Salesforce M&A Strategy Framework Worksheet

Salesforce M&A Strategy Framework Worksheet. A blueprint template to develop your own M&A strategy on how to evaluate potential targets.

If you are interested in or working in M&A, looking at companies that master the art of M&A for best practices is always an excellent way to start.

How did Salesforce grow so fast?

Salesforce is a company that provides customer relationship management (CRM) software and services. One of Salesforce's strategies for growth is through mergers and acquisitions (M&A). The company has a strong track record of successfully executing M&A deals.

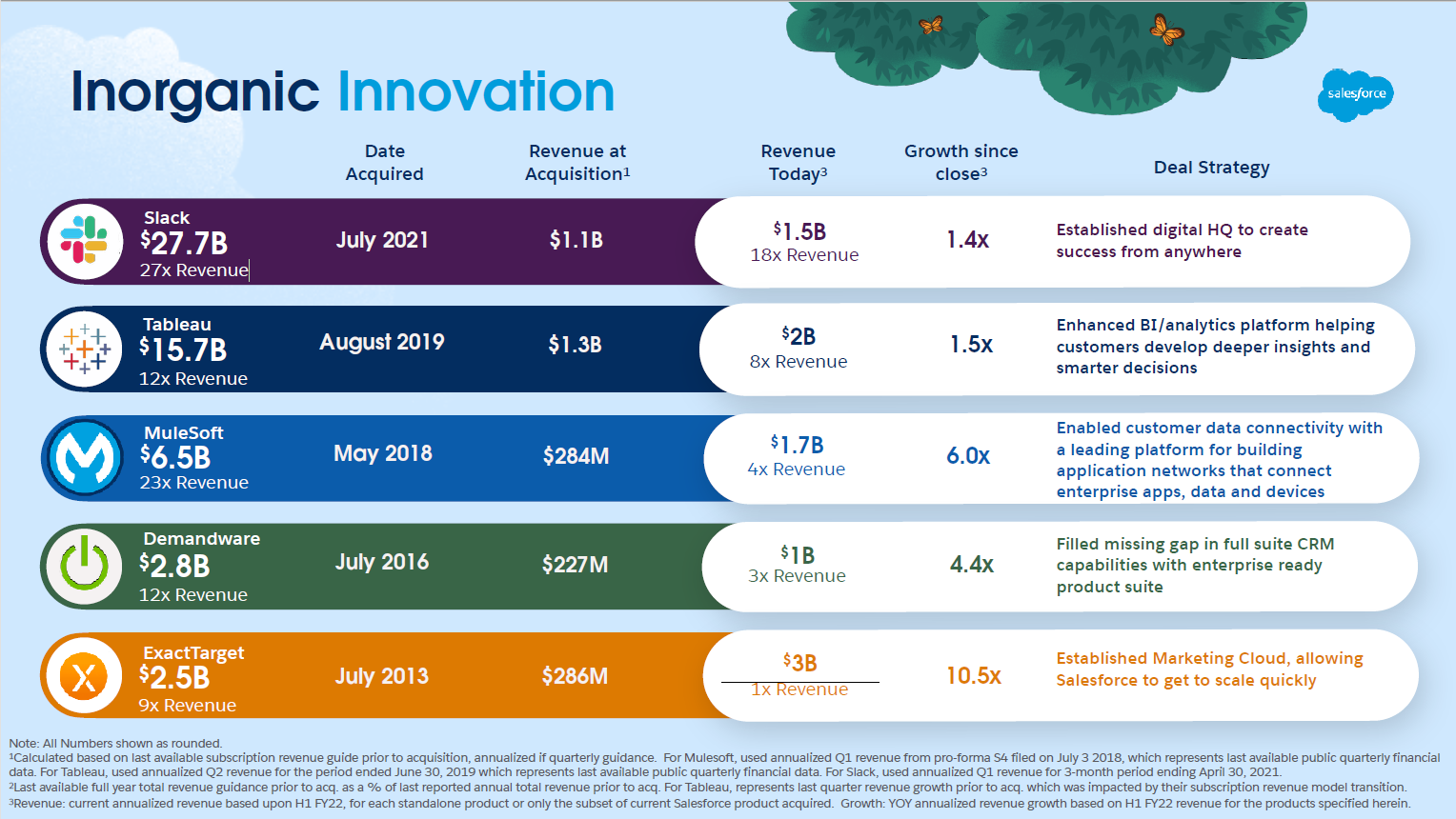

Salesforce’s most recent deal was the acquisition of the software firm Slack for $27.7B in July 2021. Other notable acquisitions include:

- Tableau: Salesforce acquired Tableau, a data visualization software company, in 2019 for $15.7 billion. This acquisition allowed Salesforce to expand its analytics capabilities and offer more data-driven insights to its customers.

- Mulesoft: Salesforce acquired Mulesoft, an integration platform company, 2018 for $6.5 billion. This acquisition allowed Salesforce to expand its integration capabilities and provide more seamless integration with other systems and applications.

- ExactTarget: Salesforce acquired ExactTarget, a digital marketing platform company, 2013 for $2.5 billion. This acquisition allowed Salesforce to expand its marketing automation capabilities and provide more comprehensive marketing solutions to its customers.

