Private Equity Investment Process: Free Template

Private Equity Investment Process: Acquire, Grow, and Exit. Free and editable template.

What is private equity?

Private equity involves investing in unlisted companies and can refer to various investment strategies, including leveraged buyouts (LBOs), venture capital (VC), and distressed investing. Typically, a takeover is structured as a limited partnership, but in this case, the term refers to a wide range of investments.

It involves taking a majority stake in an existing business, acquiring ownership, and helping it grow. Typically, private equity companies acquire a current company, restructure its operations, or acquire new technology.

Private equity can also help businesses grow by providing access to capital and expertise. For example, a private equity firm may help a company by offering advice on strategy development, sales channels, and marketing strategies. By doing this, a private equity firm can help the business reach its goals faster and more effectively.

Private equity firms are typically large institutions that invest in companies across various sectors. They usually have access to large amounts of capital (debt and equity), allowing them to invest in many companies.

What are the stages of private equity?

Private equity firms, or private equity (PE) companies, raise investors' capital and then invest in private businesses.

The goal of a private equity firm is to earn a return on its investments. This can be done by investing in companies, buying them out, or liquidating them at some point in the future.

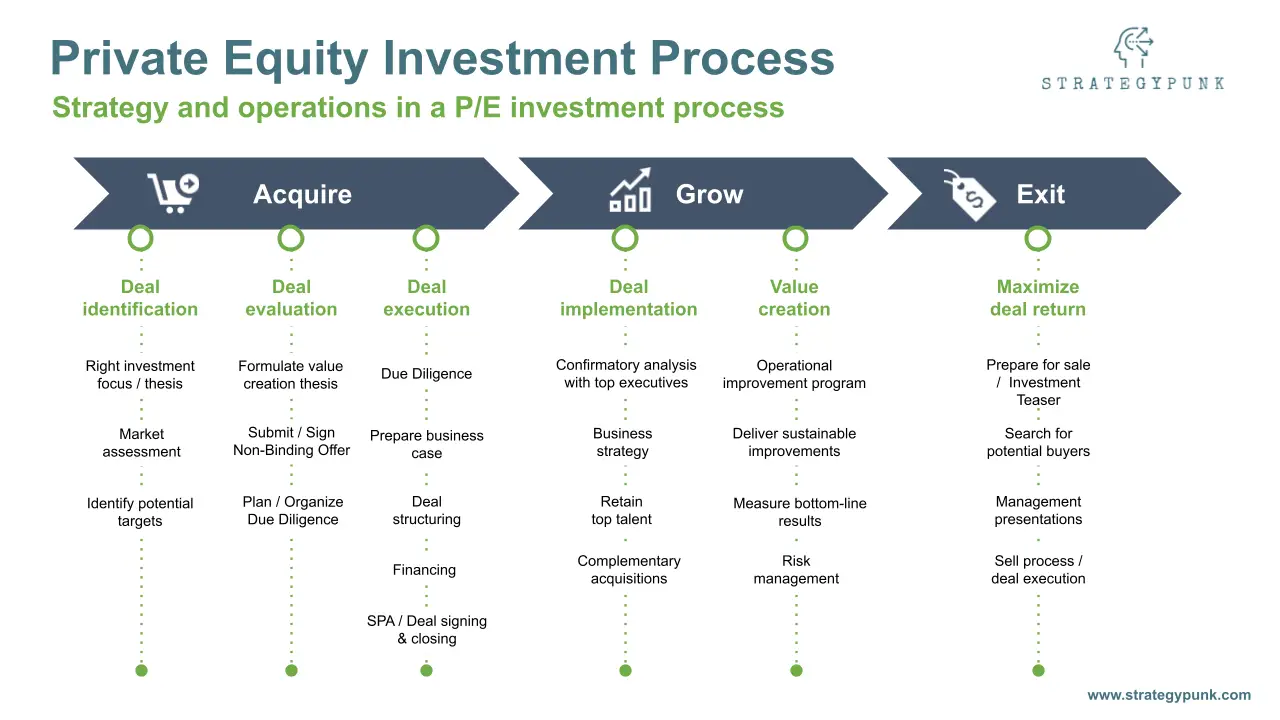

Private equity has three main stages: acquire, grow, and exit. These stages typically occur over time.

An acquisition stage occurs when the private equity firm invests in a company.

The growth stage occurs when the firm builds up its stake in the business and tries to increase its value.

Finally, the exit stage occurs when the private equity firm decides to sell its stake in the business.

Private equity follows three stages: Acquire, Grow and Exit

Private Equity Process: Aquire

Deal identification

- Right investment focus / thesis

- Market assessment

- Identify potential targets

Deal evaluation

- Formulate value creation thesis

- Submit / Sign Non-Binding Offer

- Plan / Organize Due Diligence

Deal execution

- Due Diligence

- Prepare business case

- Deal structuring

- Define financing structure

- SPA & Deal signing / closing

Private Equity Process: Grow

Deal implementation

- Confirmatory analysis with top executives of the acquired company

- Business strategy

- Retain and attract top talent

- Complementary acquisitions (if required)

Value creation

- Operational improvement program

- Deliver sustainable improvements

- Measure bottom-line results

- Risk management

Private Equity Process: Exit

Maximize deal returns

- Prepare of sale with short & long investment teaser

- Search for potential buyers

- Management presentations

- Sell process and deal execution

Private Equity vs. Venture Capital: What’s the Difference?

