SWOT Analysis of Ford Motor: Free PPT Template and In-Depth Insights 2024

Embark on a journey through Ford Motor Company's 2023 SWOT analysis. This post unpacks Ford's heritage, market dynamics, and financials, culminating in a free, insightful PPT/PDF SWOT template.

Introduction

Ford Motor Company is one of the largest automakers in the world.

Founded in 1903 by Henry Ford, the company is known for revolutionizing the auto industry with the Model T and developing the moving assembly line.

Headquartered in Dearborn, Michigan, Ford employs over 180,000 people worldwide and sells vehicles under the Ford and Lincoln brands. In 2022, Ford reported $158 billion in revenue.

Ford has gone through many ups and downs over its 100+ year history as an iconic American brand.

A SWOT analysis of Ford Motor can provide valuable insights into the company's current situation and prospects. For those interested in a deeper dive, a free PowerPoint and PDF template of Ford's SWOT analysis is available at the end of this blog post.

A Brief History of Ford Motor

Henry Ford founded the Ford Motor Company in 1903 in Detroit, Michigan. Ford's vision was to make automobiles affordable and accessible to the average American family.

In 1908, Ford introduced the Model T, which quickly became a huge success. The Model T was affordable and easy to drive and maintain, at $825 in 1908 (around $23,000 today). Ford kept costs down through innovations like the moving assembly line.

By 1918, half of all cars in the United States were Model Ts. Over the decades, Ford has experienced periods of innovation and stagnation. It introduced successful vehicles like the F-Series pickup trucks and the Mustang pony car.

However, Ford struggled in the 1970s and 1980s due to rising gas prices and competition from foreign automakers.

In the 1990s and 2000s, Ford acquired luxury brands like Volvo, Land Rover, Jaguar, and Aston Martin. It also sold off brands like Mazda and Mercury to focus on its core Ford and Lincoln lines.

Under CEO Alan Mulally in the late 2000s, Ford avoided bankruptcy and restructured to be leaner and more competitive. 3

Today, Ford remains one of the top automakers worldwide. However, it faces challenges as consumer preferences shift and new technologies disrupt the auto industry.

Financials of Ford Motor 2023

As of December 2024, Ford Motor Company has reported the following financial results for the fiscal year 2023:

- Revenue: $176 billion, a 11% increase from 2022. Wikipedia

- Net Income: $4.3 billion, showing a return to profitability from the net loss in 2022. Wikipedia

- Vehicles Sold: 4.4 million units, an increase from 4.2 million in 2022. Wikipedia

- Automotive Revenue: Specific figures for 2023 are not detailed in the available sources.

- North America Market Share: Specific figures for 2023 are not detailed in the available sources.

- Research and Development Spending: Specific figures for 2023 are not detailed in the available sources.

- Cash and Liquidity: Specific figures for 2023 are not detailed in the available sources.

- Debt: Specific figures for 2023 are not detailed in the available sources.

These results indicate a positive trend in Ford's financial performance, with increased revenue and a return to profitability in 2023.