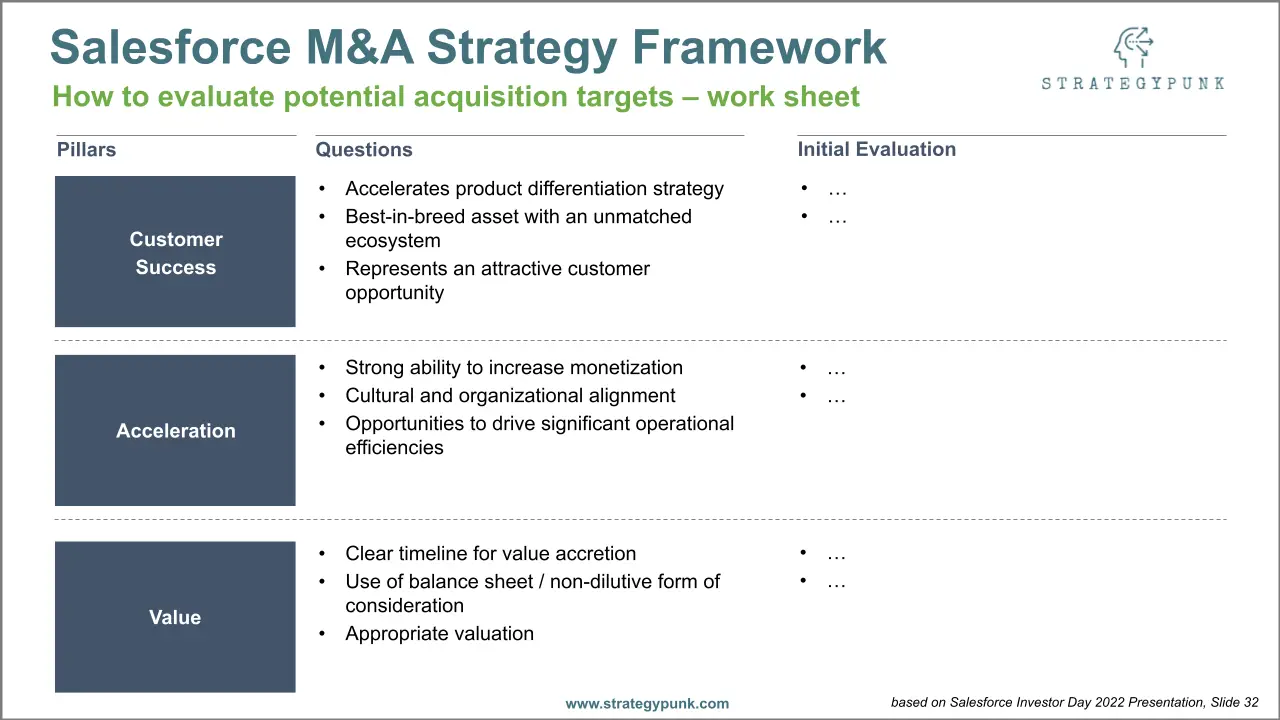

Since 2013, Salesforce spent more than $55B on acquisitions. That’s why it was interesting to hear President and Chief Financial Officer Amy Weaver, in her finance presentation, talk about what they look for in an acquisition target at the Salesforce Investor Day 2022 on September 21st.

M&A is a complicated process that requires a lot of planning and analysis to execute successfully. Using the Salesforce M&A strategy framework worksheet can be a blueprint to develop your M&A strategy to evaluate potential targets.

Download the Salesforce M&A strategy framework worksheet as PDF, Google Slides, and PowerPoint template below.

Salesforce's M&A strategy

Salesforce's M&A strategy is acquiring companies that complement or enhance i offerings. By acquiring companies with expertise in data visualization, integration, and marketing automation, Salesforce can offer its customers a more comprehensive suite of products and services.

It is important to note that Salesforce's M&A strategy is focused on expanding its product offerings and acquiring niche companies that can help it grow into new markets and increase its customer base.

Salesforce's impressive M&A track record over the last decade.

Salesforce had an impressive track record of innovation, constantly innovating and integrating new segments into their Customer 360 product offering in the last twenty years. Next to organic creation, salesforce invested in the previous decade in best-of-class assets and incorporated them into salesforce.

In the last decade, Salesforce acquired Slack (2021), Tableau (2019), MuleSoft (2018), Demandware (2016), and ExactTarget (2013) for a total of $ 55.2B (according to Salesforce Investor Presentation 2022, Slide 31).

All acquired companies brought vital products and solutions into the salesforce customer 360. They thrived under the new leadership of Salesforce, which speaks for a great integration mindset. An absolute highlight is the acquisition of Mulesoft. Acquired in May 2018 with 284M$ of revenue at purchase, it today generates 1.7B$ revenues.

M&A has been an influential part of their capital allocation strategy in growing the company to FY22 $26,5B revenue.

Howdg at M&A? How does Salesforce evaluate M&A deals?

