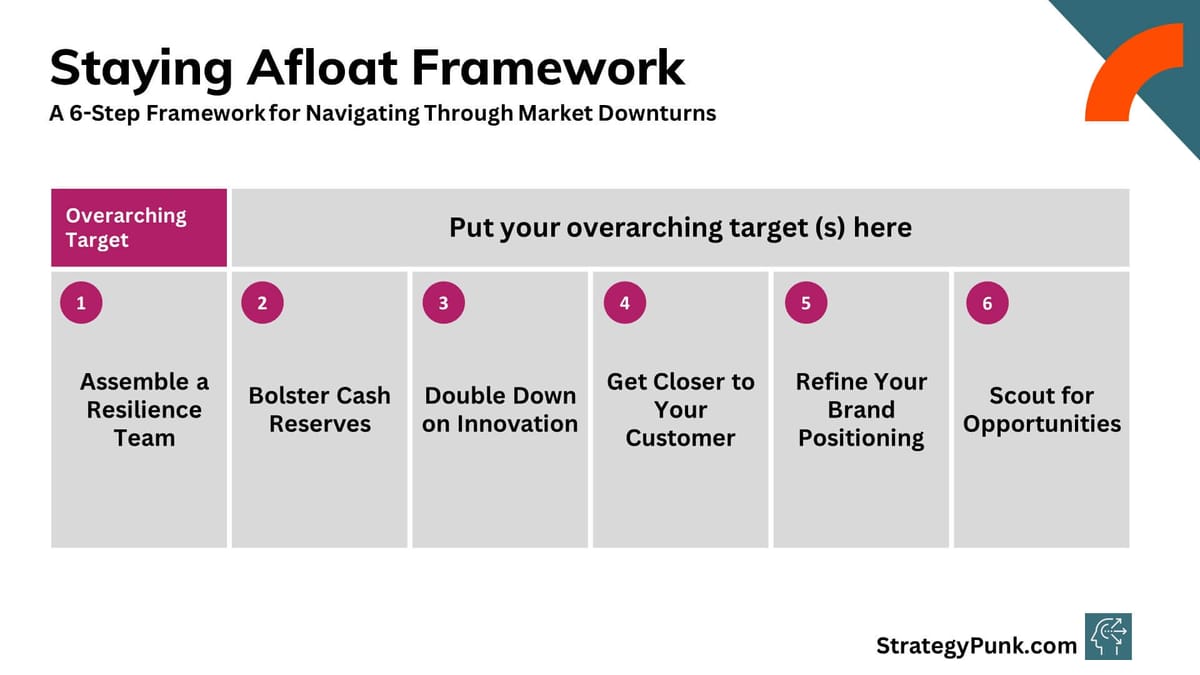

Staying Afloat: A 6-Step Framework for Navigating Through Market Downturns

Discover Staying Afloat: a 6-Step Framework for thriving in market downturns. Essential strategies to navigate financial challenges and maintain business growth.

Introduction

Uncertain times call for proactive planning. With ominous signs of a potential recession looming ahead in 2024, business leaders need to brace themselves for the possibility of reduced consumer spending and disrupted supply chains. However, with careful preparation and execution, a market downturn doesn’t have to sink your business.

Many successful companies have leveraged past recessions to solidify their market position. By taking strategic risks, doubling down on innovation, and optimizing their operations, they emerged stronger once the economy bounced back.

This framework outlines six steps you can take to not only weather the storm but potentially thrive through turbulent markets.

Step 1: Assemble a Resilience Team

Your first step is to assemble a cross-functional “resilience team” across critical departments like sales, marketing, finance, HR, and operations. This team will steer you through stormy seas by rapidly responding to challenges.

Empower them to make quick decisions without bureaucratic red tape. Set up recurring touchpoint meetings to closely track metrics, consumer sentiment shifts, supply issues, and changes in the competitive landscape. The agility and collaboration of this team could make or break your recovery efforts.

Step 2: Bolster Cash Reserves

Shoring up your balance sheet by maintaining healthy cash reserves and improving working capital is vital in uncertain times. Cash is king, so examine ways to extend payment cycles, incentivize early customer payments, and optimize inventory to what sells.

Identify your fastest-selling, highest-margin products and redirect resources toward scaling those up. Trim any excess fat that doesn’t align with immediate growth priorities. Develop contingency plans across functions to restrict spending and, if required, reduce operational costs.

Step 3: Double Down on Innovation

Downturns dampen risk appetites as leaders look inward to protect existing operations. However, the most enduring companies focus on pushing new boundaries despite external environments.

