SWOT Analysis of Stellantis: Free PPT Template and In-Depth Insights 2024

Explore the 2023 SWOT Analysis of Stellantis, the automotive giant formed from Fiat Chrysler and Groupe PSA. Our free PPT template offers key insights into their brand strength, financial health, and strategic challenges in the evolving auto industry.

Introduction

Stellantis N.V. is a leading global automaker formed in January 2021 from the merger of Fiat Chrysler Automobiles and Groupe PSA.

Headquartered in Amsterdam, Stellantis designs, engineers, manufactures, distributes, and sells vehicles and mobility solutions worldwide.

With a portfolio of iconic brands including Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS, Fiat, Jeep®, Lancia, Maserati, Opel, Peugeot, Ram and Vauxhall, Stellantis has a rich heritage spanning over 130 years of automotive history.

Today, Stellantis is focused on becoming the most significant sustainable mobility tech company powered by iconic brands offering innovative mobility solutions.

Stellantis aims to embrace this change and lead the way as the world rapidly transforms.

For those interested in a deeper dive, a free PowerPoint and PDF template of Stellantis's SWOT analysis is available at the end of this blog post.

Introduction to Stellantis

Stellantis was formed through the merger of Fiat Chrysler Automobiles N.V. and Peugeot S.A. in a 50/50 cross-border merger.

Fiat Chrysler brought brands like Jeep, Ram, Dodge, Maserati, and Alfa Romeo to the merger, while Peugeot contributed to Peugeot, Citroën, DS, Opel, and Vauxhall.

The merger created the world’s 4th largest automaker by volume, with combined sales of over 8 million vehicles globally in 2020. Stellantis has a balanced presence across key regions:

- Europe: 46% of sales

- North America: 44% of sales

- South America: 6% of sales

- China, India, Asia Pacific: 4% of sales

With 400,000 employees across nearly 200 countries, Stellantis has the scale, resources, and diversity to compete strongly in the rapidly changing automotive industry.

A Brief Look at the History of Stellantis

Stellantis was formed only recently in 2021, but its constituent companies, Fiat Chrysler and Peugeot, have long and storied histories:

- Fiat was founded in 1899 in Italy and grew to become Italy's largest automobile manufacturer. Major milestones included acquiring Lancia in 1969, Ferrari in 1988, Maserati in 1993, and Chrysler in 2014.

- Chrysler was founded in 1925 in the United States. It emerged as one of Detroit's "Big Three" automakers along with Ford and GM. Over the decades, Chrysler acquired brands like Dodge, Jeep, Ram, and Fiat.

- Peugeot was founded in 1810 in France as a family business. It grew rapidly in the early 20th century, acquiring Citroën in 1976. PSA Peugeot Citroën was formed in 1976 and acquired Opel and Vauxhall in 2017.

Bringing these historic companies together creates a powerful auto group positioned to lead the 21st-century mobility revolution.

Financials of Stellantis 2023

Stellantis reported stellar financial results for 2023, setting new records across several key metrics. Net revenues climbed 6% to €189.5 billion, driven by a 7% increase in global vehicle shipments.

Net profit surged 11% to €18.6 billion, an all-time high for the automaker. Adjusted operating income rose 1% to €24.3 billion, though margins dipped slightly to 12.8% due to costs from UAW strikes in the U.S.

The company generated robust industrial free cash flows of €12.9 billion, up 19% year-over-year, fueled by strong operations and disciplined investments. Stellantis made notable progress on electrification, with global battery electric vehicle sales jumping 21% and the company ranking #1 for plug-in hybrid sales and #2 for low-emission vehicles in the U.S.

Overall, low-emission vehicle sales rose by 27%.

Stellantis rewarded shareholders handsomely in 2023, returning €6.6 billion through increased dividends of €1.55 per share (up 16%) and share buybacks. The company also announced a new €3 billion buyback program for 2024. These record results position Stellantis strongly to execute its "Dare Forward 2030" strategic plan for long-term sustainable growth.

