SWOT Analysis of Hyundai: Free Templates and In-Depth Insights 2024

Discover the workings of Hyundai Motor Company with our comprehensive SWOT analysis for 2023. Download our free PowerPoint template.

Introduction

Step into Hyundai's world with our captivating SWOT analysis for 2024. In this blog post, we navigate through the company's global journey, spotlighting its triumphs and pinpointing its challenges.

And there's more—download our free PowerPoint template to visualize Hyundai's strategic landscape with clarity and precision.

Ready for an insightful ride into the core of Hyundai's market dynamics?

This post is your key to unlocking a wealth of professional insights. Buckle up for an enlightening experience.

Introduction to Hyundai Motor Company

Hyundai Motor Company is a South Korean multinational automotive manufacturer headquartered in Seoul.

Founded in 1967, Hyundai has become one of the world's largest automakers, selling over 4.5 million vehicles globally in 2020.

Hyundai operates assembly plants and R&D centers worldwide, including South Korea, the United States, China, India, Brazil, and Europe.

The company sells passenger vehicles, electric vehicles, SUVs, and commercial vehicles under the Hyundai brand. It also owns a controlling interest in luxury automaker Genesis.

A Brief Look at the History of Hyundai

Hyundai was founded by Chung Ju-Yung in 1967 as a construction company in South Korea.

In 1968, Hyundai entered the automotive industry by establishing Hyundai Motor Company, which produced its first model, the Cortina, in cooperation with Ford Motor Company. Throughout the 1970s and 1980s, Hyundai expanded production in South Korea and began exporting models to Western Europe and North America.

Key milestones included:

- 1975 - Hyundai completes its first integrated car manufacturing plant, allowing mass production.

- 1986 - Hyundai exported Excel to the United States, and its first model was sold in America.

- 1998 - Hyundai acquires Kia Motors, another major South Korean automaker.

- 2005 - Hyundai opens its first US manufacturing plant in Alabama, expanding American production.

- 2015 - The Genesis brand is launched as Hyundai's luxury vehicle division.

- 2020 - Hyundai plans to invest $35 billion in future mobility technologies, including electric, autonomous, and connected vehicles.

Today, Hyundai is among the top five automakers in the world and a leading Asian brand. The company continues to grow its market share globally while investing in next-generation vehicles.

Hyundai Financial Performance 2023

Hyundai Motor Company reported robust financial performance in 2023, achieving significant growth across key metrics compared to 2022:

Revenues: KRW 162.7 trillion (USD 122 billion), a 14.4% increase from KRW 142.2 trillion in 2022.

Operating Profit: KRW 15.12 trillion (USD 11.3 billion), up 54% from KRW 9.82 trillion in the previous year.

Net Profit: KRW 12.27 trillion (USD 9.2 billion), a 54% rise from KRW 7.98 trillion in 2022.

Vehicle Sales: 4.22 million units, a 7% increase from 3.94 million units in 2022.

Key Highlights from Hyundai's 2023 Financial Results:

Global Sales Distribution: Sales in markets outside Korea rose by 6.2% to 3.45 million units, driven by strong demand in North America, Europe, and India. Domestic sales in Korea increased by 10.6% to 762,077 units.

Electrified Vehicle Sales: Global sales of electrified vehicles, including hybrids and electric vehicles (EVs), grew by 37.2% year-over-year to 695,382 units. This total comprised 268,785 EVs and 373,941 hybrids.

Operating Profit Margin: The operating profit margin improved to 9.3%, up from 6.9% in 2022, reflecting enhanced profitability.

Dividend Increase: Hyundai Motor increased its annual dividend by 63% from the previous year, paying a total of KRW 11,400 per common share, including a year-end dividend of KRW 8,400.

Shareholder Returns: The company initiated a KRW 1 trillion share buyback program, its largest to date, as part of a broader plan to repurchase and partially retire KRW 4 trillion worth of shares by 2027 to enhance shareholder value.

Hyundai Motor's strong performance in 2023 underscores its strategic focus on expanding its global presence, increasing sales of electrified vehicles, and enhancing shareholder value through dividends and share buybacks.

