Mergers and Acquisitions Explained: A Crash Course on M&A (Free Templates)

Unlock the strategic power of Mergers and Acquisitions with our comprehensive guide. From types of transactions to key players, we break down the complexities of M&A, providing a crash course that drives growth and transformation in the world of business.

In the ever-evolving global business landscape, Mergers and Acquisitions (M&A) are powerful tools for growth and transformation.

This comprehensive guide aims to shed light on the intricate world of M&A, offering fresh perspectives on business transactions, strategic considerations, and the key players involved in these complex deals.

Unraveling the Types of Business Transactions

At the heart of M&A lie various forms of business transactions, each with its unique characteristics and implications. These include asset sales, stock or equity sales, and mergers. While asset and stock sales are relatively common, mergers, though less frequent, carry a unique allure. Mergers often occur due to complex tax considerations or the strategic advantage of combining two companies into a single, more powerful entity. Understanding these different transaction types is the first step towards mastering the art of M&A.

Navigating the M&A Market Landscape

The M&A market is as diverse as it is dynamic. At the lower end of the market, asset sales are more common. These transactions involve the sale of a company's assets, such as its technology, brand, or customer base. As the market scales up, stock sales become more prevalent. These involve the sale of ownership stakes in the company itself. This spectrum of transaction types offers a fascinating insight into the dynamics of the M&A market and the strategic considerations at play.

The Strategic Choice: Build or Buy?

A company's most critical decision is to build its products or services or acquire other companies. Industry giants like Google and Facebook often opt for the latter, leveraging M&A to swiftly enter new markets, develop innovative technologies, or eliminate competition. The reasons behind this strategic choice can be manifold, including the need for speed, the complexity of creating new products, and the barriers to entry in specific markets. This strategic perspective on M&A underscores its importance as a tool for business growth and transformation.

The Key Players in M&A: More Than Just Buyers and Sellers

M&A transactions involve a host of key players, each contributing their unique expertise to the deal:

- Business Brokers: Facilitate the sale of businesses, often focusing on smaller deals.

- Investment Bankers: Specialize in more significant transactions, leveraging their extensive networks to find buyers and sellers.

- Corporate Lawyers: Handle the legal aspects of the deal, ensuring compliance with regulations and protecting their client's interests.

- Accountants: Provide financial analysis and insights for valuing the deal.

- Tax Advisors: Offer advice on the tax implications of the deal, which can significantly impact its attractiveness.

- Consultants: Assist with the strategic aspects of the deal, including post-merger integration.

Understanding the roles of these professionals can provide valuable insights into the mechanics of M&A transactions.

Due Diligence: The Unsung Hero of M&A

Due diligence is a critical yet often overlooked aspect of M&A. This process involves a thorough investigation by the buyer to ensure they are getting what they believe they are buying. It includes reviewing financial statements, legal documents, customer contracts, and more. The importance of due diligence cannot be overstated, as it helps identify potential risks and liabilities, ensuring a fair and transparent transaction.

A Fresh Perspective on M&A

M&A is more than just a series of business transactions. It's a strategic tool that can transform industries, reshape markets, and create significant value for companies and their stakeholders. By understanding the different types of transactions, the strategic considerations, and the key players involved, businesses can leverage M&A to drive growth, innovation, and competitive advantage.

In conclusion, Mergers and Acquisitions offer a fascinating and complex field of study. Whether you're a seasoned professional or a newcomer, understanding M&A can provide valuable insights and open up new opportunities. So, why wait? Dive into the world of M&A today and discover the strategic power of business transformation!

Critical Questions on Mergers and Acquisitions

Formulating practical questions can stimulate deeper thinking and curiosity. Here are some questions related to "Mergers and Acquisitions:

What strategic considerations should a company evaluate before pursuing a merger or acquisition?

Before embarking on an M&A journey, a company must evaluate several strategic considerations. These include alignment with the company's long-term goals, the financial health of the target company, potential synergies, cultural fit, and the impact on stakeholders. A well-planned M&A strategy can lead to growth, innovation, and competitive advantage.

How do the roles of business brokers, investment bankers, corporate lawyers, accountants, tax advisors, and consultants differ in an M&A transaction? How do they collaborate to ensure a successful deal?

An M&A transaction involves a team of professionals, each playing a unique role. Business brokers and investment bankers facilitate the deal, corporate lawyers handle legal aspects, accountants provide financial insights, tax advisors offer tax-related advice, and consultants assist with strategic elements and post-merger integration. Their collaboration is crucial for a successful deal.

