Netflix SWOT Analysis: Free Templates and In-Depth Insights 2024

Unlock the Secrets of Netflix's Success: Get your hands on our exclusive, free PowerPoint template for an in-depth 2024 SWOT Analysis of Netflix. Understand the dynamics of the streaming giant's enduring dominance.

Introduction to Netflix

Netflix is the world's leading streaming entertainment service, with over 230 million paid memberships in over 190 countries.

Founded in 1997 by Reed Hastings and Marc Randolph, Netflix started as a DVD rental service but pivoted to streaming in 2007.

Today, Netflix offers various award-winning TV shows, movies, documentaries, and more across multiple genres and languages.

A Brief History of Netflix

Netflix began in 1997 as a DVD rental service. The co-founders Reed Hastings and Marc Randolph sought a convenient online rental service as an alternative to brick-and-mortar video rental stores.

In 1998, Netflix launched its website with 925 titles available for rent. The company offered a subscription model where customers could rent unlimited DVDs and keep them for as long as they wished without late fees.

In 1999, Netflix pioneered the concept of personalized movie recommendations based on customers' ratings and reviews. This recommendation algorithm became a vital part of the Netflix experience.

In 2007, Netflix introduced online streaming while retaining the DVD rental service. This allowed customers to instantly watch movies and TV shows on various internet-connected devices. Over the next decade, Netflix expanded its streaming service internationally and invested heavily in original content.

In 2022, Netflix had over 230 million subscribers globally.

Financial Performance of Netflix in 2022

In 2022, Netflix reported total revenues of $31.6 billion, up 6.5% over 2021. However, net income declined to $4.5 billion from $5.1 billion the previous year. The decline was attributed to a slowdown in subscriber growth. Some key financial highlights for 2022:

- Revenues: $31.6 billion

- Operating Income: $6.1 billion

- Net Income: $4.5 billion

- Total Subscribers: 230 million

- Average Monthly Revenue per Subscriber: $11.75

Despite declining profits in 2022, Netflix remains a financially strong company. Its continued investments into content production and product innovation position it well for long-term growth.

