Strategic Analysis NVIDIA (SWOT, Free PDF)

Nvidia strategic analysis: SWOT breakdown of AI chip dominance, CUDA moat, and key threats. Free PDF download.

Introduction: Nvidia, The Engine of the AI Economy

Nvidia sits at the center of the AI revolution. Every major tech company racing to build the next breakthrough model relies on Nvidia hardware.

But how sustainable is this position?

I put together a strategic analysis to answer that question. Here's what the research reveals.

The Dual Moat

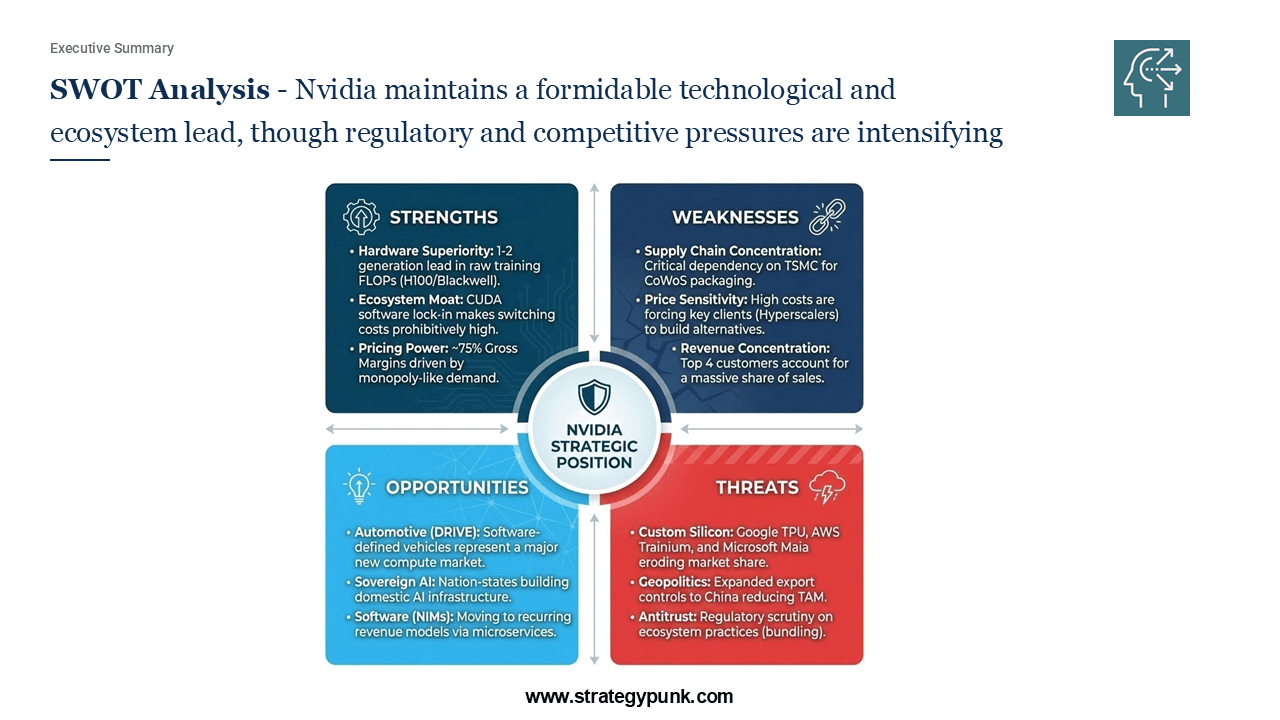

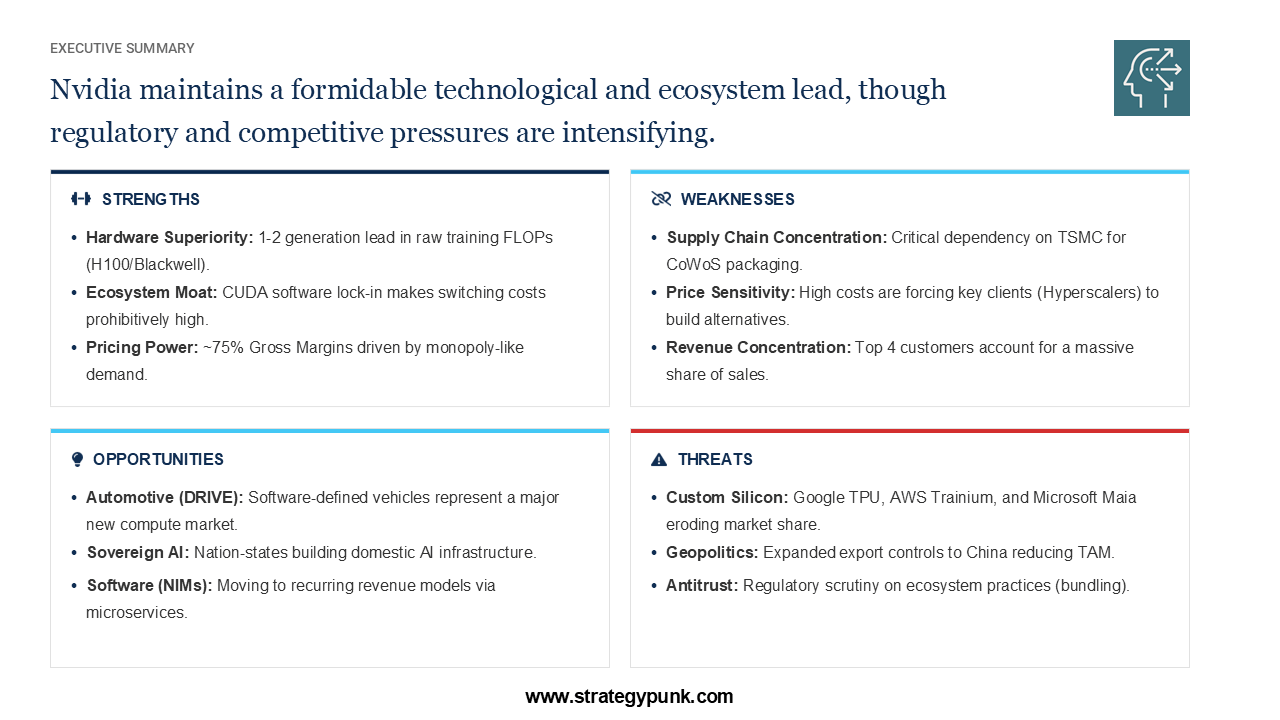

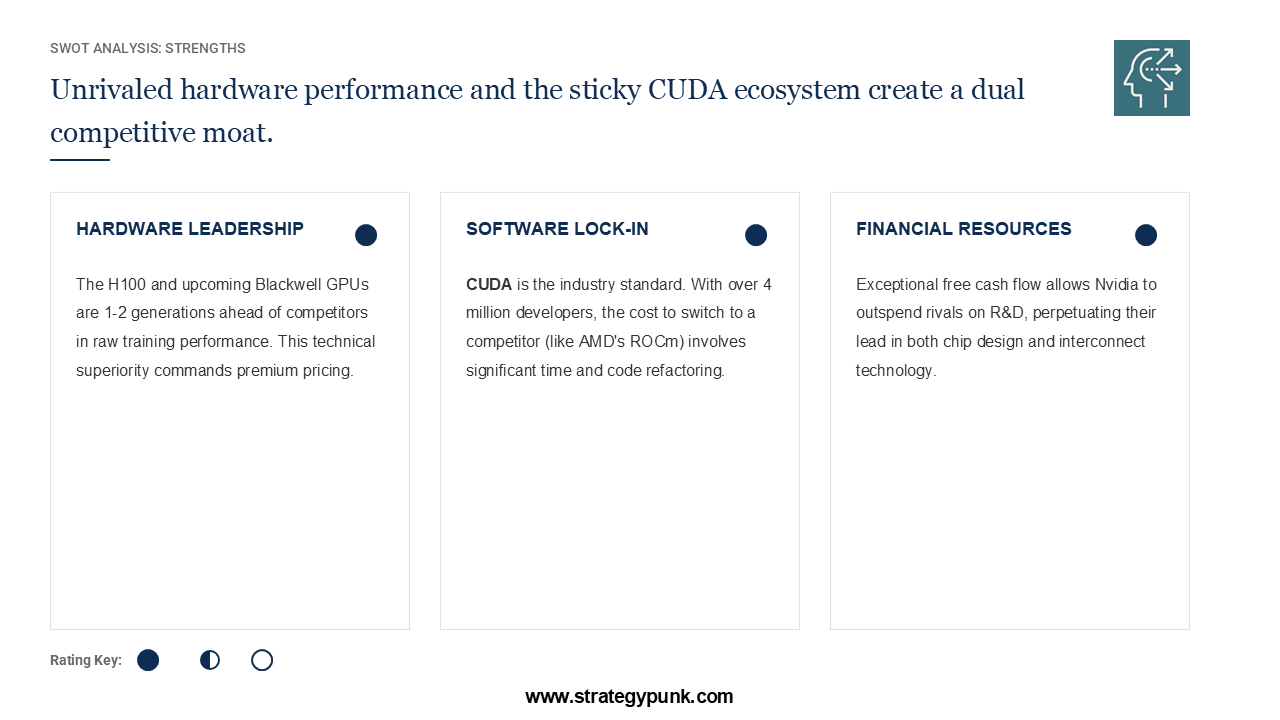

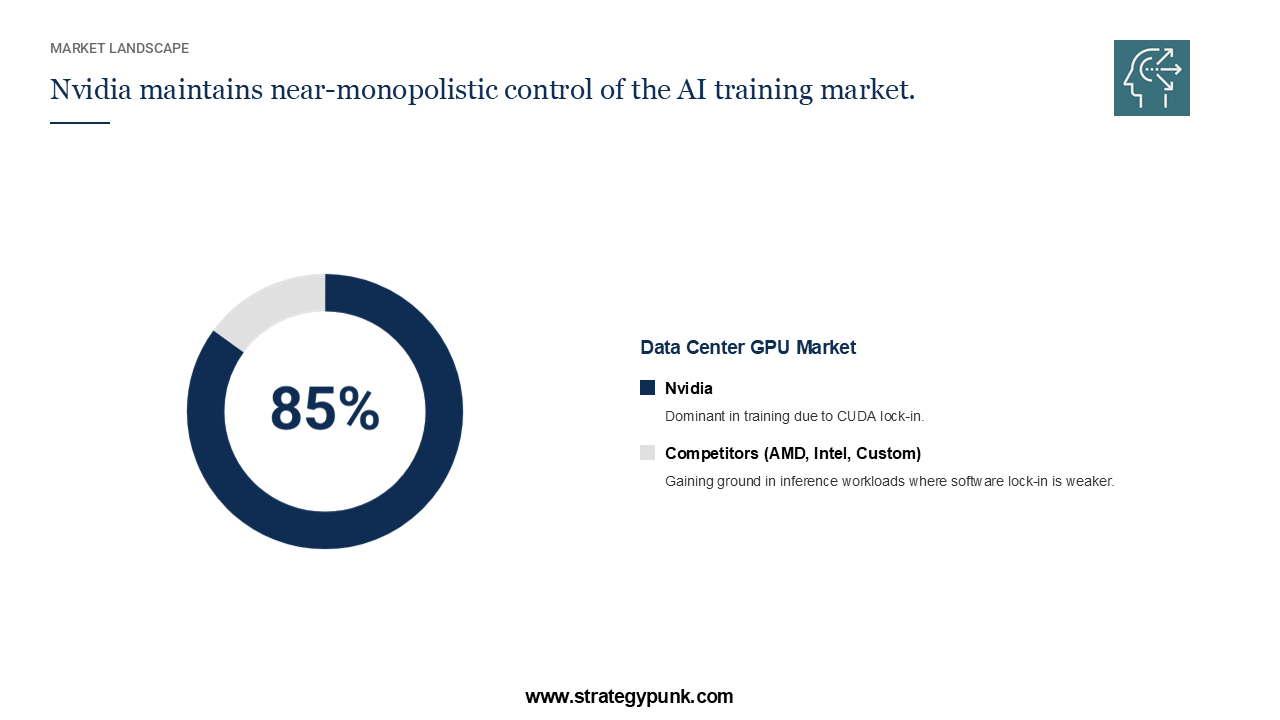

Nvidia has built two layers of defense that competitors struggle to breach.