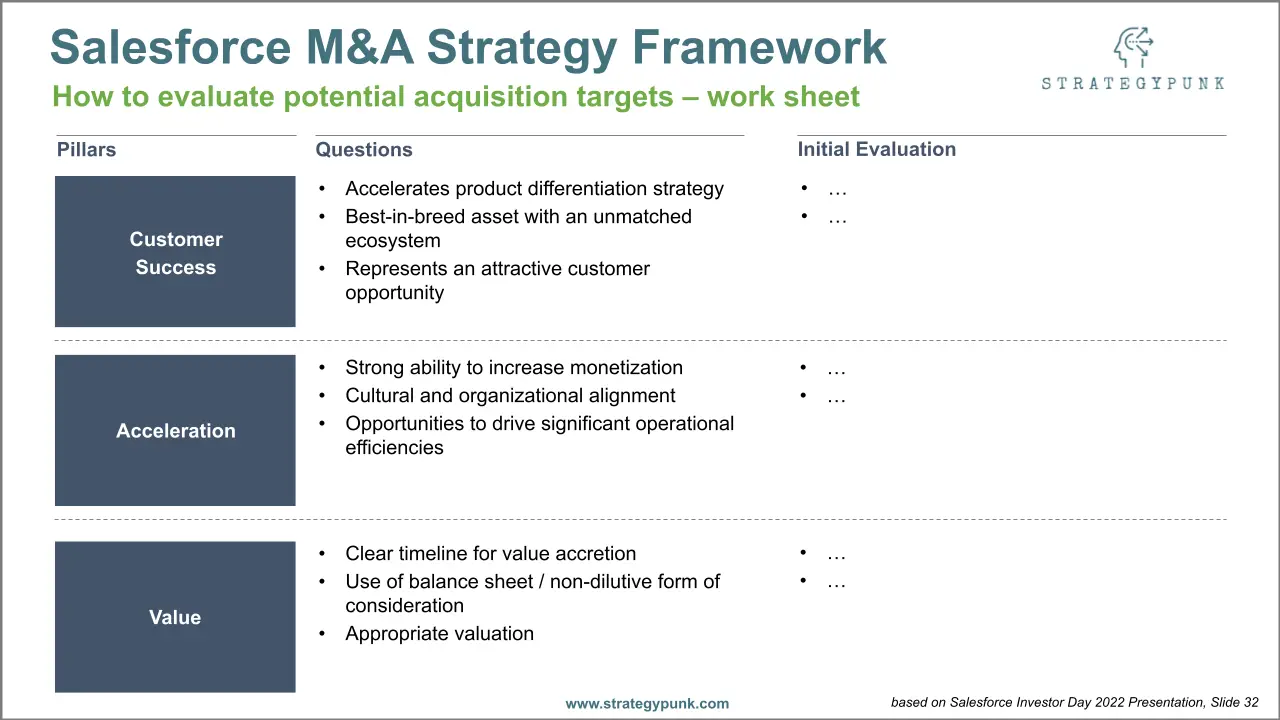

Salesforce defines 3 main pillars in their salesforce customer 360 M&A strategy framework:

1. Customer Success

Is the target the best-in-class asset to serve our customer's need

2) Acceleration

Is there a way to monetize the product effectively? How does the acquisition support salesforce financially?

3) Value

Is there a clear timeline for value accretion?

In the future, salesforce wants to use its strong balance sheet, primarily financing acquisitions with cash and debt.

Key Takeaway

Acquisitions are one of the most common ways for technology companies to grow their market share and reach new segments. Salesforce masters the art of M&A, acquiring and integrating more than five multi-billion companies in the last decade.

When done right, M&A can help most companies expand their product offerings, reach new customers, and strengthen their go-to-market strategy.

Still, M&A is a complicated process that requires a lot of planning and analysis to execute successfully. Using the salesforce M&A strategy framework worksheet can be a blueprint to develop your own M&A strategy.