In-Depth SWOT Analysis of Netflix in 2024

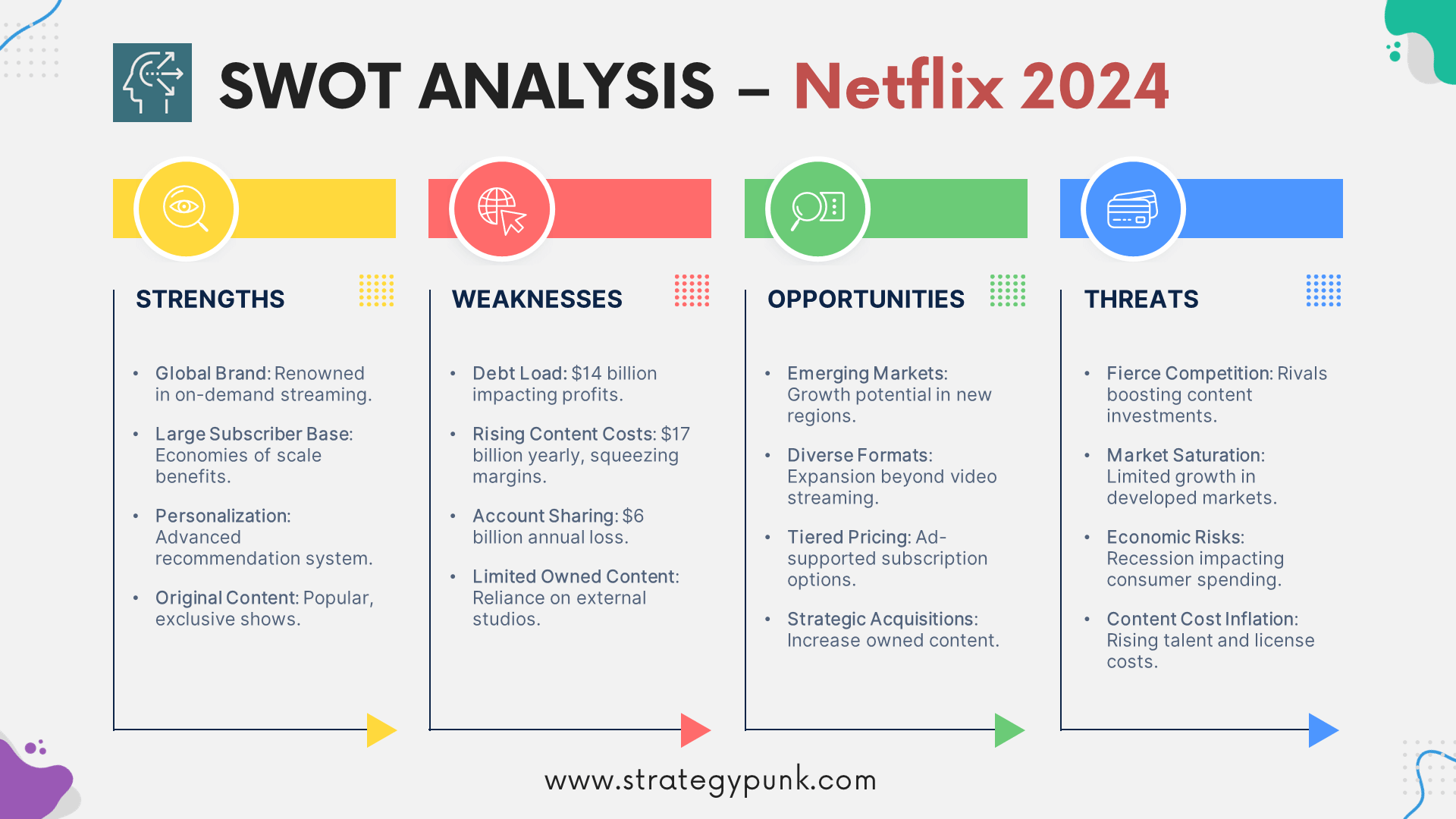

Netflix’s Strengths

- Global Brand Recognition: Netflix is now a globally recognized brand name associated with on-demand video streaming. This grants it an enviable competitive position.

- Large Subscriber Base: Netflix’s 230+ million global subscribers give it an unrivaled scale and reduce costs through economies of scale.

- Personalization: Netflix’s vaunted recommendation algorithm provides a personalized experience to each subscriber. This feature retains customers and reduces churn.

- Original Programming: Netflix originals like Stranger Things and Squid Game have been global phenomena, winning new subscribers and acclaim.

- Technical Prowess: Netflix’s streaming technology and infrastructure are industry-leading. The technical expertise required for seamless global video streaming is a formidable competitive advantage.

Netflix’s Weaknesses

- Debt Burden: Netflix carries over $14 billion in long-term debt from its massive investments in content. Servicing this debt load reduces profitability.

- Content Costs: Netflix spends over $17 billion yearly on content. These costs are rising as the streaming wars intensify. This pressures margins.

- Account Sharing: Netflix is estimated to lose over $6 billion yearly from household password sharing. This negatively impacts growth and revenues.

- Limited Owned Content: While growing, Netflix owns only a tiny fraction of the content it licenses. This forces reliance on outside studios, reducing control and margins.

- Inconsistent Profitability: As a growth company, Netflix has remained barely profitable despite its scale. Consistently generating cash and profits would require a fundamental shift.

Netflix’s Opportunities

- Emerging Markets: Countries like India, African nations, and Southeast Asia offer Netflix huge room for subscriber growth, given the expanding middle class and rapid economic development.

- New Content Formats: Netflix can leverage its platform to pursue formats like podcasts, music streaming, and live events. Diversification reduces reliance on video content.

- Tiered Pricing: Introducing an ad-supported subscription tier at a lower price point could unlock a massive new market of price-conscious cord-cutters.

- Strategic Acquisitions: Acquiring content libraries and production houses would let Netflix rely less on licensing and produce more owned content to improve margins.

- Gaming: Expanding into video gaming will increase engagement and stickiness while diversifying revenue streams beyond pure video streaming.

