Fastly SWOT Analysis: Free PPT and In-Depth Insights 2024

2024 SWOT Analysis of Fastly with free, detailed PPT guide and insights.

Fastly has become a pivotal force in edge cloud platforms, offering rapid content delivery, enhanced security, and cloud services that keep pace with the digital demands of today's businesses.

As we move into 2024, investors, stakeholders, and industry watchers must grasp Fastly's strengths, weaknesses, opportunities, and threats (SWOT)in this dynamic market landscape.

In this blog post, we've looked at an in-depth SWOT analysis of Fastly, providing a comprehensive guide to understanding the company's current position and prospects. Our analysis sheds light on Fastly's robust CDN services, innovative technology stack, and strategic partnerships, as well as the challenges it encounters in a competitive market and potential areas for growth.

We offer a free PowerPoint template to equip you with the essential tools for a thorough analysis. This meticulously designed template encapsulates the key points of our SWOT analysis and offers you the flexibility to tailor the information for presentations or strategic discussions.

Join us as we explore each segment of Fastly's SWOT analysis, offering valuable insights to inform your decisions and strategies for 2024 and beyond.

Introduction to Fastly

Fastly is a leading-edge cloud platform company that provides content delivery network (CDN) services, image and video optimization, cloud security, load balancing, and edge computing capabilities.

Founded in 2011, Fastly has become a significant player in the CDN and edge computing industry, serving over 3,000 enterprise customers globally.

Fastly operates a software-defined edge cloud network with advanced points of presence (POPs) in critical metros and population centers worldwide. This allows Fastly to push content, applications, and computing power to the edge, closer to end users.

By reducing the distance between Fastly's edge cloud POPs and end users, Fastly can accelerate and optimize the delivery of content and apps for superior digital experiences.

A Brief Look at the History of Fastly

Fastly was founded in 2011 by current CTO Artur Bergman and entrepreneurs Simon Wistow and Gil Penchina. The founders aimed to build a new type of CDN explicitly designed for the modern, mobile era of app and web development.

The company raised several rounds of venture funding in its early years, including a $10 million Series B round in 2013 and a $40 million Series C round in 2014. Fastly continued to grow quickly, raising over $200 million in total funding before going public in 2019. Since its founding, Fastly has expanded well beyond CDN services. In 2020, Fastly acquired application security company Signal Sciences for $775 million, adding web application firewall (WAF) and related security capabilities to its portfolio. Fastly also acquired Glitch, a developer platform company, in 2022.

Other key milestones in Fastly's history include:

- 2014: Launched edge cloud services

- 2016: Formed partnership with Google Cloud Platform

- 2019: Went public on the NYSE

- 2020: Acquired Signal Sciences for $775M

- 2022: Named new CEO Todd Nightingale

- 2022: Acquired Glitch developer platform

Today, Fastly serves over 3,000 business customers across industry verticals like media, e-commerce, technology, financial services, etc.

The New York Times, Stripe, Pinterest, and Epic Games are significant customers.

What is the business model of Fastly?

Fastly operates on a software-as-a-service (SaaS) business model centered around its edge cloud platform. The company generates revenue primarily from usage-based fees from customers utilizing Fastly's content delivery, security, computing, and other network services.

As of Q3 2023, Fastly reported having 3,102 total customers, including 540 enterprise customers. Enterprise customers are those generating over $100,000 in trailing twelve-month billings. In the first nine months of 2023, 93% of Fastly's revenue came from existing customers, while new customer revenue contributed just 7%. This highlights the land-and-expand nature of Fastly's business model.

Once onboarded, customers tend to increase their usage and spending on Fastly's platform over time as they deploy more applications and workloads on the edge. Fastly aims to accelerate this expansion through excellent customer support and account management. Other aspects of Fastly's business model include:

- Usage-based pricing - Customers pay based on utilization of computing, bandwidth, and requests

- Minimum commitments - Larger deals often include minimum monthly or annual commitments

- Channel partnerships - Fastly drives new business through resellers, referrals, and integrations

- Developer community - Fastly engages directly with the open-source community

- Freemium offerings - Free developer trials and nonprofit/open source tiers onboard new users

This multifaceted approach allows Fastly to land new customers across segments while expanding spend from existing accounts over time.

Financials of Fastly 2023

In the first three quarters of 2023, Fastly generated $366.3 million in revenue, representing 15% year-over-year growth. The company has invested heavily in sales, marketing, and R&D for future growth.

As a result, Fastly operates at a net loss of $186.2 million through the first three quarters of 2023. However, the company does produce positive gross margins north of 50% every quarter. Other key financial metrics for Fastly include:

- Q3 2023 Revenue: $127.8 million

- Trailing 12 Month Revenue: $489.8 million

- 2022 Revenue Growth: 21% YoY

- Q3 2023 Gross Margin: 50.4%

- Operating Cash Flow: -$95.5 million (Q1-Q3 2023)

- Cash & Equivalents: $92.3 million (Q3 2023)

Fastly expects to produce between $490-500 million in total 2023 revenue, representing growth between 13-15% over 2022.