Can you provide examples of successful mergers or acquisitions? What factors contributed to their success?

A classic example of a successful merger is the Disney-Pixar merger. This merger combined Disney's marketing and merchandising power with Pixar's creative prowess, leading to blockbuster hits. The success was primarily due to the two companies' complementary strengths and shared vision.

How does the due diligence process help mitigate risks in M&A transactions? Can you provide an example of a deal where due diligence played a crucial role?

Due diligence is a risk mitigation process in M&A transactions. It involves a thorough investigation of the target company. For instance, in the acquisition of LinkedIn by Microsoft, due diligence played a crucial role in understanding LinkedIn's financial health, user base, and growth potential, leading to a successful acquisition.

How do market dynamics influence the choice between asset sales, stock sales, and mergers? Can you provide examples of each within different market contexts?

Market dynamics significantly influence the choice between asset sales, stock sales, and mergers. For instance, companies prefer stock sales to capitalize on high valuations in a booming market. Conversely, asset sales might be more common in a downturn as companies look to offload non-core assets.

How have M&A strategies evolved with the rise of the digital economy and technology companies?

The rise of the digital economy has transformed M&A strategies. Tech companies often use acquisitions to access innovative technologies, skilled talent, or new markets. For example, Facebook's acquisition of Instagram allowed it to expand into the photo-sharing market rapidly.

What common pitfalls or challenges in M&A transactions, and how can they be avoided or mitigated?

Common pitfalls in M&A include cultural clashes, overestimating synergies, and inadequate due diligence. These can be mitigated through careful planning, thorough due diligence, and effective post-merger integration.

How does a merger or acquisition impact the employees of the companies involved? What strategies can be used to manage this impact?

M&A can significantly impact employees, including changes in corporate culture, job redundancies, or shifts in responsibilities. Effective communication, careful planning, and support programs can help manage this impact and ensure a smooth transition.

How can M&A be used as a tool for business growth and transformation? Can you provide an example of a company that has effectively used M&A in this way?

M&A can be a powerful tool for business growth and transformation. For example, Google has used acquisitions to expand its product portfolio, enter new markets, and acquire innovative technologies, contributing to its position as a global tech leader.

How do tax considerations influence the decision to merge with or acquire another company? Can you provide an example where tax considerations significantly influenced the decision?

Tax considerations can significantly influence M&A decisions. For instance, a merger might be preferred over an acquisition if it offers more favorable tax treatment. A notable example is the "inversion" strategy, where U.S. companies merge with foreign firms to benefit from lower corporate tax rates abroad.

Quizzes on Mergers and Acquisitions

Here are some quizzes at varying difficulty levels to test your understanding of Mergers and Acquisitions

Beginner Level:

1.What are the three main types of business transactions involved in M&A?

a) Asset sales, stock sales, and mergers

b) Asset sales, equity sales, and acquisitions

c) Stock sales, equity sales, and mergers

d) Asset sales, equity sales, and partnerships

2.What is due diligence in the context of M&A?

a) A legal requirement for all businesses

b) A process where the buyer ensures they are getting what they think they are buying

c) A tax strategy to reduce the cost of the acquisition

d) A type of insurance policy for M&A transactions

Intermediate Level:

3.Why might a company acquire another company instead of building its products or services?

a) To eliminate competition

b) To acquire innovative technologies

c) To enter new markets swiftly

d) All of the above

4.Which professionals are typically involved in an M&A transaction?

a) Business Brokers

b) Investment Bankers

c) Corporate Lawyers

d) All of the above

Advanced Level:

5.How do market dynamics influence the choice between asset sales, stock sales, and mergers?

a) In a booming market, companies might prefer stock sales to capitalize on high valuations

b) In a downturn, asset sales might be more common as companies look to offload non-core assets

c) Both a and b

d) Neither a nor b

6.What are some common pitfalls in M&A transactions, and how can they be mitigated?

a) Cultural clashes, overestimation of synergies, and inadequate due diligence; mitigated through careful planning, thorough due diligence, and effective post-merger integration

b) Financial instability, lack of market knowledge, and poor communication; mitigated through financial audits, market research, and clear communication strategies

c) Both a and b are correct

d) Neither a nor b is correct

Challenges or obstacles related to Mergers and Acquisitions

Here are some challenges or obstacles related to Mergers and Acquisitions that can stimulate deeper thinking and enhance your learning and problem-solving abilities.