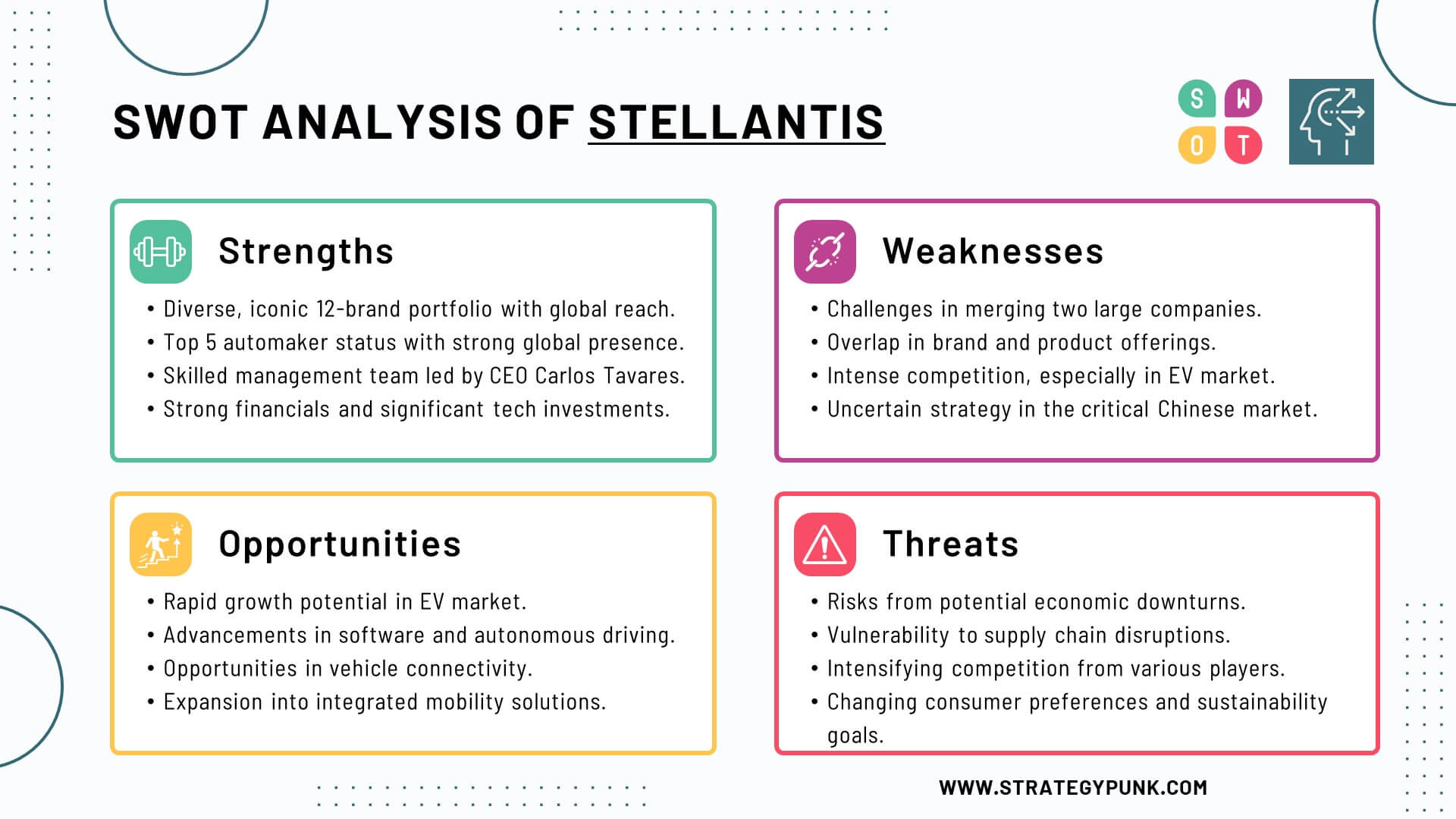

In-depth SWOT Analysis of Stellantis 2024

Let's examine Stellantis' strengths, weaknesses, opportunities, and threats in detail:

Stellantis’s Strengths

- Iconic brand portfolio: Jeep, Ram, Peugeot, Citroen, Opel, Fiat, Chrysler, Dodge, Alfa Romeo, Lancia, Maserati. These 12 brands provide geographic and segment coverage.