Click-Worthy Links

Salesforce Investor Day September 2022

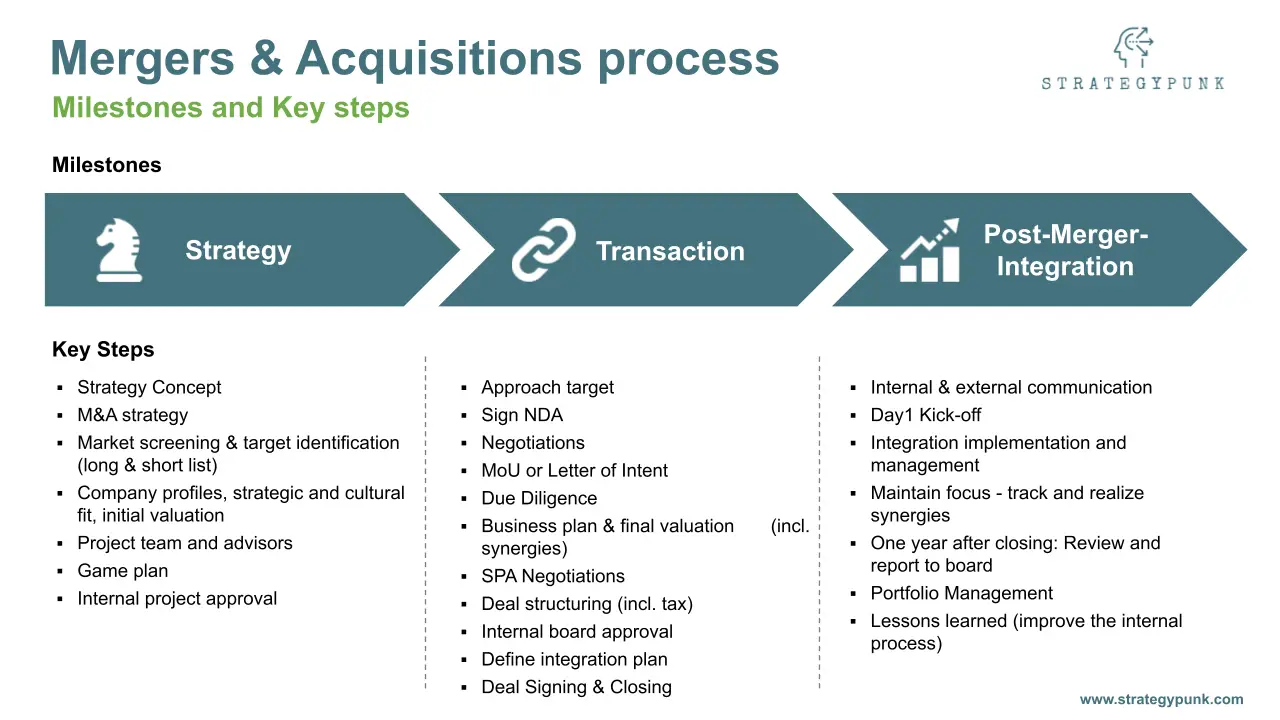

Mergers & Acquisitions Process: Guide and free template

The M&A process guide and free template includes