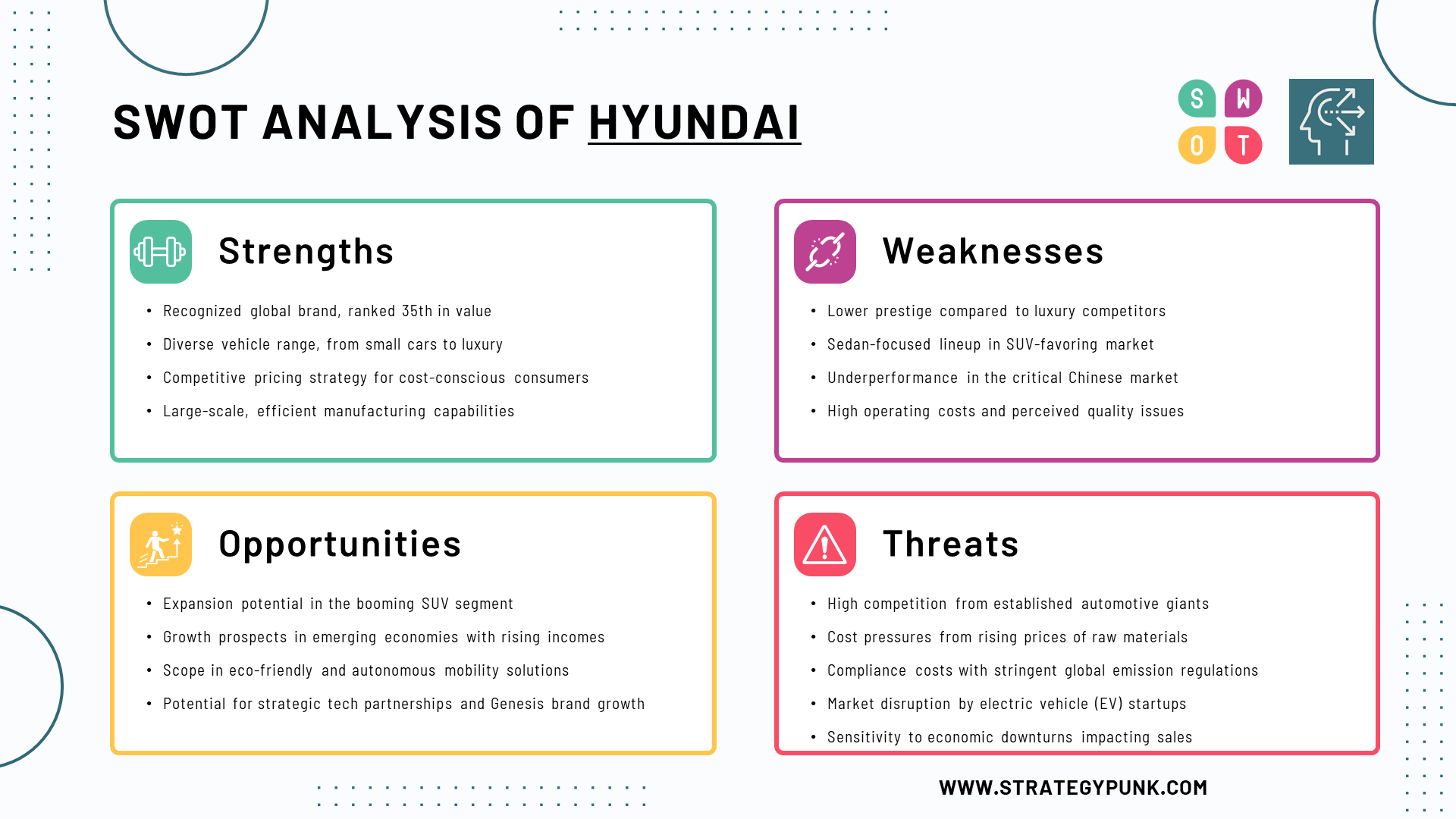

In-depth SWOT Analysis of Hyundai 2024

Hyundai’s Strengths

- Strong brand image: Hyundai has built considerable brand equity over the years as an affordable and reliable automaker. Interbrand ranked the company as the 35th most valuable brand globally.

- Broad product portfolio: Hyundai's lineup includes small cars, sedans, SUVs, eco-friendly models, and luxury vehicles under Genesis, appealing to diverse customer segments.

- Competitive pricing: Hyundai vehicles are generally priced lower than rivals with similar features, making them accessible to value-conscious buyers.

- Manufacturing expertise: Hyundai operates one of the most extensive integrated manufacturing facilities globally. The economies of scale enable cost competitiveness.

- Technology investments: To prepare for industry trends, the company has invested heavily in connected, electric, and autonomous vehicle technologies.

Hyundai’s Weaknesses

- Low brand prestige: Hyundai's brand does not have the same prestige as luxury marques like Mercedes and BMW, limiting pricing power and margins.

- Overreliance on sedans: Sedan sales have declined as consumer preferences have shifted to SUVs. Hyundai's sedan-heavy lineup has affected sales.

- Weak position in the Chinese market: Hyundai has low brand visibility in China compared to leaders like Volkswagen. China is the world's largest auto market.

