What is the M&A Strategy of a Business?

Uncover M&A strategy in business: reasons, types, benefits, challenges, and transformative deals. What is the M&A Strategy of a Business?

M&A Strategy Explained

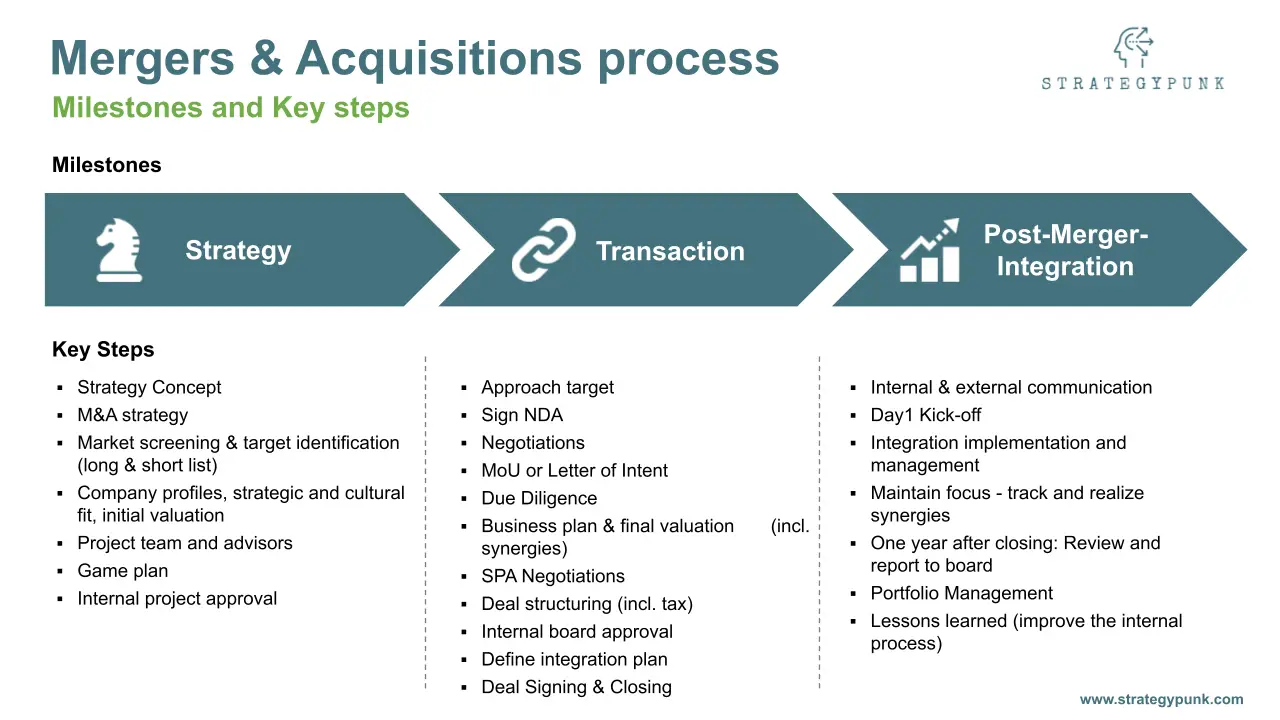

Mergers and acquisitions (M&A) is a strategy businesses employ to grow, diversify, and enhance their market position. At its core, M&A involves combining two companies into one. This strategy can be a game-changer but demands meticulous planning, negotiation, and execution.

The essence of M&A lies in pinpointing potential targets, conducting rigorous due diligence, negotiating the deal, and seamlessly integrating the new acquisition.

The endgame? Synergies that boost revenue, cut costs and sharpen competitiveness. While M&A can open doors to new markets and technologies, it comes with risks. A misstep can be costly, both in terms of resources and reputation.

Key Components of M&A Strategy

Identifying the Right Target

The journey begins with finding companies that align with the acquirer's objectives and promise synergies. This involves assessing financial health, market position, and growth prospects.

Due Diligence

This step is non-negotiable. It's about diving deep into the target's financial, legal, and operational facets to uncover potential risks or liabilities. It's the foundation for informed decision-making.

Crafting an Integration Plan

Post-acquisition, the real work begins. An integration plan outlines how to meld the target into the acquirer's operations. It's about ensuring smooth communication, defining roles, and anticipating challenges.

Here is the full M&A process:

Types of M&A Strategies

Horizontal M&A:

This involves merging companies in the same industry. It's about market share and reducing competition.

Horizontal M&A refers to the merger or acquisition of two companies that operate in the same industry or market. This type of M&A strategy is common among companies seeking to increase their market share, eliminate competition, or gain access to new products or technologies. Horizontal M&A can also lead to economies of scale, resulting in cost savings for the merged company. However, it can also lead to antitrust concerns.

Vertical M&A

Here, companies at different stages of a supply chain merge. It's about efficiency and control.

Vertical M&A refers to the merger or acquisition of companies that operate in different stages of the same supply chain or distribution channel. This type of M&A strategy is common among companies seeking to increase efficiency, reduce costs, and improve their control over the supply chain. Vertical M&A can also lead to increased bargaining power and reduced transaction costs.