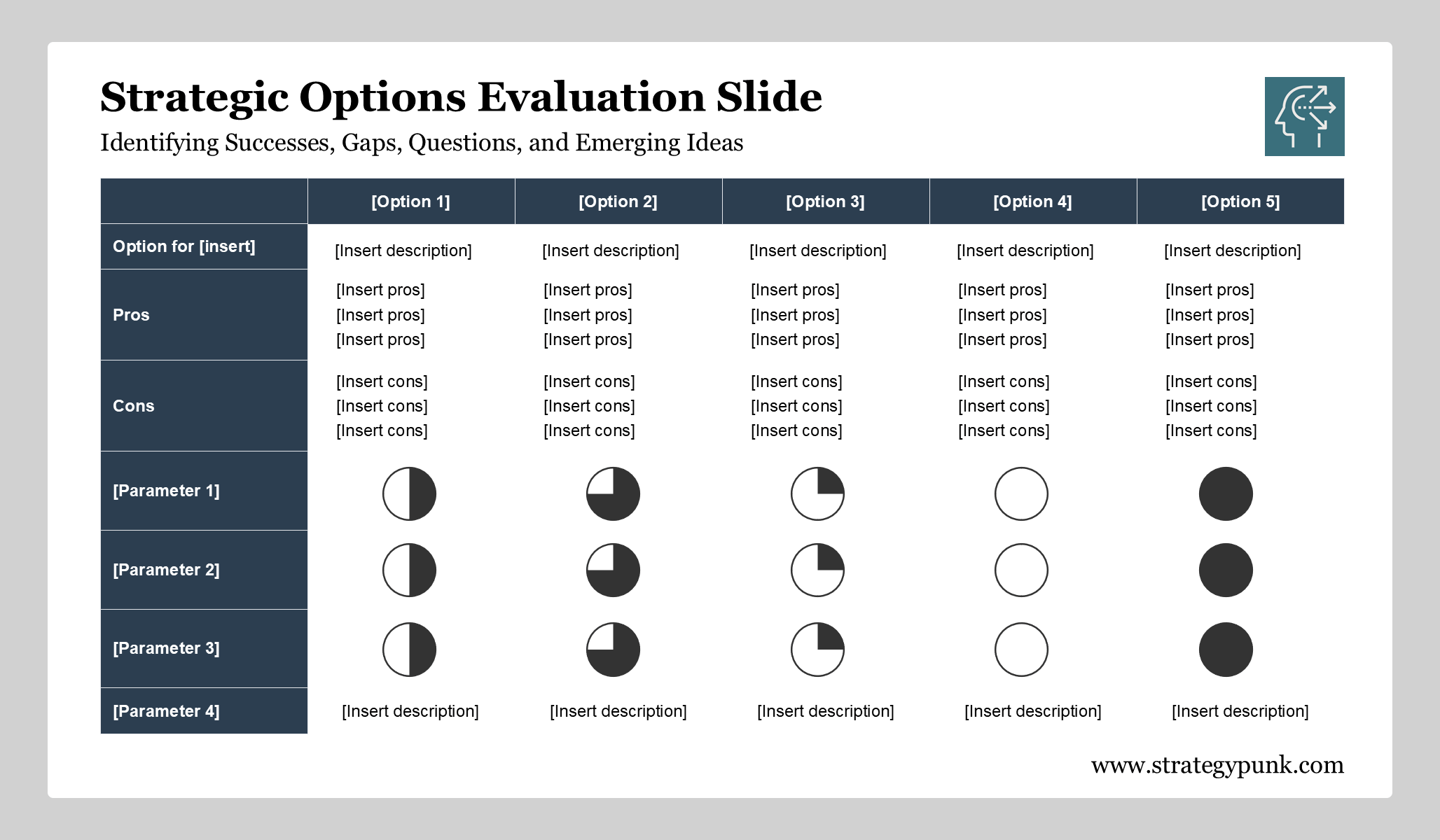

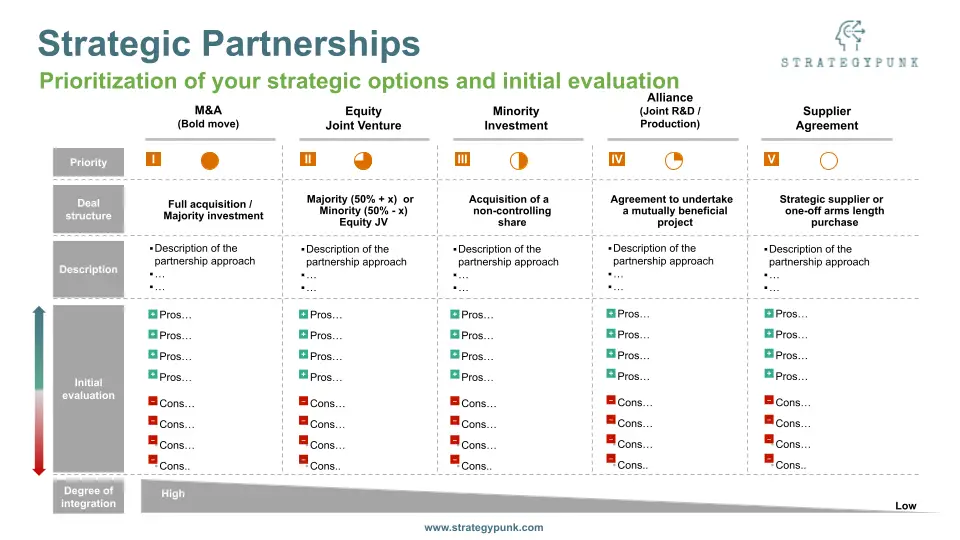

Strategic Partnerships: PowerPoint Evaluation Tool

M&A and Strategic Partnerships: PowerPoint Evaluation tool

A simple

Salesforce M&A Strategy Framework Worksheet

Template in PDF, PowerPoint and Google Slides

Salesforce M&A Strategy Framework Worksheet PDF

Please subscribe and sign in to download the worksheet and template in Google Slides or PowerPoint format for free below.