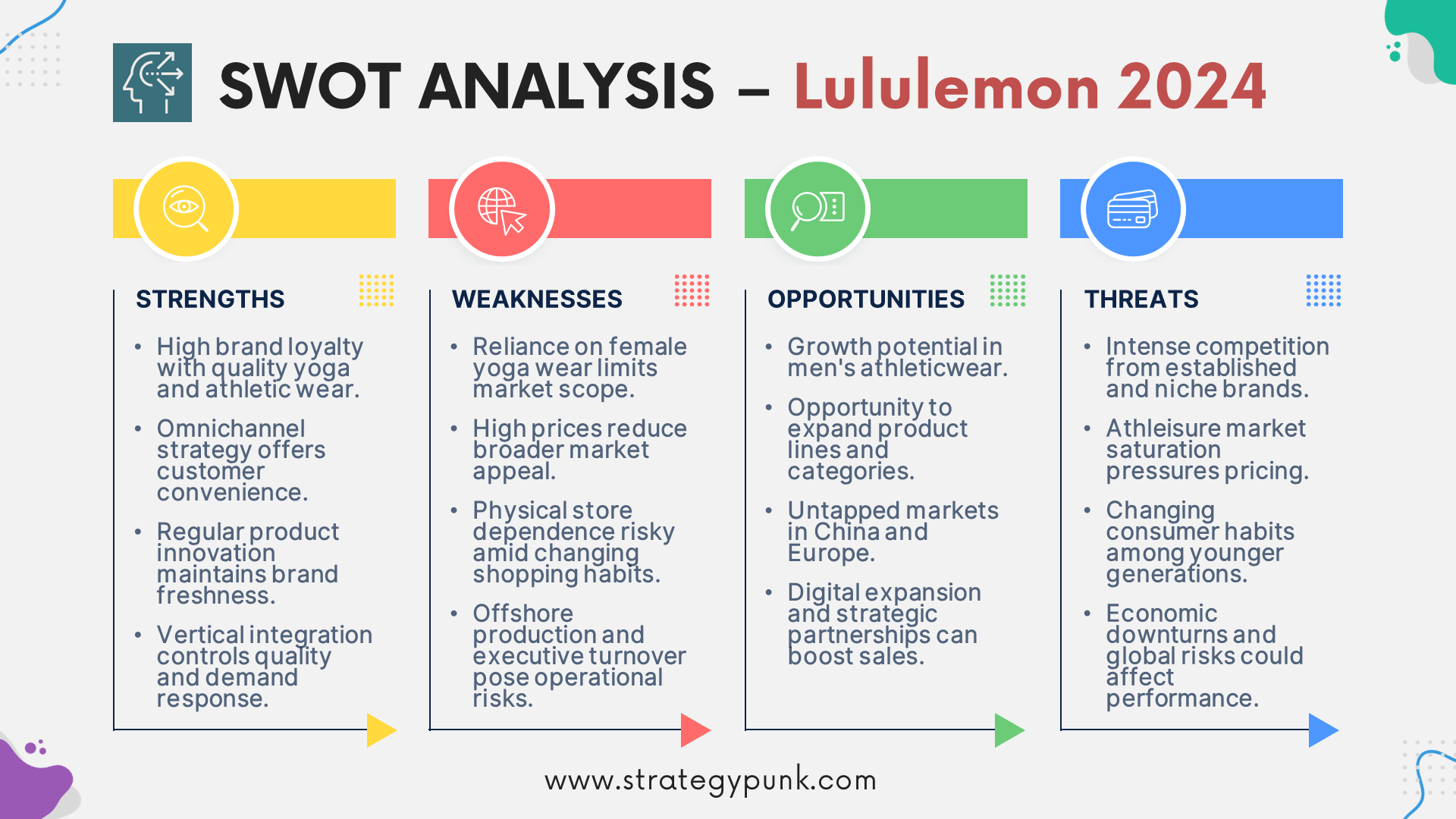

Lululemon SWOT Analysis: Free PPT Template and In-Depth Insights 2024

Explore Lululemon's strengths, weaknesses, opportunities, and threats with our 2024 SWOT Analysis PowerPoint template. Free download available for in-depth business insights and strategic planning. Perfect for marketers, analysts, and business strategists.

Yoga apparel retailer Lululemon has seen tremendous growth over the past decade.

