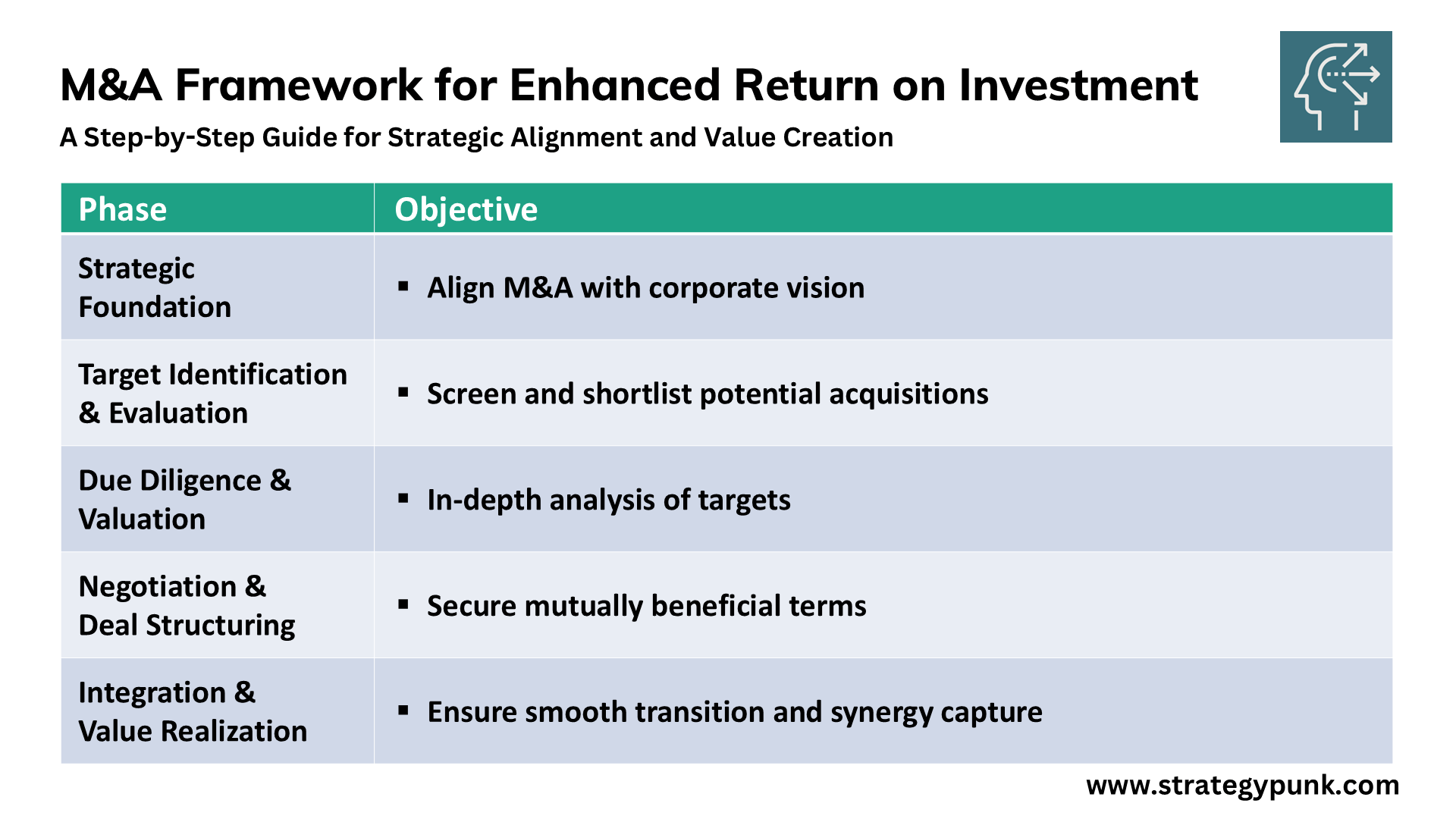

M&A Framework for Enhanced Return on Investment

Unlock growth and maximize ROI with our M&A guide. Learn actionable steps to align strategy, evaluate targets, and integrate acquisitions successfully. Free PDF overview.

Embarking on a merger and acquisition (M&A) journey can be a transformative strategic move for companies seeking growth and competitive advantage.

However, even the most promising deals can encounter pitfalls without a well-structured approach.

This comprehensive framework breaks down the M&A process into clear, actionable steps aligned with corporate goals, ensuring strategic fit and maximizing the return on investment.

Whether you are a seasoned M&A strategist or new to the landscape, this guide will equip you with essential tools to identify, evaluate, and successfully integrate acquisitions, driving value creation at every stage.

