates their commitment to the sector and their ability to generate returns.

2. Software (28% of Portfolio)

- Performance: Since the beginning of 2018, Kinnevik's software investments have generated a 28% IRR, highlighting its success in identifying and supporting high-growth software companies.

3. Climate Tech (10% of Portfolio)

- Performance: While the sources don't explicitly state the overall performance of Kinnevik's climate tech investments since 2018, they emphasize the strategic importance of this sector for the firm's future growth.

- Growth Potential: Kinnevik believes climate tech presents significant future opportunities and has allocated a dedicated team to identify and invest in promising ventures within this sector.

Overall:

The sources demonstrate Kinnevik's unwavering commitment to these three sectors and their successful track record in generating returns, particularly in healthcare and software. This commitment suggests its increasing importance within the portfolio and potential for future value creation, instilling optimism about the firm's future growth potential.

Contrasting Kinnevik's Approach with Traditional Venture Capital

The sources highlight several key aspects of Kinnevik's investment strategy that distinguish it from traditional venture capital firms.

1. Long-Term Vision and "Unconstrained" Investment Horizon

- Kinnevik emphasizes a long-term perspective, thinking in decades rather than quarters. This contrasts with the typical venture capital model, which often operates with fund durations that necessitate exits within a shorter timeframe.

- The firm describes its approach as an "unrestricted partnership" model. Its permanent capital base allows for investment horizons that adapt to the opportunities presented by each company, rather than being constrained by fund deadlines. This empowers Kinnevik to support portfolio companies through various stages of growth and market cycles.

2. Active Ownership and Operational Support

- Kinnevik positions itself as an "entrepreneurial investor, active owner, and operational partner". The firm goes beyond providing capital by actively engaging with its portfolio companies, offering operational support and guidance to help them achieve their full potential.

- This active involvement allows Kinnevik to provide more than just financial backing; it contributes expertise and strategic insights to foster the growth of its portfolio companies.

3. Resilience and Adaptability in Market Fluctuations

- Kinnevik's structure enables it to navigate market volatility effectively. The sources point to the firm's ability to capitalize on opportunities presented by market downturns, such as pursuing secondary acquisitions in core companies at attractive valuations when other investors seek liquidity.

- Kinnevik's resilient approach contrasts with the pressure faced by traditional venture capital funds to exit investments within specific timeframes, even during challenging market conditions.

4. Focus on "Core Companies" and Disciplined Follow-On Investments

- Kinnevik's portfolio strategy centers around a select group of "core companies" that represent a significant portion of its holdings and are expected to drive long-term value creation.

- The firm emphasizes disciplined follow-on investments, primarily directed towards these core companies and new ventures that demonstrate strong performance and align with their strategic focus. This disciplined approach ensures capital is allocated to the most promising opportunities.

5. Sector Focus and Expertise

- Kinnevik concentrates its investments in three specific sectors: healthcare, software, and climate tech. This focused approach allows the firm to develop deep expertise in these areas, enabling them to identify and support companies with high growth potential.

- Within each sector, Kinnevik has developed specific strategies and investment criteria to guide their decision-making process, such as targeting innovative care delivery models in healthcare, vertical SaaS solutions in software, and climate tech companies addressing high-emission industries.

Summary

Kinnevik's investment strategy diverges from traditional venture capital models by embracing a long-term perspective, active ownership, resilience in market fluctuations, and a focus on core companies within specific sectors. These factors, combined with their disciplined approach to capital allocation, position Kinnevik as a unique player in the investment landscape, enabling them to support the growth of their portfolio companies and generate strong returns over extended periods.