In-depth SWOT Analysis of Ford Motor 2024

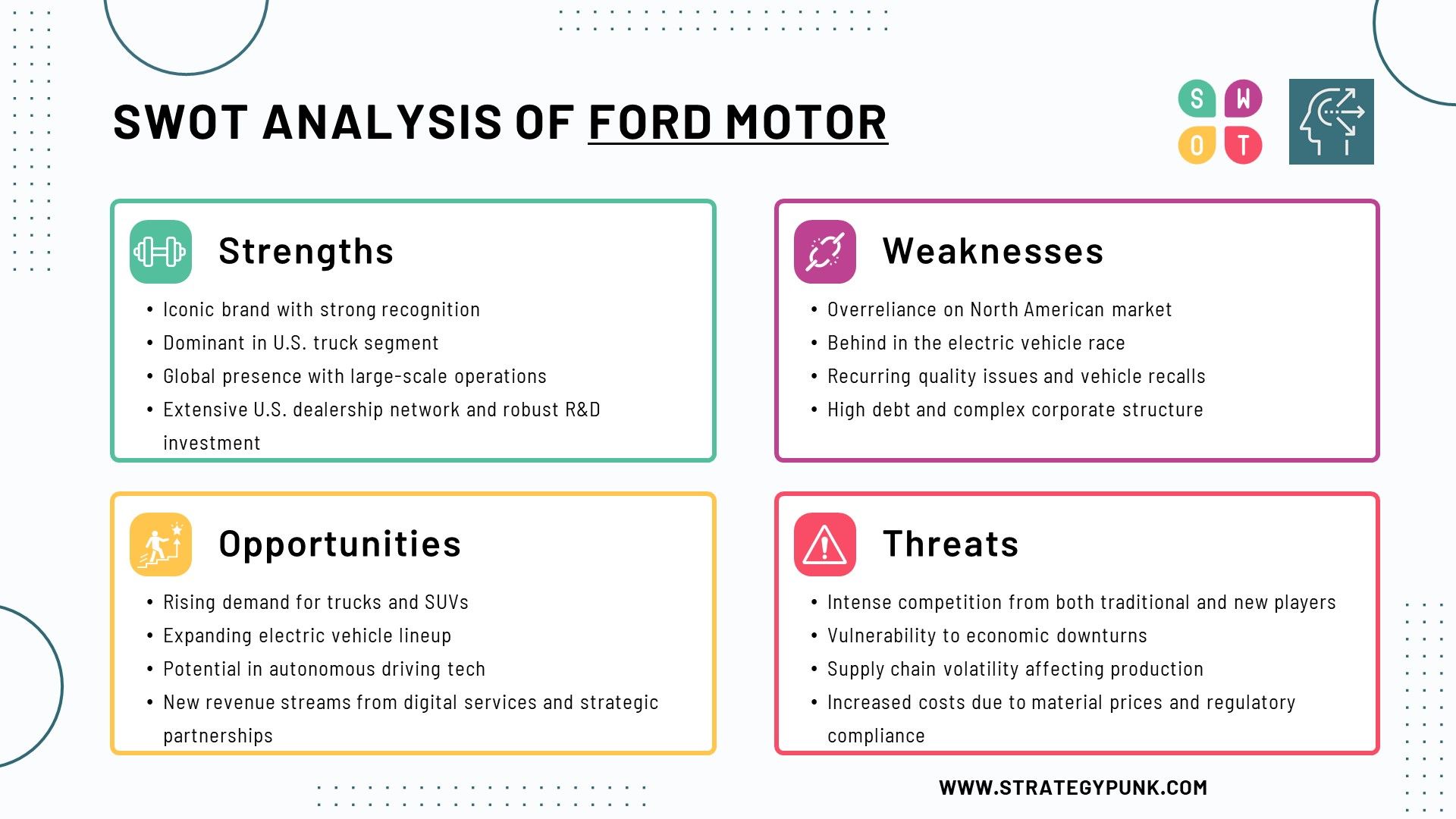

A SWOT analysis examines a company's strengths, weaknesses, opportunities, and threats.

Here is a deeper look at Ford's SWOT:

Ford Motor's Strengths

- Strong brand recognition: Ford is an iconic American brand with a rich history dating back to 1903. It has built up brand equity and consumer trust over the decades.

- Leading position in trucks: Ford's F-Series pickup trucks are the best-selling vehicles in the United States. The company has a dominant 40% share in the pickup truck segment.

- Global scale and reach: Ford employs over 180,000 people and sells vehicles in over 100 countries. This global scale provides cost advantages and diversification.

- Extensive dealer network: Ford has over 3,000 dealerships nationwide, providing broad access to sales and service support nationwide.

- Research and development capabilities: Ford invests heavily in R&D, spending $7.8 billion in 2022. This allows Ford to innovate and stay competitive.

Ford Motor's Weaknesses

- Dependence on North America: Over 60% of Ford's sales come from North America, making the company vulnerable to regional declines.

- Lagging in electric vehicles: Ford has fallen behind competitors in bringing compelling electric cars to market. This could impact future revenues as the market shifts to EVs.

- Quality issues: Ford has had some vehicle quality problems recently, which have led to recalls and hurt the brand image.

- High debt levels: Ford carries a considerable debt of around $108 billion, limiting financial flexibility.

- Complex organizational structure: Some analysts cite Ford's complex matrix structure as hampering agility and innovation.