The competitive athleticwear market brings both opportunities and threats. This SWOT analysis provides an in-depth look at Lululemon in 2024.

Download the free PDF and PowerPoint Template below.

Introduction to Lululemon

Founded in 1998, Lululemon is a Canadian athletic apparel retailer focused on yoga-inspired sportswear. Their products include yoga pants, shorts, tops, and jackets for healthy lifestyles and athletic pursuits.

Over the past five years, Lululemon has expanded rapidly. They now have over 500 retail locations across North America, Europe, Asia Pacific, and online. However, the competitive athleticwear market is more crowded than ever.

This SWOT analysis examines Lululemon’s current position. It provides insights into the company’s strengths, weaknesses, opportunities, and threats in 2024.

A Brief History of Lululemon

Lululemon was founded in 1998 by Chip Wilson in Vancouver, Canada. Wilson came up with the idea for a yoga clothing line after noticing a gap in the athleticwear market.

The company's first store opened in 2000 in Vancouver. In the early years, Lululemon targeted young professional women with its $100 yoga pants. Strategic product placement in yoga studios helped drive rapid early growth.

Over the next decade, Lululemon expanded across Canada and into the United States. By 2010, the company had over 100 stores and registered nearly $1 billion in annual sales.

The early 2010s saw continued retail expansion coupled with supply chain investments. However, a significant product recall in 2013 highlighted quality control issues.

Since bringing in new management in 2013, Lululemon has focused on rebuilding its brand image. The company now generates over $4 billion in annual sales across two brands – Lululemon and Ivivva Athletics.

Financials of Lululemon 2024

As of 2024, Lululemon remains one of North America's most prominent athletic apparel brands.

In 2023, Lululemon generated $8.1 billion in total revenue, up 22% from the previous year. The strong growth came despite a volatile retail environment and inflationary pressures.

Nearly 70% of Lululemon's sales come from core women's yoga apparel, including pants, shorts, tops, and jackets. Men's sales account for 20% of revenue.

Lululemon's operating margins remain industry-leading at over 20%. However, higher costs and supply chain investments have put pressure on profitability.

Lululemon plans to open 40-50 new stores by 2024, bringing its total to approximately 600. Continued direct-to-consumer growth is also a priority.