The first is hardware. The H100 and upcoming Blackwell GPUs remain one to two generations ahead of anything AMD or Intel can offer. When companies need raw training power, Nvidia delivers performance that justifies premium pricing.

The second is software. CUDA has become the industry standard with over four million developers writing code on the platform. Switching to a competitor means rewriting codebases and retraining teams. That cost keeps customers locked in even when alternatives emerge.

These moats reinforce each other. Better hardware attracts more developers to CUDA. More developers make the ecosystem more valuable. The flywheel keeps spinning.

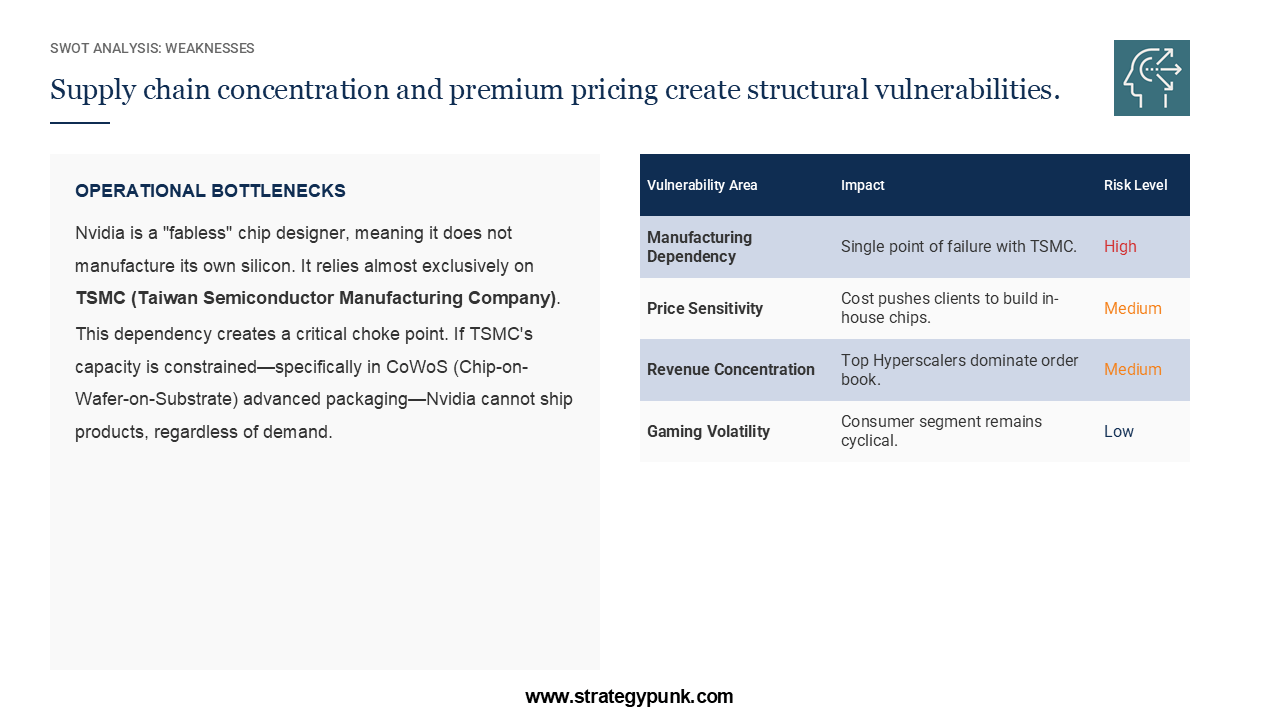

Where Nvidia Is Vulnerable

No company is bulletproof. Three vulnerabilities stand out.