- Cultural Integration: One of the biggest challenges in M&A is merging two different company cultures. How would you ensure a smooth cultural integration that minimizes disruption and maximizes employee satisfaction and productivity?

- Valuation Discrepancies: Valuing a company for M&A can be complex and subjective, often leading to discrepancies between the buyer and seller. How would you approach the valuation process to ensure a fair and agreeable outcome for both parties?

- Regulatory Hurdles: M&A often involves navigating a maze of regulatory requirements, varying by industry and geography. How would you ensure compliance with all relevant regulations while minimizing delays and complications?

- Post-Merger Integration: The real work integrates the two companies after closing the deal. This involves merging operations, technologies, and teams. What strategies would you use to ensure a successful post-merger integration?

- Synergy Realization: M&A deals are often justified by the potential synergies between the two companies. However, realizing these synergies can be challenging. How would you identify, quantify, and realize synergies in an M&A deal?

- Stakeholder Management: M&A deals can significantly impact various stakeholders, including employees, customers, shareholders, and regulators. How would you manage and communicate with these stakeholders to minimize disruption and maintain trust?

- Due Diligence Limitations: Despite thorough due diligence, some risks or issues may only be identified after closing the deal. How would you manage these unforeseen risks or topics?

- Financing the Deal: M&A deals often involve large sums of money, which can be funded through various means, including debt, equity, or cash. What factors would you consider when deciding how to finance an M&A deal?

These challenges require deep thinking, problem-solving skills, and a thorough understanding of M&A concepts. By tackling these challenges, you can enhance your learning and become more proficient in M&A.

Executive Summary - Key Points

- M&A involves various business transactions, each with unique characteristics and implications.

- Market dynamics influence the choice of transaction type in M&A.

- Companies often acquire other companies for speed, the complexity of creating new products, and barriers to entry in specific markets.

- Key players in M&A transactions include business brokers, investment bankers, corporate lawyers, accountants, tax advisors, and consultants.

- Due diligence is a critical aspect of M&A, helping to identify potential risks and liabilities.

- M&A is more than just a series of business transactions; it's a strategic tool that can transform industries, reshape markets, and create significant value for companies and their stakeholders.

- The blog post includes quizzes at varying difficulty levels to test readers' understanding of M&A.

- The center presents several challenges related to M&A to stimulate deeper thinking and enhance learning and problem-solving abilities.