In-depth SWOT Analysis of Lululemon 2024

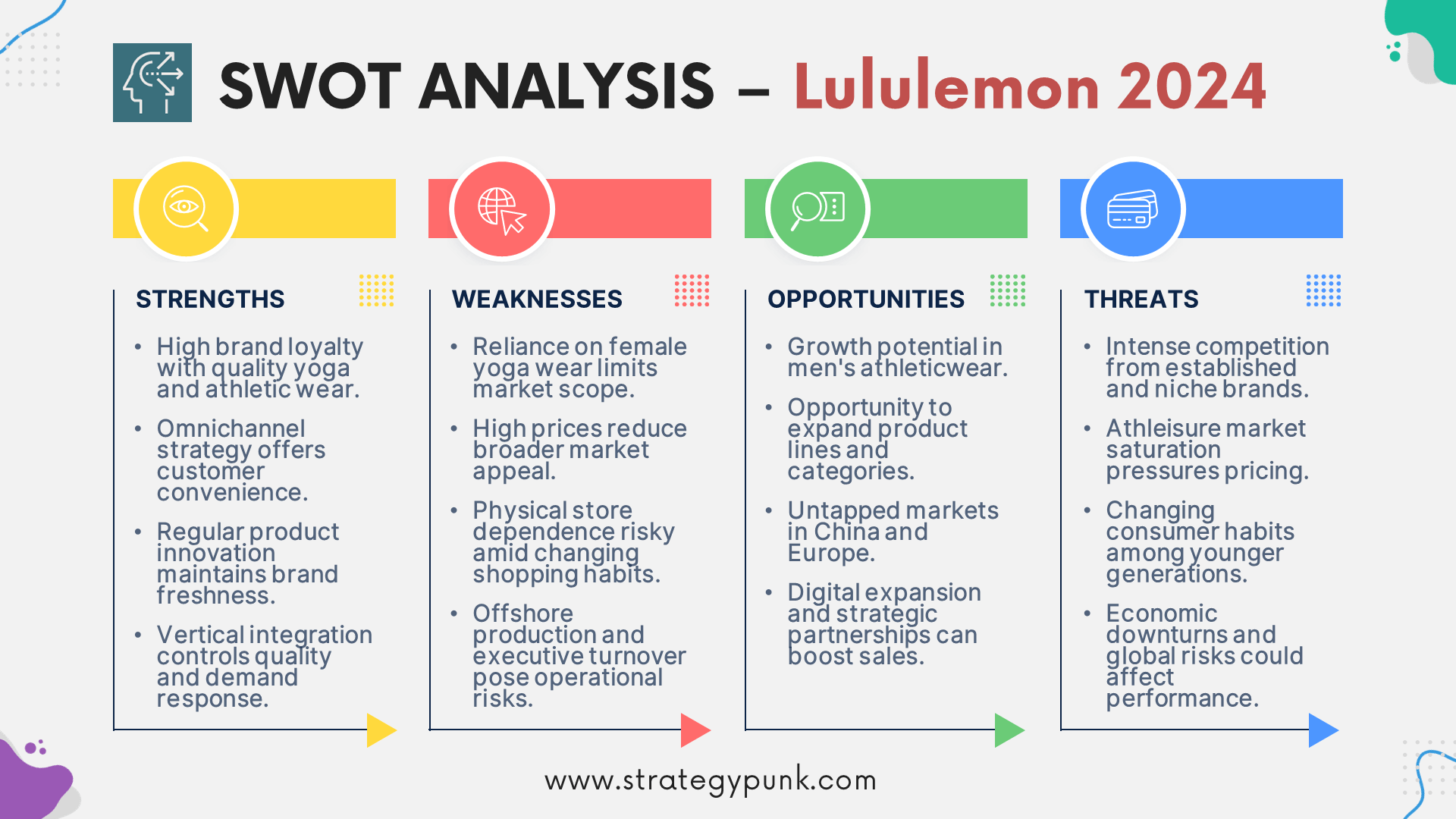

This section provides an in-depth SWOT analysis of Lululemon in 2024. It examines the company's strengths, weaknesses, opportunities, and threats.

Lululemon’s Strengths

Lululemon has built several core strengths that contribute to its industry-leading position:

- Strong brand image: Lululemon is renowned for its fashionable, high-quality yoga wear and athletic apparel. Customer loyalty remains very high.

- Omnichannel presence: Lululemon sells across physical retail, e-commerce, and mobile channels. Its integrated strategy provides convenience and flexibility.

- Product innovation: Lululemon frequently updates its product lines with new, innovative fabrics and athleticwear technologies, keeping the brand fresh.

- Vertical integration: By owning its supply chain, Lululemon controls product quality and can respond quickly to market demand.

- Strong financial performance: Industry-leading revenue growth and profit margins give Lululemon financial flexibility to keep investing in the business.

Lululemon’s Weaknesses

However, Lululemon also faces some weaknesses and competitive disadvantages:

- Narrow product focus: Lululemon heavily depends on female yoga apparel, exposing it to market trends.

- High prices: The brand's premium pricing limits its addressable market relative to lower-cost athleticwear brands.

- Reliance on retail: Physical stores account for over 60% of Lululemon's sales. Expensive retail leases pose a long-term risk as shopping habits change.

- Overseas manufacturing: Offshore production creates product quality and supply chain risks that could jeopardize inventory flow.

- Executive changes: Recent turnover in Lululemon's C-suite brings uncertainty and transition risks in 2024.

Lululemon’s Opportunities

Lululemon also has significant opportunities to drive additional growth:

- Men's expansion: The men's athleticwear market is multiplying. Lululemon is well-positioned to expand its male customer base.

- New products: Lululemon can expand into new athleticwear categories, such as shoes, socks, bags, and accessories.

- International growth: Lululemon remains underpenetrated overseas, especially in China and Europe. Targeted international expansion would tap new markets.

- Digital sales: Mobile and online sales are rising rapidly. Lululemon can capture more direct-to-consumer sales through digital marketing and try-before-you-buy programs.

- Strategic partnerships: Co-branding arrangements and corporate partnerships would expose Lululemon to new demographics and distribution channels.

Lululemon’s Threats

Finally, Lululemon faces an array of external threats:

- Intensifying competition: Rivals like Nike, Adidas, and Under Armour are expanding aggressively in the athleticwear market. Smaller brands also threaten specialty niches.