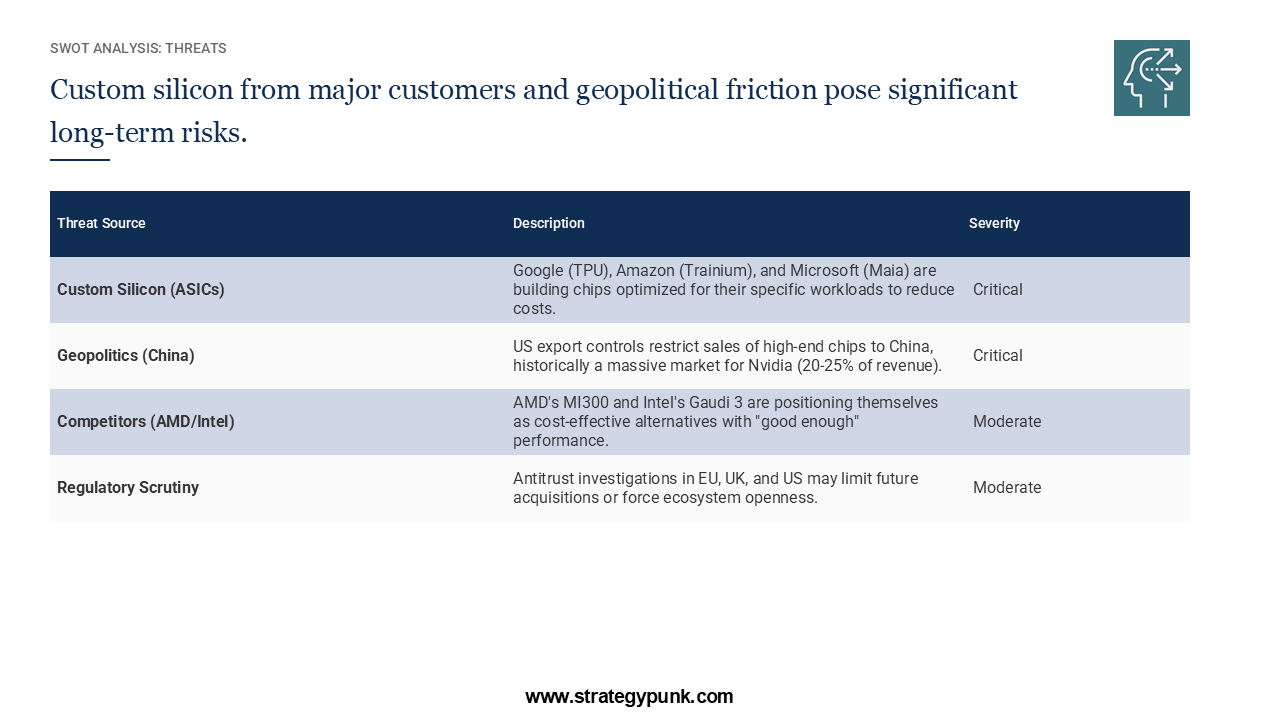

First, Nvidia depends on TSMC for manufacturing. As a fabless chip designer, Nvidia cannot build its own products. If TSMC faces capacity constraints or geopolitical disruption, Nvidia cannot ship even if demand is high. This single point of failure sits outside Nvidia's control.

Second, high prices push customers toward alternatives. Google, Amazon, and Microsoft have each launched their own AI chip programs. When your biggest buyers start building competing products, the warning sign is clear.

Third, US export controls have restricted sales to China. That market once represented 20 to 25 percent of revenue. Geopolitical friction has cut into a significant piece of the business.