- Global scale and presence: Top 5 automakers with balanced regional exposure and manufacturing footprint. Achieves economies of scale.

- Diverse and talented management: Executives from both merging companies. Carlos Tavares, as CEO, provides strong leadership.

- Financial strength: €62.7 billion liquidity, investment grade credit rating, profitability, and positive cash flow.

- Technology investments: Investing 35+ billion euros through 2025 in electrification and software.

- Vertical integration: Ambition to insource EV components to reduce costs and secure supplies.

Stellantis’s Weaknesses

- Complexity of merger integration: Combining two giant companies is an immense challenge requiring years of work.

- Overlapping brands and models: Rationalization of brands and products required to reduce internal competition.

- Highly competitive markets: Stellantis competes with giants like VW, Toyota, and Renault-Nissan, with aggressive Chinese automakers rising fast.

- Lagging in EVs today: Stellantis has catching up to do relative to leaders in EV technology and sales like Tesla and VW.

- Unproven China strategy: China is a tough nut to crack but critical for global automakers. Stellantis needs to accelerate here.

Stellantis’s Opportunities

- EV growth: Forecasted rapid growth in EV adoption represents a massive opportunity as a new core segment. Stellantis can leverage its iconic brands to lead this shift.

- Software and autonomous driving: Software and autonomy are the future. Stellantis has the resources to build competitive capabilities through partnerships and in-house development.

- Connected vehicles: Onboard connectivity and over-the-air updates are rapidly becoming standard features that Stellantis can capitalize on.

- New mobility solutions: Stellantis can expand beyond traditional vehicle sales to provide integrated mobility solutions.

- Cost savings from synergies: Additional synergies expected from integration can boost profitability.

Stellantis’s Threats

- Economic downturn: A recession could substantially dampen demand and reduce profits industry-wide.

- Supply chain disruptions: Shortages of semiconductors, raw materials, and logistics bottlenecks pose ongoing supply risks.

- Increasing competition: Traditional automakers, tech giants, startups, and Chinese players create a highly competitive landscape.

- Changing consumer preferences: Younger buyers are less interested in traditional vehicle ownership, posing risks to long-term demand.

- Sustainability pressures: Stellantis faces rising carbon regulations and needs to transform its business model to achieve carbon neutrality by 2038.

Stellantis SWOT Analysis Summary

Stellantis has compelling strengths as a newly merged auto giant with iconic brands, global scale, strong leadership, and financial firepower.

It has opportunities to leverage these assets to lead the industry’s transformation amidst rising EV adoption, software innovation, and new mobility solutions.

Stellantis needs help with legacy inefficiencies, unproven China strategy, competitive threats, and sustainability pressures. Its success will depend on disciplined execution of its merger integration, product portfolio rationalization and technology roadmaps.

Strong leadership and decisive action will be required to realize Stellantis’ bold vision.

Internal Factors

| Strengths | Weaknesses |

|---|---|

| Iconic brand portfolio | Complexity of merger integration |

| Global scale and presence | Overlapping brands and models |

| Diverse and talented management | Lagging in EVs today |

| Financial strength | Unproven China strategy |

| Technology investments | |

| Vertical integration |

External Factors

| Opportunities | Threats |

|---|---|

| EV growth | Economic downturn |

| Software and autonomous driving | Supply chain disruptions |

| Connected vehicles | Increasing competition |

| New mobility solutions | Changing consumer preferences |

| Cost savings from synergies | Sustainability pressures |

Frequently Asked Questions

What are the key strengths of Stellantis?

Some of Stellantis' significant strengths include its iconic brand portfolio comprising 12 brands, global scale and presence balanced across critical regions, diverse and talented management team, strong financial position, and technology investments to lead in EVs and software.

What are some weaknesses and threats facing Stellantis?

Stellantis faces challenges like the complexity of integrating two large merging companies, overlapping brands and products, unproven China strategy, lagging in EVs, competitive threats from traditional and new players, changing consumer preferences, and sustainability pressures.