The key to unlocking an M&A transaction's full potential lies in meticulous planning and execution. This framework guides you through the critical phases, from initial target identification to post-merger integration, helping you navigate the complexities and capitalize on synergies.

By following this structured approach, you will be able to:

- Clearly define your strategic objectives and acquisition criteria to target the right opportunities

- Conduct thorough due diligence to assess the strategic, operational, and financial fit of potential targets

- Develop a comprehensive integration plan that ensures a smooth transition and seamless value realization

- Implement robust governance and performance management frameworks to monitor progress and course-correct as needed

Regardless of your experience level, this guide provides a roadmap to successful M&A, empowering you to make informed decisions, mitigate risks, and create lasting value for your organization. Embrace the transformative power of M&A and unlock your company's full growth potential.

So, are you ready to take your company to new heights through the power of M&A?

Let's dive in and make some magic happen!

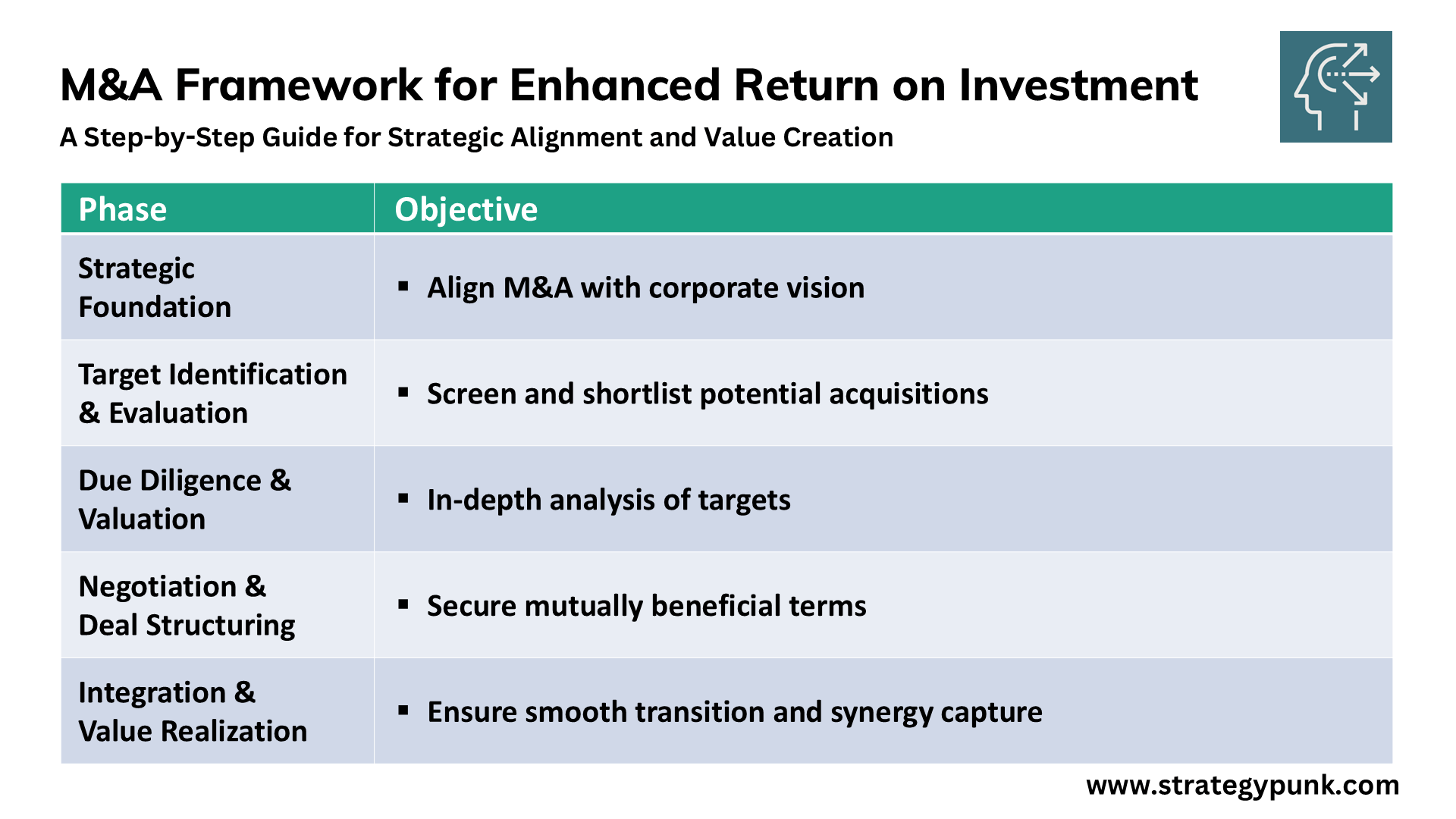

A Step-by-Step Guide for Strategic Alignment and Value Creation

Here is a framework for developing and executing a successful M&A strategy that aligns with corporate goals and enhances return on investment (ROI)

Phase 1: Strategic Foundation

- Define Corporate Strategy: Articulate the company's long-term vision and objectives. This may involve:

- Identifying target markets and desired market position

- Determining essential product or service offerings

- Setting financial growth and profitability goals

- Identify Strategic Gaps: Assess the company's capabilities and resources against the defined corporate strategy. Determine areas where M&A can bridge these gaps and contribute to achieving strategic objectives.