Netflix’s Threats

- Competition: Deep-pocketed rivals like Disney, Apple, and Amazon are aggressively ramping up content investments and subscriber growth, intensifying competition.

- Cord-cutting saturation: As cord-cutting reaches saturation among younger demographics in developed markets, Netflix’s addressable market ceases to expand rapidly.

- Recession: An economic downturn would make consumers cut back on discretionary purchases like Netflix, hurting growth and retention.

- Content Cost Inflation: The bidding wars over talent and licenses will continue to drive content costs higher, which will pressure Netflix’s margins.

- Regulation: Governments closely examine censorship, taxation, and data privacy regarding streaming services. Unfavorable regulations could impact operations and costs.

SWOT Analysis Summary

Netflix has leveraged pioneering technology and beloved original content to cement itself as the world’s leading video streaming service. Sustaining growth and profitability is challenged by rising competitive and cost pressures.

Pursuing emerging markets, new formats like gaming, and strategic acquisitions are promising opportunities, but recession risks and content cost inflation pose significant threats.

On balance, Netflix retains key strengths around technical infrastructure, brand equity, and personalization that should sustain its leadership despite gathering headwinds.

Internal Factors

Netflix’s internal factors are mostly strengths derived from intangibles like brand, data, and technical prowess built over years of focused investment. These grant it an identity and platform that are actual competitive advantages.

Weaknesses around debt, costs, and inconsistent profits indicate how continuous large-scale growth has stretched its balance sheet. Addressing these while retaining its internal technology and customer experience strengths is vital.

External Factors

Netflix broadly faces threats like competition and recession risks over which it has little control. But opportunities exist in uncharted formats like gaming and fast-growing emerging markets, which offer new frontiers.

Netflix’s fortunes are closely tied to external factors regarding the streaming industry’s evolution amidst regulatory scrutiny and economic shifts. Navigating these choppy waters will require strategic foresight.

Frequently Asked Questions

What is Netflix’s greatest strength?

Netflix’s algorithms and technical infrastructure, which enable seamless, personalized global video streaming, are its crown jewel. Built over decades, this capability will be almost impossible for rivals to replicate.

What is Netflix’s greatest weakness?

Reliance on debt to fund content investments has left Netflix with over $14 billion in liabilities. Servicing this debt burden will pressure margins and reduce flexibility for years.

What is Netflix’s most significant opportunity?

Emerging markets across Asia, Africa, and Latin America offer Netflix its best opportunity for subscriber growth. These regions are home to billions of potential cord-cutters just now adopting streaming.

What is the biggest threat facing Netflix?

Deep-pocketed rivals like Disney, Apple, and Amazon ramp up content investments and promotional efforts to rapidly grow market share. This intense competition threatens Netflix’s leadership position.

Will Netflix be profitable in the long run?

Yes, Netflix should remain profitable in the long run. However, margins may face pressure as competition reduces pricing power. Boosting owned content and entering advertising could help Netflix improve profitability over time.

What are key potential opportunities for Netflix in 2024?

- Emerging markets like India, Southeast Asia, and Africa offer significant growth potential with expanding middle classes adopting streaming. Netflix is investing heavily in local content to win subscribers in these regions.

- New revenue streams, like advertising-supported tiers and content formats beyond video, like podcasts, music, and games, can boost revenues. An ad-tier at a lower price point could unlock many new subscribers.

- Strategic acquisitions of content libraries or production houses could reduce reliance on licensing and improve margins through owned content.

- Improving profitability through operating leverage from its scale, price increases, and owned IP. Consensus forecasts indicate rapidly growing earnings per share.

- Leveraging its technical expertise in streaming and personalization to improve customer experience and engagement further as competition intensifies.

- Opportunity to beat earnings expectations in 2023 and 2024 based on management's strong free cash flow guidance, indicating accelerating profits.

- Potential for continued stock price appreciation in 2023-24 as profits grow after years of investing for growth. Analyst price targets indicate a significant upside.

Netflix SWOT Analysis PowerPoint Template

free and fully editable PPT template

A SWOT analysis evaluates the strengths, weaknesses, opportunities, and threats impacting a company.