Mergers & Acquisitions Templates

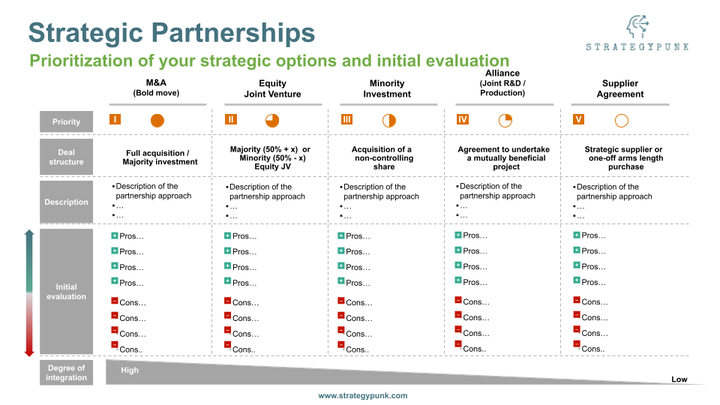

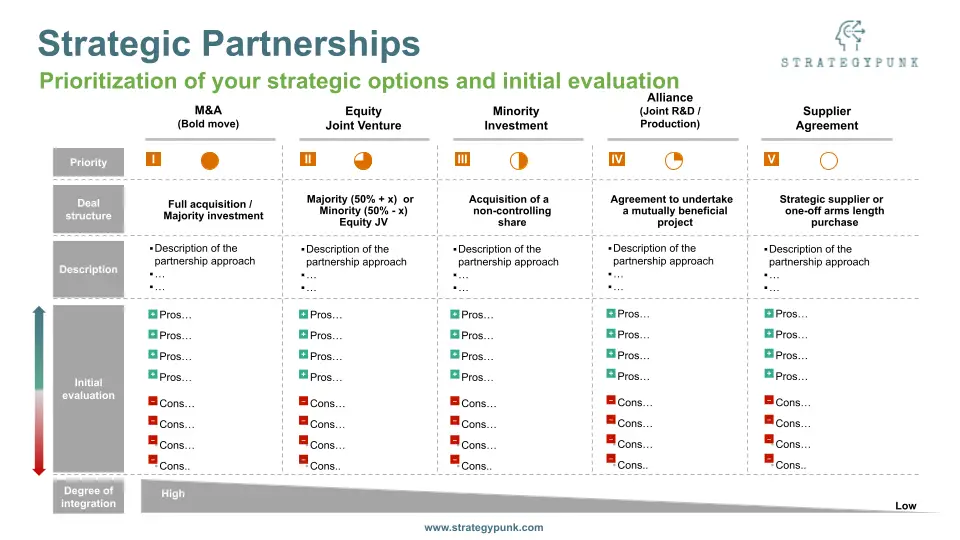

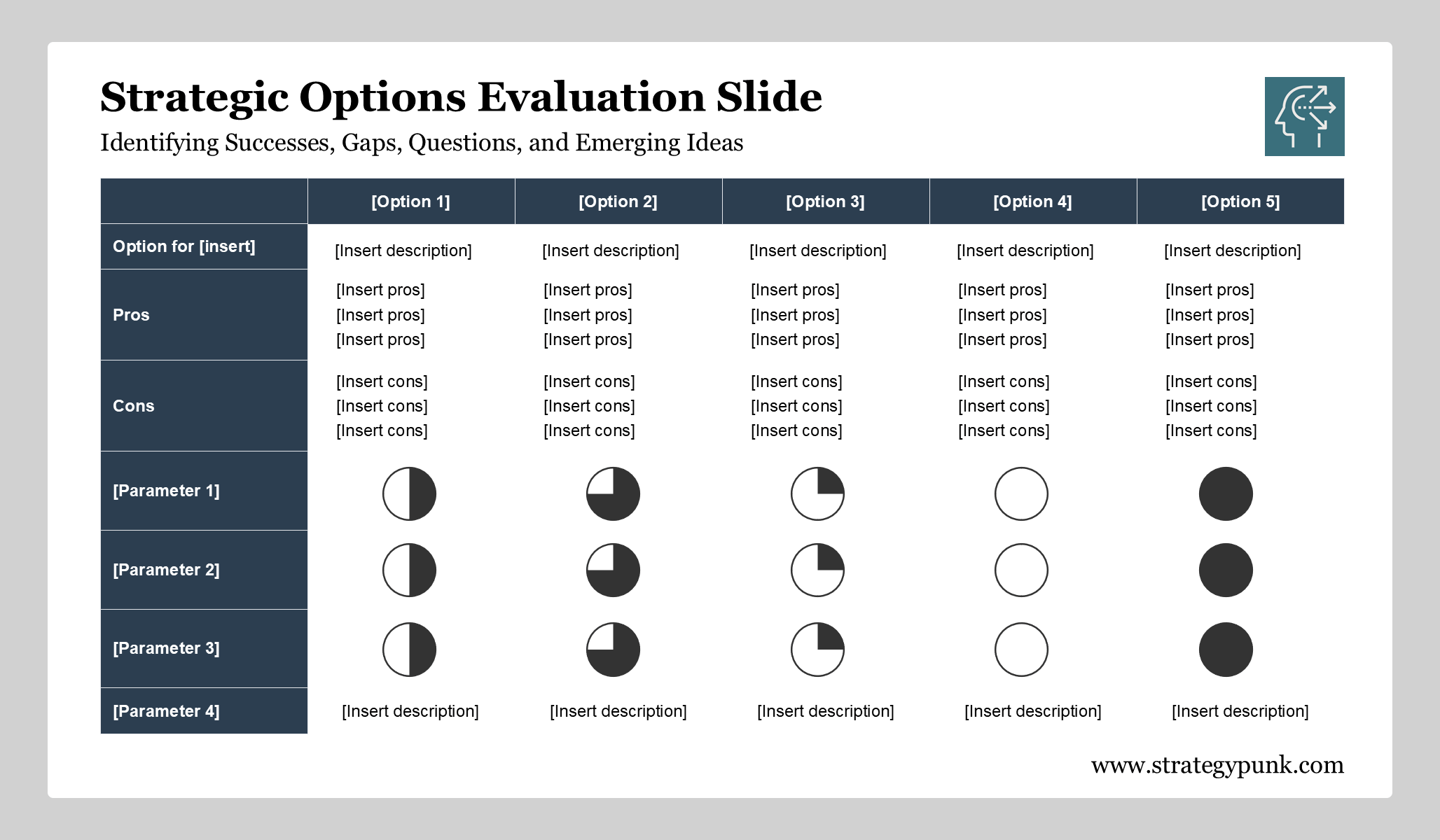

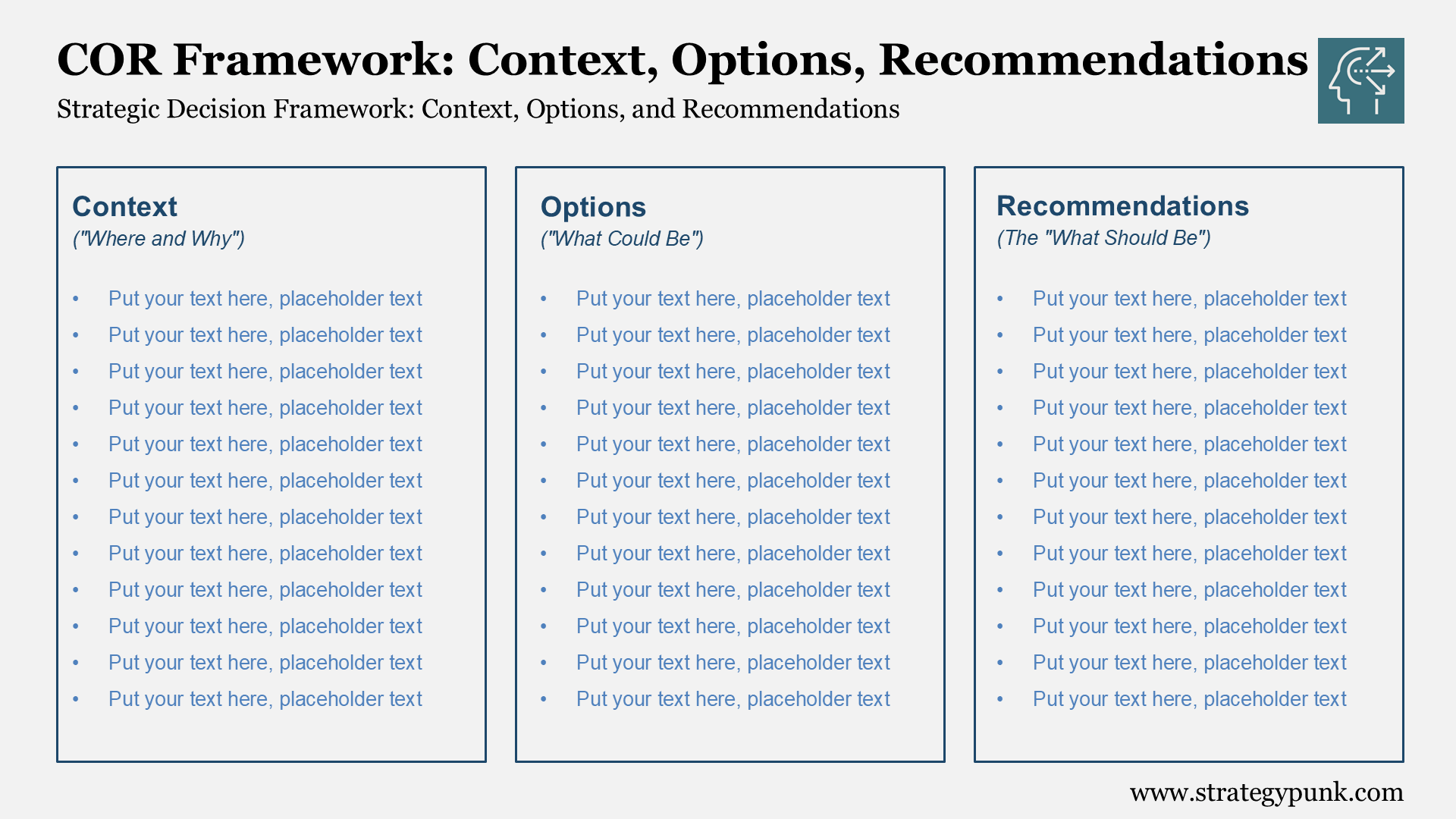

M&A and Strategic Partnerships: PowerPoint Evaluation tool

M&A and Strategic Partnerships: Free PowerPoint Evaluation tool. A simple evaluation tool to describe and rate the strategic rationales of M&A projects or partnerships.