Conglomerate M&A

This strategy sees companies from diverse industries coming together, aiming for diversification.

Conglomerate M&A refers to the merger or acquisition of companies that operate in unrelated industries or markets. This type of M&A strategy is common among companies seeking to diversify their portfolio, reduce risk, and gain access to new markets. Conglomerate M&A can also increase financial flexibility and reduce dependence on a single industry or market.

Leveraged Buyouts

This is about acquiring a company using significant debt. It's a favorite among private equity firms.

Leveraged Buyouts (LBOs) refer to the acquisition of a company using a significant amount of debt financing. This type of M&A strategy is common among private equity firms seeking to acquire undervalued or underperforming companies. LBOs can also increase financial returns, as the acquired company's assets can be sold off to pay down debt.

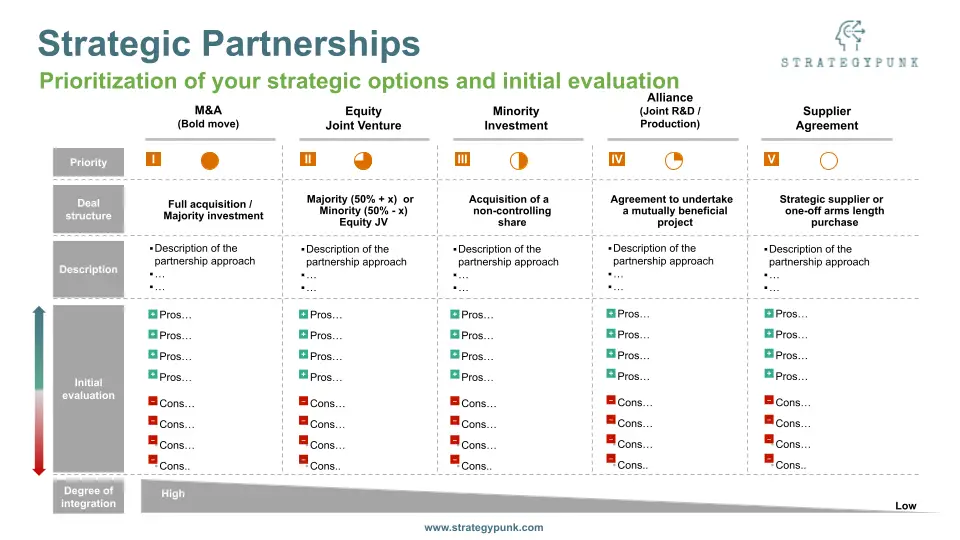

Joint Ventures

Two or more companies form a new entity for a specific project. It's about pooling resources and expertise.

Joint Ventures refer to creating a new company by two or more companies, typically for a specific project or business objective. This type of M&A strategy is common among companies seeking to share resources, expertise, and risks. Joint Ventures can also lead to increased access to new markets and technologies.

Strategic Alliances

Companies partner to achieve a shared objective. It's about leveraging strengths for mutual benefit.

Strategic Alliances refer to a partnership between two or more companies to achieve a specific business objective. This type of M&A strategy is common among companies seeking to combine their strengths and resources to achieve a common goal. Strategic Alliances can also lead to increased access to new markets, technologies, and customers.

Here is the M&A and Strategic Partnerships Evaluation Tool

Benefits and Risks of M&A Strategy

Benefits

M&A can be transformative. It offers rapid expansion, access to new markets, and product diversification. It can also lead to cost savings and enhanced profitability.

Mergers and acquisitions (M&A) can bring many benefits to businesses. One of the main advantages is the ability to expand quickly and gain access to new markets. By acquiring another company, a business can increase its customer base, diversify its product offerings, and reduce competition. M&A can also help companies achieve economies of scale, leading to cost savings and increased profitability.

Another potential benefit of M&A is gaining access to new technology or intellectual property. This can be particularly valuable for companies in rapidly evolving industries or facing disruptive changes. By acquiring a company with valuable patents or proprietary technology, a business can gain a competitive advantage and position itself for future growth.

Risks

M&A has pitfalls. Overpaying for a target, cultural mismatches, and regulatory hurdles can derail the best-laid plans. Hence, a clear strategy aligned with long-term goals is paramount.

While M&A can bring many benefits, it also carries significant risks. One of the main risks is the potential for overpaying for the target company. If the acquirer pays less, it can generate a return on investment and avoid financial difficulties. Another risk is the potential for cultural clashes between the two companies. If the cultures are not aligned, it can lead to employee turnover, decreased productivity, and other issues.

M&A can also be risky from a regulatory standpoint. Acquiring another company can be complex and time-consuming and may require approval from multiple regulatory bodies. If the acquirer fails to obtain the necessary permissions or violates any regulations, it could face fines, legal action, and damage to its reputation. Finally, M&A can be risky from a strategic perspective. If the acquirer does not have a clear plan for integrating the target company and realizing synergies, the acquisition may not deliver the expected benefits.