Your innovation efforts may range from new products or business models to improved customer experiences and internal processes. Challenge teams to view constraints as opportunities to get creative despite budget limitations. Resource allocation may be restricted, but unleashing your collective ingenuity is unlimited.

Step 4: Get Closer to Your Customer

There is no better time to strengthen customer loyalty than when buyers are more cautious. Launch targeted campaigns to engage your most valuable customers. Survey them continuously to understand shifting needs and identify at-risk accounts you could lose.

Empower sales teams with data-driven insights to have relevant conversations. Ramp up customer success efforts to boost retention and mine cross-selling potential. The trust and goodwill you cement now will form the foundation for growth when the fog lifts.

Step 5: Refine Your Brand Positioning

Downturns shift consumer psychographics in terms of both emotional appeal and price sensitivity. This necessitates revisiting your brand positioning with a fresh perspective. Figure out where demand is stable or even increasing despite the gloom.

Then, re-evaluate your value proposition compared to customer budgets and competitors. Reposition your brand, target the right segments, and craft the right messages to stand out for the right reasons.

Step 6: Scout for Opportunities

Finally, maintain an outward lens to spot potential opportunities that turbulent times may uncover. Distressed competitors struggling to stay solvent could be prime targets for acquisitions that expand your market share.

Look for ways to poach undervalued talent from other companies that could become future leaders in your roster. Be ready to rapidly scale up to seize white spaces as the market contracts before others spot them.

The Road Ahead

No one truly knows how rocky the road ahead may be or when the tide will turn. We know that companies that proactively prepare their defenses have a higher chance of weathering storms when they strike.

While hoping for the best, intelligent leaders also plan for the worst by taking action along the dimensions above. Remember, smooth seas do not make skillful sailors. Turbulent times call for your best work and reveal the true character of leaders.

The frameworks and principles outlined above will serve you well in distress and when things are sailing smoothly. So, brace yourself for choppy waters ahead, but know you have what it takes to steer your ship through!

Frequently Asked Questions

Which industries are usually worst hit during recessions?

Cyclical sectors like manufacturing, construction, real estate, travel, and hospitality tend to be most vulnerable in downturns due to high fixed costs and the discretionary nature of demand. However, ripple effects spread across supply chains, impacting even defensive sectors.

Should we stop all new hiring and lay off employees?

Not necessarily. Making knee-jerk human capital cuts can profoundly impact employee morale, retention, and future growth potential. Take a strategic approach - pause non-critical hiring but continue to attract top talent for critical roles. Evaluate performance to weed out the bottom 10% of low performers.

Is this a good time to introduce new products and enter new markets?

Downturns open unique white space opportunities as competitors falter. It may be an optimal time to accelerate game-changing innovations or enter high-potential adjacent segments before others do. Of course, poor timing could also backfire, so evaluate risks before leaping.

How else can we improve our balance sheet besides cash reserves?

Explore negotiating extended payment terms with suppliers to improve working capital. Offer discounts to customers for early payments. Look at offloading unused assets or equipment for cash. Examine debt refinancing if terms are unfavorable. The key is boosting the assets side while reducing liabilities.

Should we cut research and development (R&D) spending to save costs?

It depends. Evaluate current R&D projects and trim non-essential ones focused on incremental gains. However, consider increasing spending on innovations aligned to customer needs or high-growth areas to widen competitive gaps when markets rebound.

How can we motivate and incentivize sales teams during an economic decline?

Use relative benchmarks like performance versus past periods rather than absolute revenue targets. Have frequent conversations on customer shifts and role model resilience through optimism and empathy. Incentivize behaviors like mining existing accounts and capturing market share from struggling competitors.

What are some early indicators that signal when downturns could potentially bottom out?

Leading indicators include GDP and industrial production showing signs of stabilization, business and consumer sentiment seeing consistent upticks, easing lending restrictions, rebounding housing data, and growth in new orders/jobs. The stock market usually rebounds 6 months before the actual economy turns around.

How should marketing efforts differ during prosperous times versus downturns?

Focus more on retention and loyalty rather than acquisition during downturns. Tone down flashy, expensive campaigns and redirect funds to targeted grassroots initiatives. Spotlight value, savings, and assistance over features. Share tangible content that helps customers navigate challenges.

Besides cash reserves, what are some other buffers we can build to absorb revenue declines?

Explore building an asset base with lines of credit or focused equity investments. Evaluate diversifying revenue streams to hedge risks. Develop programs like loyalty subscriptions that have predictable recurring revenue. Build operational flexibility to dial capacity up or down quickly. Implement policies to restrict discretionary spending in a scalable way.