This free editable PowerPoint template provides a SWOT analysis framework to evaluate Netflix's internal strengths and weaknesses and external opportunities and threats.

Netflix SWOT Analysis PowerPoint Template

Netflix SWOT Analysis PDF Template

Discover more

Clickworthy Resources

SWOT Analysis: Free PowerPoint Template

This PowerPoint slide deck contains five different layouts to complete a SWOT analysis.

New! SWOT Framework & Free PPT Template - 2024 Edition

Dive into the 2024 Edition of our SWOT Analysis guide, complete with a free PowerPoint template. This resource covers the essentials of conducting a SWOT analysis, its benefits, and practical application tips, including a case study on Mercedes Benz.

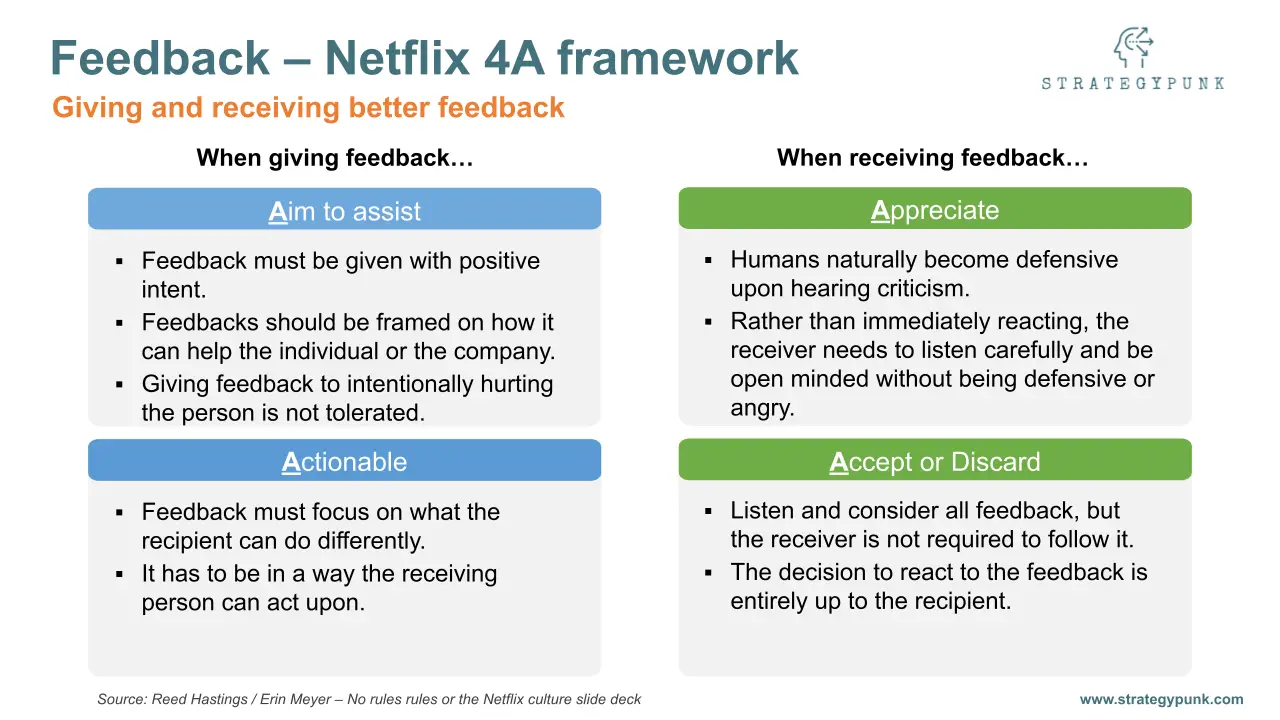

Netflix 4A feedback principles: Free PowerPoint Template

Netflix 4A feedback principles: How to give and receive feedback the Netflix way.

How to give feedback, the Netflix way.

Master Netflix-style feedback in 10 steps with our free PDF template! Elevate your leadership and boost your team's growth through honest, actionable, and empowering feedback.