Growth Opportunities Beyond Data Centers

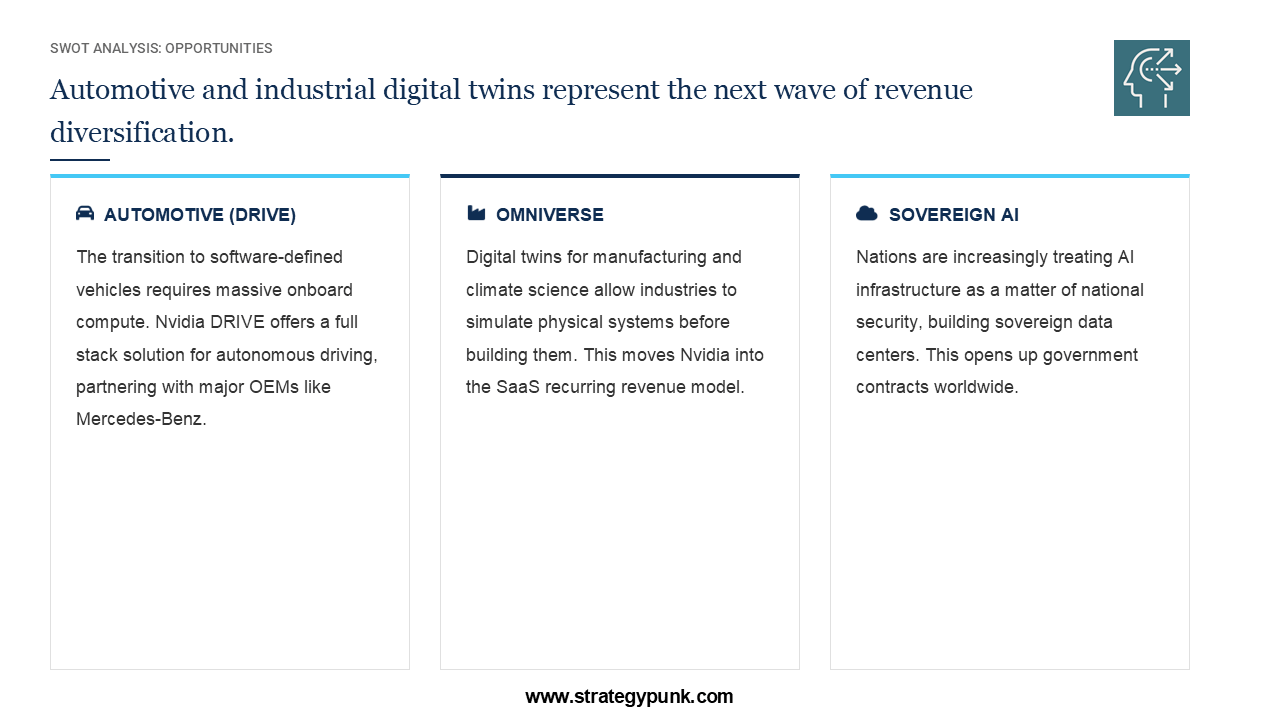

Nvidia is not standing still. Three expansion areas could drive the next wave of growth.

The automotive market needs massive onboard compute for software-defined vehicles. Nvidia DRIVE offers a complete solution for autonomous driving and has partnered with manufacturers such as Mercedes-Benz. Cars are becoming computers on wheels, and someone needs to supply the chips.

Sovereign AI is gaining momentum. Nations now treat AI infrastructure as a matter of national security. Countries worldwide are building domestic data centers rather than relying on foreign providers. This opens government contracts worldwide.

The Omniverse platform moves Nvidia into recurring revenue. Digital twins for manufacturing and climate science let industries simulate physical systems before building them. This shifts the business model from selling hardware to licensing software.

The Competitive Threat That Matters Most

Forget AMD and Intel for a moment. The real threat comes from Nvidia's own customers.

Google has TPU. Amazon has Trainium. Microsoft has Maia. Each hyperscaler is investing billions to reduce dependence on Nvidia. These chips optimize for specific workloads at lower cost. They don't need to match Nvidia across every use case. They just need to handle their own internal demand.