Ford Motor's Opportunities

- Growing demand for trucks and SUVs: As gas prices decline, demand for profitable trucks and SUVs increases, playing to Ford's strengths.

- New electric vehicles: Ford plans significant investments in electric cars, aiming for 50% of sales to be electric by 2030. This vast market represents a growth opportunity.

- Autonomous driving technology: Ford acquired autonomous vehicle startup Argo AI in 2017 and can lead self-driving vehicles as the technology matures.

- Digital and mobility solutions: Services like subscription packages and mobility solutions provide recurring revenue streams beyond vehicle sales.

- Strategic partnerships: Partnerships, acquisitions, and collaborations can help Ford access new technologies and capabilities.

Ford Motor's Threats

- Competitive pressure: The auto industry is fiercely competitive, with challengers like Tesla and traditional rivals like GM and Toyota threatening Ford's market share.

- Economic downturns: As a consumer cyclical, Ford's sales are vulnerable to economic declines when buyers delay big-ticket purchases.

- Supply chain disruptions: Shortages of semiconductors, raw materials, and other components have impacted Ford's production volume, costs, and ability to meet demand.

- Rising material costs: Key commodities and materials like steel and lithium are seeing costs increase, eating into Ford's profit margins.

- Environmental regulations: Tighter regulations on fuel economy and vehicle emissions require ongoing investments from automakers like Ford.

Ford Motor SWOT Analysis Summary

Internal Factors

Strengths

- Strong brand recognition and equity

- Leading position in the profitable truck segment

- Extensive global scale and reach

- Strong research and development capabilities

Weaknesses

- Dependence on the North American market

- Lagging in electric vehicle development

- Past vehicle quality issues

- High debt levels

- Complex organizational structure

External Factors

Opportunities

- Growing demand for trucks and SUVs

- Investments in electric vehicles

- Autonomous driving technology

- Digital and mobility solutions

- Strategic partnerships

Threats

- Fiercely competitive auto industry

- Vulnerability to economic downturns

- Supply chain disruptions

- Rising material and commodity costs

- Stricter environmental regulations

Frequently Asked Questions

What are Ford's main strengths?

Ford's main strengths are its strong brand recognition, leadership in pickup trucks, global scale and reach, extensive dealer network, and research and development capabilities. The F-Series truck lineup is a dominant profit driver.

What are the biggest threats facing Ford?

Critical threats Ford faces are competitive pressure, economic downturns, supply chain disruptions, rising material costs, and tighter environmental regulations. Competition from new EV makers and traditional rivals threatens Ford's market share.

How can Ford capitalize on emerging opportunities?

Ford has growth opportunities by investing in electric vehicles, autonomous driving technology, digital mobility solutions, and forming strategic partnerships. The growth of SUV and truck sales also plays to Ford's strengths.

Is Ford in good financial shape?

Ford has a strong balance sheet with ample cash reserves and liquidity. However, it also carries considerable debt. Ford reported a net loss in 2022 but has solid adjusted pre-tax earnings. Profitability needs to improve.

What is Ford's current global market share?

Ford has an overall global market share in new vehicle sales of approximately 6.1% as of 2021. In its core U.S. market, Ford has a 12.6% share. The F-Series pickup truck lineup comprises about 40% of the U.S. market. In summary, Ford is an automotive giant with competitive strengths but also faces risks from disruptive forces reshaping the auto industry. Investing in new technologies and leveraging its scale and brand power can help Ford navigate challenges and capitalize on emerging opportunities. A balanced SWOT assessment provides insights into Ford's strategic position.

Define a One-Page Strategic Plan to communicate your strategy.

Ford Motor SWOT Analysis PowerPoint Template

free and fully editable PPT template

A SWOT analysis evaluates the strengths, weaknesses, opportunities, and threats impacting a company.

This free editable PowerPoint template provides a SWOT analysis framework to evaluate Ford Motor's internal strengths and weaknesses and external opportunities and threats.

Ford Motor SWOT Analysis Slide Deck

Ford Motor SWOT Analysis PowerPoint Template

Ford Motor SWOT Analysis PDF Template

Discover more

Clickworthy Resources

SWOT Analysis: Free PowerPoint Template

This PowerPoint slide deck contains five different layouts to complete a SWOT analysis.