- High operating costs: Large manufacturing overhead and rising raw material costs have recently impacted Hyundai's profitability.

- Quality perceptions: Despite improvements, Hyundai still lags behind Japanese rivals like Toyota and Honda in quality and reliability perceptions.

Hyundai’s Opportunities

- Growing SUV demand: The popularity of SUVs globally presents an opportunity for Hyundai to expand its SUV lineup and improve its sales mix.

- Rising middle class in emerging markets: As incomes rise, developing markets like Southeast Asia and Latin America offer growth potential.

- Alternative mobility solutions: Hyundai can leverage expertise in eco-friendly and autonomous technologies to provide services like ride-sharing.

- New partnerships: Cooperation with technology firms on connectivity, AI, and battery innovations can enhance capabilities.

- Genesis luxury brand growth: Genesis has an opportunity to establish itself as an affordable luxury alternative to German brands.

Hyundai’s Threats

- Intensifying competition: The auto industry is fiercely competitive, with well-established rivals like Toyota, Volkswagen, and General Motors.

- Rising raw material costs: Input cost inflation, such as from steel and microchips, threatens Hyundai's cost competitiveness.

- Tighter emissions regulations: Stricter emission norms in key markets will require investments in new powertrain technologies.

- Growth of electric vehicle startups: EV startups like Tesla and Rivian pose an emerging competitive threat, especially in high-end segments.

- Economic cyclicality: Recessions and downturns that affect consumer spending can negatively impact Hyundai's vehicle sales.

Hyundai SWOT Analysis Summary

Hyundai has leveraged its manufacturing scale, product breadth, and technology investments to become a top global automaker. However, the company faces rising competition, raw material costs, and disruptive shifts in the auto industry landscape.

In the future, Hyundai's focus on new SUV models, cost structure improvements, and leadership in future mobility will dictate its ability to gain market share over rivals. The company's performance in China and with the Genesis brand is closely monitored.

Overall, Hyundai is positioned reasonably well to navigate industry headwinds, but it will require continued innovation and adaptability to remain a leader.

Internal Factors

Strengths

- Strong brand image globally

- Broad vehicle lineup and portfolio

- Competitive pricing provides value

- Large-scale integrated manufacturing

- Investments in future technologies

Weaknesses

- Brand lacks prestige compared to luxury, which makes

- Overreliance on sedans in the model mix

- Weak position and sales in the Chinese market

- High operating costs impact margins

- Perceptions of lower quality versus Japanese brands

External Factors

Opportunities

- Growing consumer demand for SUVs

- Expanding middle class in developing markets

- Alternative mobility solutions and partnerships

- Continued growth of Genesis luxury division

Threats

- Highly competitive auto industry dynamics

- Rising costs of raw materials and components

- Tighter emission regulations in key markets

- Emergence of electric vehicle startups as new competitors

- Economic cyclicality and recessions affecting sales

Frequently Asked Questions

What are Hyundai's biggest strengths?

Hyundai's major strengths include its strong brand image and recognition, broad vehicle lineup spanning multiple segments, competitive pricing and value proposition, large-scale integrated manufacturing, and investments in future technologies like electric and autonomous vehicles.

What are some weaknesses Hyundai needs to address?

Key weaknesses Hyundai faces are its brand lacking prestige compared to luxury automakers, overreliance on sedans in the model mix as SUV demand grows, weak position in the large China market, high operating costs impacting profit margins, and customer perceptions that quality lags behind leading Japanese brands.

What opportunities exist for Hyundai to grow in the future?

Major opportunities include capitalizing on booming consumer demand for SUVs, expanding sales in developing markets as incomes rise, offering alternative mobility solutions beyond traditional vehicle sales, forming new technology partnerships, and continuing to establish its Genesis brand as an affordable luxury alternative.

What are the biggest threats Hyundai must contend with?

Hyundai faces significant threats from intensifying competition across the auto industry, rising raw materials and components costs, tighter emissions regulations in key markets, growth of electric vehicle startups as new competitors, and economic cyclicality that could lead to recessions affecting vehicle sales.

How can Hyundai maintain its competitive position in the future?

To maintain its strong competitive position, Hyundai must launch new SUV models, improve cost structures, invest in future mobility technologies, grow sales in China, boost the Genesis brand, and leverage partnerships to enhance capabilities in areas like electrification and autonomous driving.

Define a One-Page Strategic Plan to communicate your strategy.

Hyundai SWOT Analysis PowerPoint Template

free and fully editable PPT template

A SWOT analysis evaluates the strengths, weaknesses, opportunities, and threats impacting a company.

This free editable PowerPoint template provides a SWOT analysis framework to evaluate Hyundai's internal strengths and weaknesses and external opportunities and threats.