This dynamic limits Nvidia's pricing power over time. When your best customers become your competitors, gross margins face pressure.

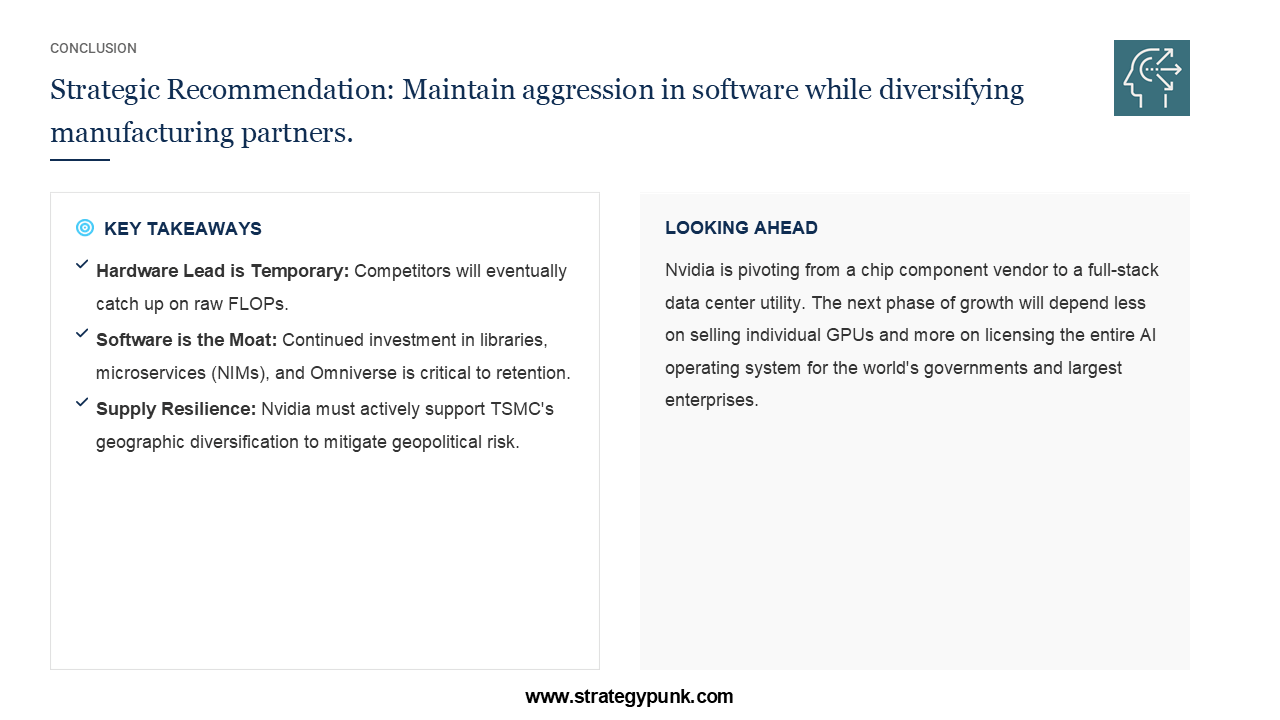

The Strategic Path Forward

Hardware leads are temporary. Competitors will eventually close the gap on raw performance. The sustainable advantage lives in software.

Nvidia must keep investing in libraries, microservices, and Omniverse to retain customers. The company also needs to support TSMC's geographic diversification to reduce supply chain risk.

The future looks less like selling chips and more like licensing an AI operating system. Governments and enterprises will pay for the whole stack rather than individual components.

Nvidia has built something rare. But the environment is shifting. Competitors are spending. Regulators are watching. The next chapter will test whether the moats hold.

Download the Full Analysis

Want the complete strategic breakdown? Download the free PDF below. It includes the full SWOT analysis, financial performance charts, market share data, and detailed threat assessment.

Full vidia Strategic Analysis (PDF)

![11 One-Page Strategic Plan Templates [Free PPT & PDF Download]](/content/images/size/w600/2026/01/one-page-strategic-templates-header-light-1.png)