- Athleisure market saturation: The athleisure trend has attracted countless new entrants. Continued fragmentation puts pressure on pricing and margins.

- Consumer shifts: Younger generations like Gen Z have different shopping habits and brand preferences relative to Lululemon's core millennial customer base.

- Economic conditions: A potential recession in 2024 would cut consumer discretionary spending. Lululemon's premium products may be especially vulnerable.

- Global risks: Ongoing supply chain disruptions, emerging market volatility, climate change impacts, and geopolitical tensions pose macroeconomic threats.

Lululemon SWOT Analysis Summary

In summary, Lululemon retains significant competitive strengths headed into 2024. The brand has exceptional loyalty and financial performance.

The omnichannel distribution provides flexibility in adapting to evolving consumer behaviors.

However, the competitive landscape grows more intense each year. Rivals are targeting high-growth athleticwear niches. Lululemon must expand its customer demographics, product lines, and geographic presence to sustain long-term growth.

Careful brand management and supply chain governance will be critical to managing external risks like economic shifts and dependence on overseas manufacturing. Investment in digital capabilities can help offset retail exposure.

Internal Factors

Lululemon's core strengths are brand image, vertical integration, and product innovation. Its proprietary fabrics and technologies and disciplined quality control allow it to offer premium pricing.

Its narrow product focus and overexposure to physical retail remain vital weaknesses. Cost pressures from expanded manufacturing and supply chain investments also threaten margins. C-suite changes bring uncertainty.

External Factors

Favorable athleisure trends, overseas expansion potential, and direct-to-consumer shifts represent opportunities. However, the core yoga apparel market needs to be more saturated.

Growing competition, economic risks, and generational shifts in shopping habits pose significant threats. Lululemon's premium pricing leaves it vulnerable to demand fluctuations. Supply uncertainties and overseas manufacturing concentrate risk.

Frequently Asked Questions

What are Lululemon's main strengths?

Lululemon's strengths include its strong brand image, integrated omnichannel sales strategy, proprietary products and technologies, vertical supply chain control, and industry-leading financial performance.

What external threats does Lululemon face?

Key threats include intensifying competition, athleisure market saturation, consumer generational shifts, economic conditions, and dependence on overseas manufacturing.

Does Lululemon have opportunities for additional growth?

Lululemon has growth opportunities in men's apparel, new products, international expansion, digital sales growth, and strategic partnerships.

What is Lululemon's growth strategy for the next five years?

Lululemon aims to double men's and digital revenue and quadruple international revenue over the next five years. The growth strategy focuses on product innovation, enhancing guest experiences, and expanding in overseas markets. Specifically, Lululemon plans to accelerate new product development, build an integrated omnichannel experience, and aggressively enter China and other Asian markets1.

How effective has Lululemon's leadership been over the past five years?

Under CEO Calvin McDonald's leadership since 2018, Lululemon has delivered consistent double-digit annual revenue growth. The brand has effectively rebuilt its image from past PR crises. Lululemon is now an $8 billion global athleticwear leader. However, the recent C-suite turnover creates some uncertainty heading into 20242.

Why did Lululemon's acquisition of Mirror struggle?

Lululemon acquired Mirror for $500 million in 2020 to capitalize on the surging demand for at-home fitness. However, as pandemic restrictions eased, the home fitness market cooled significantly. Consumers became less willing to pay for expensive hardware like Mirror. Integration challenges and a contracting market led to sluggish sales and significant write-downs on the acquisition.

What benefits could Lululemon gain from a Peloton partnership?

A partnership with Peloton could provide Lululemon with new revenue streams from digital fitness content and co-branded apparel. It would also give Lululemon's studio platform access to Peloton's large subscriber base. The deal could further cement Lululemon as a leader in connected fitness without the risks of developing costly hardware in-house.

Lululemon SWOT Analysis PowerPoint Template

free and fully editable PPT template

A SWOT analysis evaluates the strengths, weaknesses, opportunities, and threats impacting a company.

A free PowerPoint presentation template summarizing this Lululemon SWOT analysis is available for download.

The presentation visually captures Lululemon's internal strengths/weaknesses and external opportunities/threats. It can be used for strategic planning sessions or business presentations.

Lululemon SWOT Analysis PowerPoint Slide Deck