A private equity firm and a venture capital firm are terms for firms that invest in small, privately held businesses in exchange for equity. Although they are sometimes used interchangeably, they are, in fact, different.

Venture capital and private equity (VC) firms invest in different sizes and types of businesses, invest in them for various amounts, and acquire different equity percentages.

Private equity firms mainly invest in mature businesses that are already established. They purchase and streamline these companies to increase their sales. On the other hand, venture capital firms invest in young firms and startups with tremendous growth potential.

What is the purpose of a private equity firm?

Typically, private equity companies acquire mature businesses, restructure their operations, or acquire new technology. They may help a company by offering advice on strategy development, sales channels, and marketing strategies. By doing this, a private equity firm can help the business reach its goals faster and more effectively.

How do private equity firms create value?

Private equity firms create value mostly in their portfolio companies by increasing revenues and margins through three methods: deleveraging, expansion, and operational improvements.

Which private equity firms are publicly traded?

Famous large publicly traded private equity firms are The Blackstone Group, Apollo Global Management, The Carlyle Group, and KKR & Co.

Why do private equity firms go public?

Raising funds through a public offering allows private equity firms fast and steady access to capital they would otherwise have to raise privately, giving them more flexibility in pursuing new deals.

Secondly, private equity firms can offer their employees various financial and retention incentives.

Click-Worthy Links & Resources:

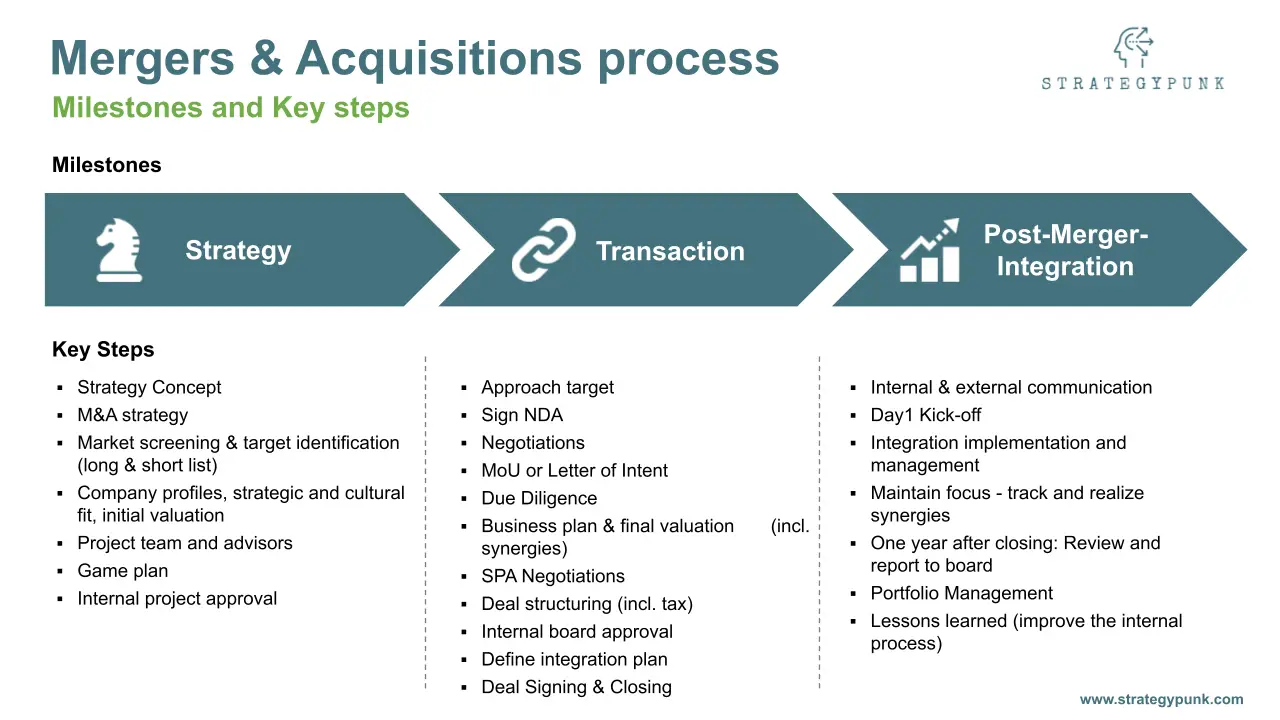

Mergers & Acquisitions Process: Guide and Process

Mergers & Acquisitions Process: Guide and Process

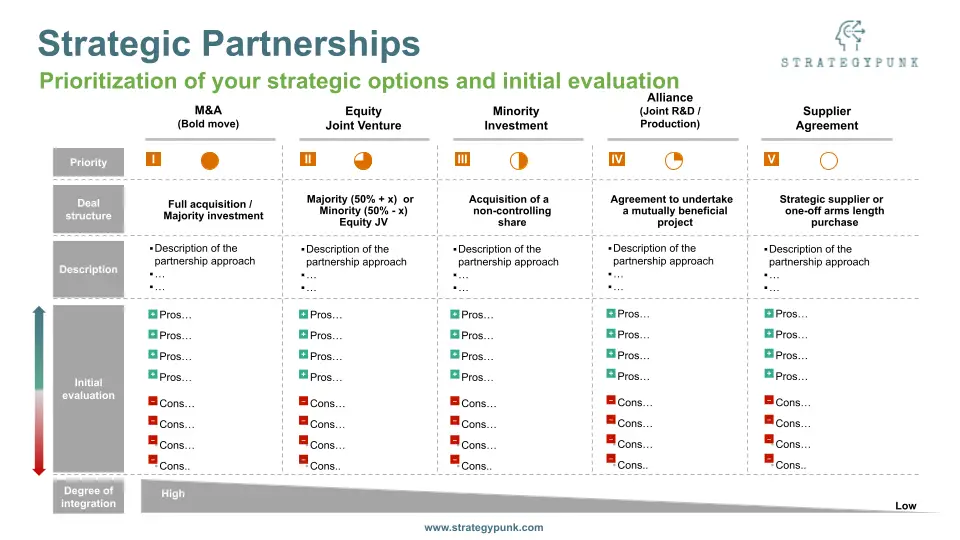

Strategic Partnerships: Evaluation Tool

Strategic Partnerships: PowerPoint Evaluation Tool

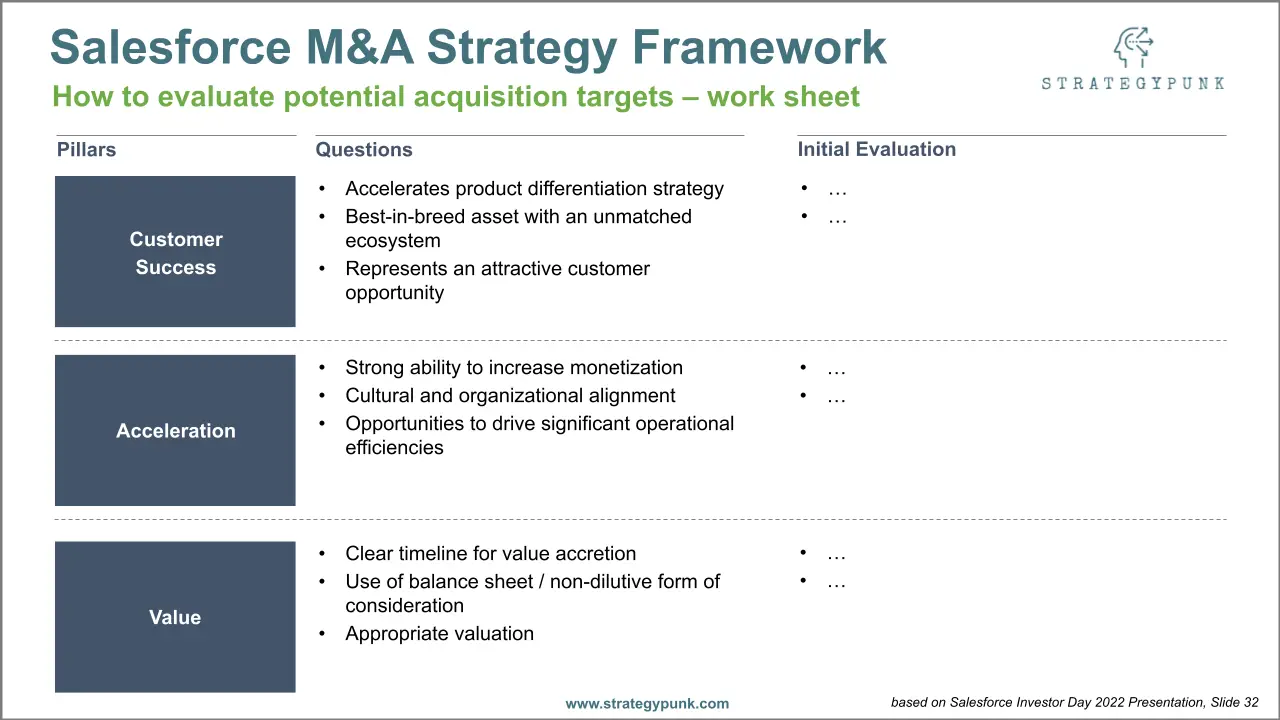

Salesforce M&A Strategy Framework

Salesforce M&A Strategy Framework Worksheet

Private Equity Investment Process Template

Free and fully editable template in PDF, PowerPoint, and Google Slides format.

The Private Equity Investment Process often varies depending on the target or the nature of the transaction.

This Private Equity Investment Process Template is intended as a starting point. This template needs to be adjusted depending on the deal and the nature of the transaction.