How can Stellantis leverage opportunities moving forward?

Stellantis can leverage rapid growth in EVs, innovations in software/autonomy, connected vehicles, new mobility solutions, and cost savings from merger synergies to boost revenues and profitability. Iconic brands and financial strength provide an edge.

What is Stellantis’s outlook for the future?

Stellantis aims to become a leading sustainable mobility tech company powered by its iconic brands. It has set bold targets for EV sales, software revenue, carbon neutrality, cost savings, and profitability under its 2030 strategic plan. Execution of merger integration and technology roadmaps will be critical.

What is Stellantis’s carbon neutrality commitment?

Stellantis has committed to achieving carbon net zero emissions by 2038, with an interim target to cut emissions in half by 2030. This demonstrates its leadership in sustainability.

How does the future look for Stellantis's iconic brands?

Stellantis is giving its 14 iconic brands a 10-year window to prove their value and justify further investment. Brands like Jeep, Ram, Peugeot, and Opel are well-positioned today, while others like Lancia, Chrysler, and Dodge need more certainty. Brand stewardship will be critical.

What are the core values of Stellantis?

Values of diversity, meritocracy, competition, excellence, and integrity guide Stellantis. The company embraces diversity and aims to lead inclusively. It is a meritocracy that empowers people to drive change and rewards competition and unconventional thinking.

Stellantis strives for best-in-class performance in all it does while delivering on commitments. Underpinning it all is a culture of integrity that builds trust with stakeholders. These values shape Stellantis' identity and strategic vision to pioneer sustainable mobility solutions.

Who is the CEO of Stellantis?

Carlos Tavares is the CEO of Stellantis.

He has served as CEO since the merger between Fiat Chrysler Automobiles and Groupe PSA, which formed Stellantis in January 2021. Tavares joined PSA Groupe in 2014 as Chairman of the Managing Board. He led PSA's turnaround and return to profitability.

Before PSA, Tavares held various leadership roles at Renault and Nissan for several decades. As CEO of Stellantis, Tavares has focused on realizing merger synergies, strengthening the company's brands, leading in electrification, and transforming Stellantis into a sustainable mobility tech company.

Under his leadership, the company aims to become carbon net zero by 2038. Tavares is a competitive, demanding leader who pushes for operational excellence.

He has extensive global experience in the auto industry, spanning Europe, the Americas, and Asia. Tavares was born in Portugal and educated in France at prestigious institutions like École Centrale Paris

Stellantis SWOT Analysis PowerPoint Template

free and fully editable PPT template

A SWOT analysis evaluates the strengths, weaknesses, opportunities, and threats impacting a company.

This free editable PowerPoint template provides a SWOT analysis framework to evaluate Stellantis's internal strengths and weaknesses and external opportunities and threats.

Stellantis SWOT Analysis PowerPoint Template

Stellantis SWOT Analysis PDF Template

Discover more

Clickworthy Resources

SWOT Analysis: Free PowerPoint Template

This PowerPoint slide deck contains five different layouts to complete a SWOT analysis.

SWOT Analysis of Ford Motor: Free PPT Template and In-Depth Insights 2023

Embark on a journey through Ford Motor Company's 2023 SWOT analysis. This post unpacks Ford's heritage, market dynamics, and financials, culminating in a free, insightful PPT/PDF SWOT template.

SWOT Analysis of Tesla: Free Templates and In-Depth Insights 2023

Delve into an in-depth SWOT analysis of Tesla, exploring the electric giant's strengths, weaknesses, opportunities, and threats. Uncover the driving forces behind Tesla's success.

How does SWOT analysis contribute to strategy formation?

Explore how SWOT analysis shapes strategy formation. Learn to leverage strengths and opportunities while addressing weaknesses and threats with our free SWOT PPT Template.

SWOT Analysis of Honda Motor: Free PPT Template and In-Depth Insights 2023

Download Honda Motor SWOT Analysis PPT Template for Free - Dive into Honda's market strategy with our in-depth SWOT Analysis. Explore opportunities and navigate threats in the auto industry.