M&A in Action: Case Studies

Mergers and acquisitions can be risky, but they can lead to significant growth and success when done correctly. Here are a few examples of companies that have executed successful M&A strategies:

Disney and Pixar: Disney's $7.4 billion acquisition of Pixar in 2006 rejuvenated its animation division, leading to hits like "Toy Story 3."

Facebook and Instagram: Acquired for $1 billion in 2012, Instagram's meteoric rise has made this deal a masterstroke for Facebook.

Amazon and Whole Foods: Amazon's $13.7 billion acquisition of Whole Foods in 2017 marked its ambitious foray into the grocery sector.

Conclusion

M&A is a potent tool in a company's arsenal. When executed well, it can redefine a company's trajectory.

However, it demands clarity of purpose, rigorous due diligence, and a well-charted integration plan. As businesses consider M&A, aligning it with long-term objectives is crucial.

Frequently Asked Questions

What's M&A?

M&A involves consolidating companies to achieve strategic goals.

What are the three different types of M&A strategies?

Mergers and acquisitions can be broadly classified into horizontal, vertical, and conglomerate.

Horizontal mergers occur when companies in the same industry merge to gain market share. Vertical mergers occur when companies in different stages of the supply chain merge. Conglomerate mergers occur when companies from various sectors join to diversify their business.

How do companies choose M&A strategies?

It's based on business objectives, financial resources, and the regulatory landscape.

Companies decide on an M&A strategy based on their business objectives. They may want to expand their market share, enter new markets, acquire new technology, or diversify their business.

The decision also depends on the target companies' availability, the acquiring company's financial resources, and the regulatory environment.

Why is due diligence vital in M&A?

It helps identify risks and opportunities, ensuring informed decisions.

Due diligence is a critical component of the M&A process. It involves a detailed analysis of the target company's financial, legal, and operational aspects. The acquiring company must conduct due diligence to identify potential risks and opportunities associated with the target company.

This helps the acquiring company make an informed decision about the acquisition.

What challenges can arise in M&A?

Cultural differences, integration issues, and stakeholder expectations can pose challenges.

Implementing an M&A strategy can be challenging. Some common challenges include cultural differences between the acquiring and target companies, integration of business processes and systems, retention of key employees, and managing stakeholder expectations.

The acquiring company must have a well-defined integration plan to address these challenges.

How can M&A drive growth?

M&A can lead to market expansion, product diversification, and a competitive edge.

M&A can be a powerful growth strategy for companies. It can help companies enter new markets, acquire new technology and expertise, and diversify their business. M&A can also help companies achieve economies of scale and gain market share.

However, it is essential for companies to carefully evaluate potential targets and conduct due diligence to ensure that the acquisition aligns with their business objectives.

Do you have any successful M&A examples?

There are many successful examples of companies using M&A as a strategy.

One such example is Facebook's acquisition of Instagram. This acquisition helped Facebook expand its user base and strengthen its position in the social media market.

Another example is Google's acquisition of YouTube. This acquisition helped Google enter the video-sharing market and gain access to a large user base.

Developing an M&A Strategy: Three Questions to Ponder

What's your company's value creation thesis? How does the target enhance your company? How does your company elevate the target?

Answering these three questions will clearly explain your company's goals and how the acquisition will help achieve them. Develop an M&A strategy aligned with your company's goals and create value for your company and the target company.

What's your company's value creation thesis?

The first question is crucial because it sets the foundation for the entire M&A strategy. The value creation thesis is why your company exists and what it hopes to achieve.

By understanding this, you can identify what types of companies would fit well with your company's mission and goals.

How does the target enhance your company?

The second question focuses on how the target company can improve your company. This could be through access to new markets, technology, or expertise.

Identifying these benefits early in the M & A process is essential to ensure the deal will create value for your company.

How does your company elevate the target?

The third question concerns how your company can improve the target company. This could be through providing resources, expertise, or access to new markets.

By identifying these opportunities, you can ensure the acquisition will succeed for both companies.

What is M&A Strategy? Explained for a Fifth-Grader

Imagine you have two separate toy stores. Each store has its own set of toys. One day, the owners of these stores decide to join together and make one big toy store. Now, they can offer more toys and attract more kids to their store.

This joining together of two stores is similar to what businesses do, and it's called "Mergers and Acquisitions," or M&A for short.

Why Do Businesses Do M&A?

- More Toys (or Products): Like our toy store example, when two companies join, they can offer more products to their customers.

- Save Money: If our two toy stores join, they might only need one cashier instead of two. This way, they save money.

- Be Stronger Together: Sometimes, two smaller toy stores might join to compete against a giant toy store. Together, they have a better chance.

How Do Businesses Do M&A?

- Find a Partner: The first step is like finding a friend to play with. Companies look for another company that will be a good match.

- Check the Toys: Before joining, they check each other's toys (or products) to make sure they're good.

- Joining Party: Once they decide to join, they plan how to put their toys together in the new big store.

Things to Remember:

- M&A is like two toy stores becoming one big store.

- They do it to have more toys, save money, and strengthen together.

- Before joining, they check each other's toys and make a plan.