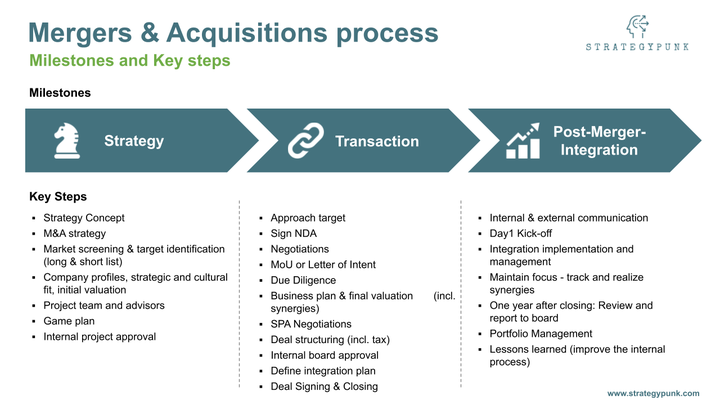

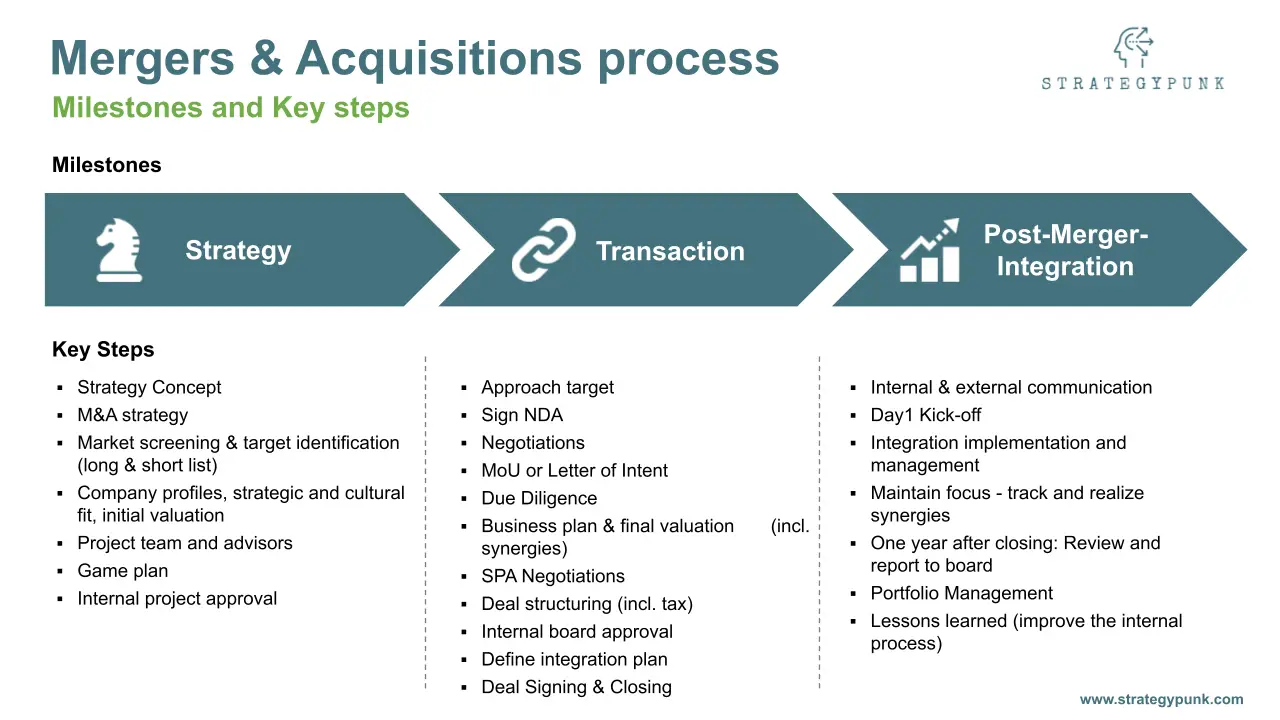

Mergers & Acquisitions Process: Guide and free template

The M&A process guide and free template includes all three stages of an M&A deal.

Strategic Partnerships: PowerPoint Evaluation Tool

Elevate your strategic partnership options with our guide and free PowerPoint template. Showcase goals, benefits, and plans with ease. Download now!