Phase 2: Target Identification and Evaluation

- Develop M&A Search Criteria: Based on the strategic gaps, establish clear criteria for identifying potential acquisition targets. This might include:

- Industry or sector focus

- Specific technologies or capabilities

- Geographic presence

- Financial performance thresholds

- Leverage External Expertise: Engage investment banks and M&A advisors to broaden the scope of target identification and benefit from their:

- Extensive industry networks and proprietary databases

- Market insights and valuation expertise

- Transaction experience and negotiation support

- Screen and Shortlist Targets: Conduct preliminary research and screening of potential targets based on the defined criteria. Create a shortlist of candidates for in-depth evaluation.

Phase 3: Due Diligence and Valuation

- Develop a Balanced M&A Scorecard: Design a scorecard that incorporates both quantitative and qualitative factors to assess the attractiveness of each target. This should include:

- Quantitative Indicators: Financial metrics such as revenue, EBITDA, cash flow, market share, and growth rates to assess financial health and market position.

- Qualitative Factors: Cultural fit, strategic alignment, management team quality, brand strength, and potential synergies.

- Conduct Comprehensive Due Diligence: Perform detailed investigations into each shortlisted target:

- Financial performance and projections

- Legal and regulatory compliance

- Operational efficiency and capabilities

- Customer relationships and market dynamics

- Valuation and Financial Modelling: Develop financial models and assess the potential value of each target. Determine the appropriate valuation methodologies (DCF, multiples, etc.) and consider factors like:

- Synergies and cost savings

- Integration costs and risks

- Projected financial performance

Phase 4: Negotiation and Deal Structuring

- Develop Negotiation Strategy: Define key deal terms, including price, payment structure, closing conditions, and representations and warranties. Determine walk-away points and alternative scenarios.

- Structure the Transaction: Consider different deal structures, such as:

- Asset vs. stock purchase

- Merger vs. Acquisition

- Use of earnouts, deferred consideration, or seller financing to preserve cash

- Negotiate and Finalize Agreements: Negotiate with the target company and its advisors to reach mutually agreeable terms. Draft and execute definitive agreements.

- Secure Necessary Approvals: Obtain required approvals from stakeholders, including:

- Board of directors

- Shareholders

- Regulatory bodies

Phase 5: Integration and Value Realization

- Develop a Detailed Integration Plan: Create a comprehensive plan that outlines:

- Key integration milestones and timelines

- Roles and responsibilities for integration teams

- Communication strategies for stakeholders

- Risk mitigation plans

- Execute the Integration Plan: Implement the integration plan efficiently and effectively, addressing potential challenges and ensuring a smooth transition.

- Monitor and Track Performance: Establish metrics and systems to monitor the integration's progress and track the realization of expected synergies and financial performance targets.

- Continuously Improve the M&A Process: Capture lessons learned from each transaction and incorporate them into future M&A strategies and processes.

Key Considerations Throughout the Process

- Active Pipeline Management: Maintain a dynamic pipeline of potential targets, regularly reassessing and updating it based on evolving market conditions and strategic priorities.

- Alignment with Corporate Strategy: Ensure that every stage of the M&A process aligns with the overarching corporate strategy and contributes to achieving defined objectives.

- Capital Allocation Discipline: Allocate capital strategically, prioritizing deals with the highest potential for value creation and aligning with the overall capital allocation framework.

- Risk Management: Identify and assess potential risks throughout the M&A process, developing mitigation plans and contingency strategies to minimize negative impacts.

- Communication and Stakeholder Management: Establish clear communication channels and engage with key stakeholders throughout the process, ensuring alignment and transparency.

By adhering to this comprehensive framework, organizations can increase the likelihood of M&A success and enhance ROI by:

- Ensuring strategic alignment and focus

- Identifying and evaluating targets effectively

- Conducting thorough due diligence and valuation

- Negotiating favourable deal terms

- Integrating acquisitions seamlessly

- Realizing expected synergies and value creation

This framework provides a roadmap for organizations seeking to leverage M&A as a strategic tool for achieving their long-term objectives and creating substantial shareholder value.

M&A Framework for Enhanced Return on Investment PDF