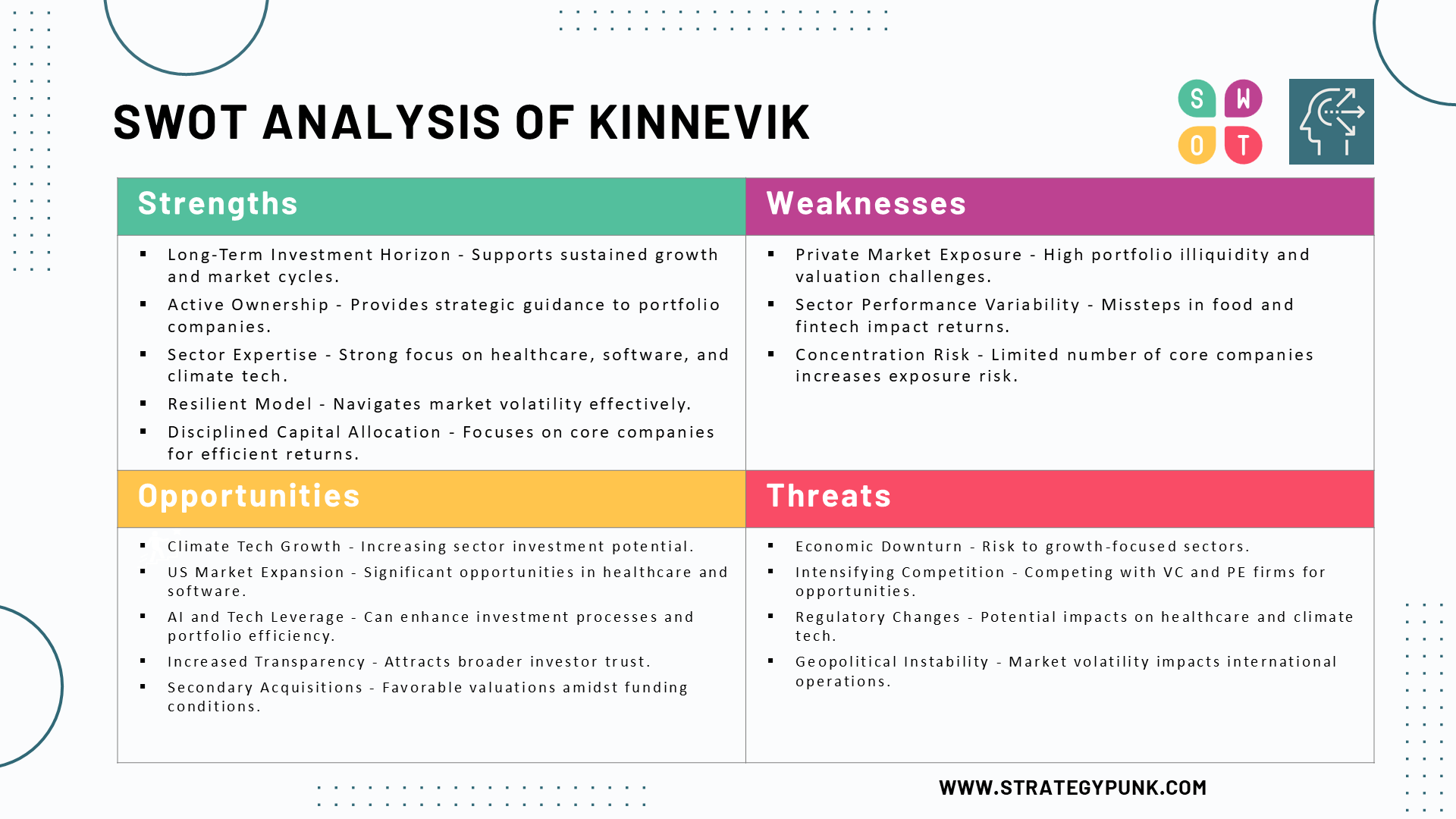

SWOT Analysis Kinnevik

based on Capital Markets Day 2024

Here is a SWOT analysis of Kinnevik:

Strengths:

- Long-Term Investment Horizon: Kinnevik operates with a permanent capital base and a long-term investment horizon, allowing it to support companies through different growth and weather market cycles more effectively than traditional venture capital firms.

- Active Ownership and Operational Support: Kinnevik actively engages with its portfolio companies, providing operational expertise and strategic guidance alongside capital investments. This hands-on approach helps their portfolio companies achieve their potential and differentiates them from passive investors.

- Sector Expertise: Kinnevik's focused strategy on healthcare, software, and climate tech enables them to develop deep sector knowledge. This expertise allows them to identify promising investment opportunities, understand industry dynamics, and support companies effectively within their chosen sectors.

- Resilient Investment Model: Kinnevik's adaptable and resilient investment model allows them to navigate market volatility and capitalize on opportunities during market downturns. This resilience is particularly advantageous in uncertain economic climates.

- Strong Track Record: The sources highlight Kinnevik's successful track record, particularly in the healthcare and software sectors, with impressive IRRs achieved since 2018. This track record reinforces their credibility and attractiveness to potential investors and entrepreneurs.

- Disciplined Capital Allocation: Kinnevik's focus on "core companies" and strategic follow-on investments ensures efficient capital allocation towards high-performing and strategically aligned ventures. This disciplined approach maximizes returns and minimizes risk.

Weaknesses:

- Exposure to Private Markets: With 96% of its portfolio in private companies, Kinnevik is highly exposed to the illiquidity and valuation challenges inherent in private markets. Exiting investments and realizing returns can be more complex and time-consuming.

- Past Performance in Certain Sectors: While Kinnevik has demonstrated strong overall performance, the sources acknowledge "missteps" in food and fintech investments that negatively impact overall returns. This highlights the importance of continued due diligence and sector selection.

- Concentration in a Limited Number of Companies: While Kinnevik's strategy of focusing on core companies is advantageous for driving value creation, it also increases its exposure to the performance of those specific companies. Any underperformance by these key holdings could significantly impact the overall portfolio.

Opportunities:

- Growth of Climate Tech: The rapidly growing climate tech sector presents significant opportunities for Kinnevik to capitalize on its early investments and expertise. The sources highlight the increasing importance of this sector for Kinnevik's future growth.

- Continued Expansion in the US: The US market offers significant growth potential in Kinnevik's focus sectors, particularly healthcare and software. Kinnevik's existing presence and strategic partnerships in the US provide a foundation for further expansion.

- Leveraging AI and Technology: Kinnevik can leverage advancements in artificial intelligence and other technologies to enhance its portfolio companies' investment process, portfolio management, and operational efficiency.

- Increased Portfolio Transparency: Kinnevik has acknowledged the need for greater transparency in its portfolio valuations and reporting. Implementing measures to enhance transparency could attract a broader range of investors and increase trust.

- Secondary Acquisitions: The current market dynamics, characterized by tighter funding conditions for startups, present opportunities for Kinnevik to pursue strategic secondary acquisitions at favorable valuations, as demonstrated by their recent investments.

Threats:

- Economic Downturn: A prolonged economic downturn could negatively impact the performance of Kinnevik's portfolio companies, particularly those in growth-oriented sectors like climate tech and software.

- Competition from Other Investors: Kinnevik faces competition from other investors, including traditional venture capital firms and private equity funds, for attractive investment opportunities.

- Regulatory Changes: Changes in regulations, particularly in the healthcare and climate tech sectors, could impact the operations and profitability of Kinnevik's portfolio companies.

- Geopolitical Instability: Global geopolitical uncertainties can create market volatility and impact the performance of companies operating in international markets.

This SWOT analysis offers a snapshot of Kinnevik's current position and potential future trajectory.