Fastly targets a Rule of 40 balance between growth and profitability as it scales. This means driving towards 40%+ combined revenue growth and free cash flow margins. Achieving this Rule of 40 balance remains a key strategic priority for Fastly over the next several years.

In-depth SWOT Analysis of Fastly 2024

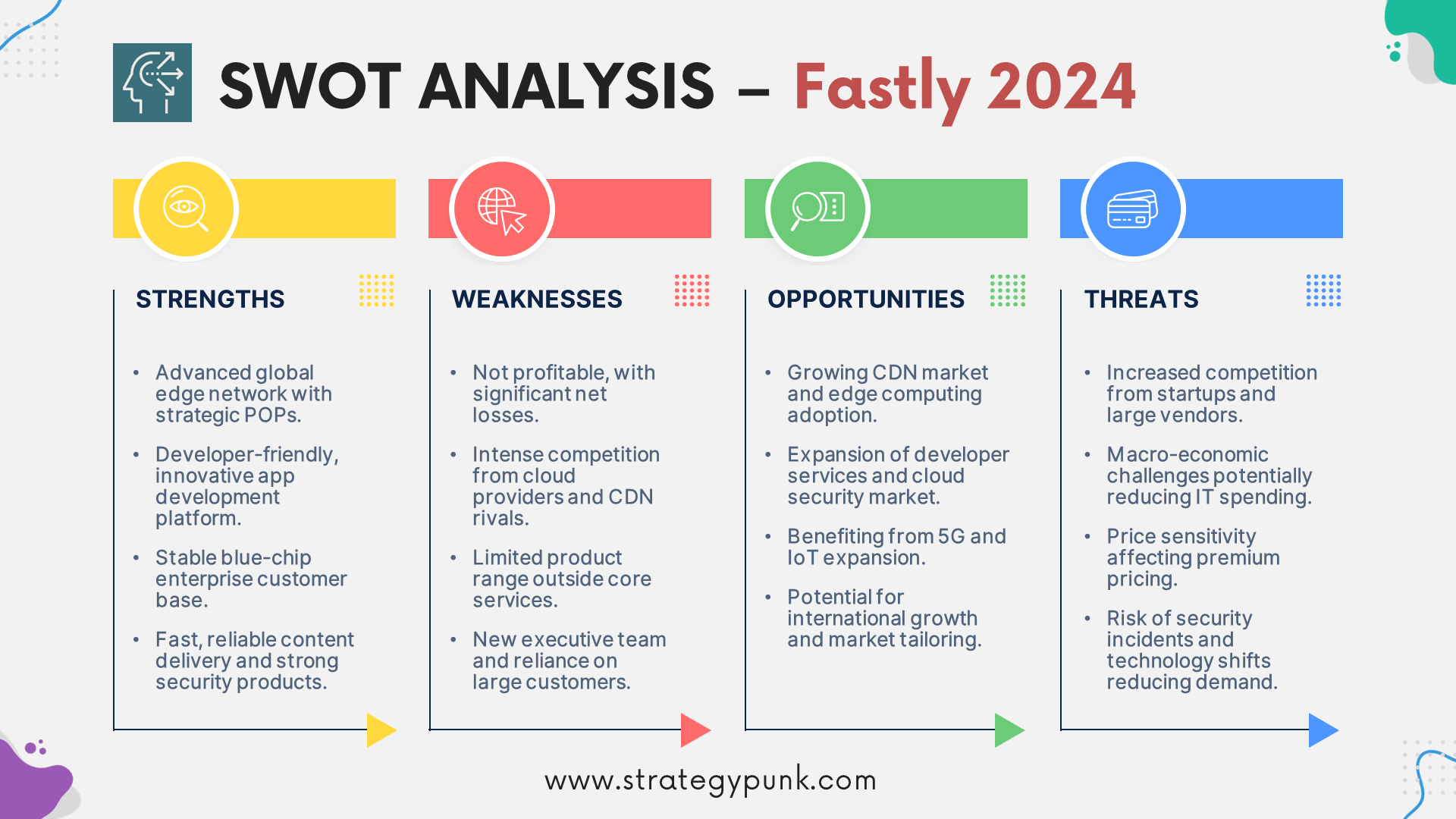

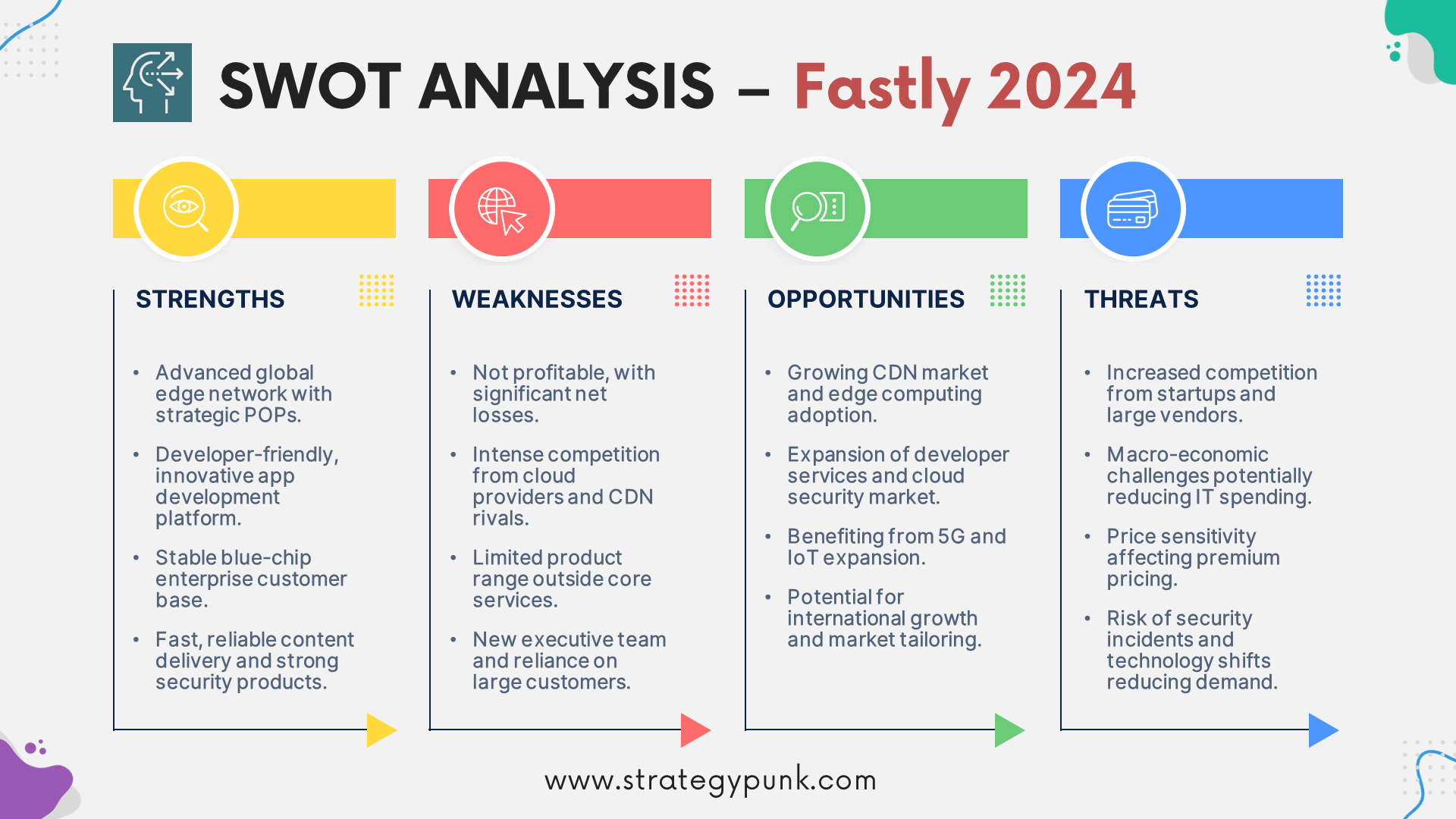

Fastly’s Strengths

Advanced global network - Fastly operates one of the fastest and most advanced edge networks, with fewer but more powerful POPs strategically located in critical metros near end users.

Developer-friendly platform - Fastly's edge cloud is programmable and extensible, allowing developers to build innovative apps and experiences.

Enterprise customer base - Long-term contracts with blue chip enterprise customers provide Fastly with stability and expansion opportunities.

Rapid content delivery - Fastly's network is optimized for fast, reliable content delivery, including streaming video and real-time apps.

Strong security capabilities - Fastly offers a robust suite of security products, including DDoS protection, WAF, and more.

Experienced leadership team - Fastly's executives bring deep experience in technology, security, networking, and SaaS.

Fastly’s Weaknesses

Operating losses - Fastly is not yet profitable, posting net losses of over $180 million in the first three quarters of 2023.

Fierce competition - Major cloud providers like AWS and CDN rivals like Cloudflare compete directly with Fastly.

Narrow product focus - Fastly has limited offerings outside its core CDN and edge computing services besides security.

New leadership team - Fastly has an essentially new executive team under recently appointed CEO Todd Nightingale.

Concentrated customer base - Fastly relies on large enterprise customers for most of its revenue. The loss of critical accounts could impact growth.

Technical complexity - Fastly's advanced edge platform can present a steep learning curve, slowing adoption by some organizations.

Fastly’s Opportunities

Growing CDN market - The content delivery network market is forecast to grow at a 15% CAGR through 2027 as more data moves to the edge.

Edge computing adoption - More enterprises are utilizing edge computing and need specialized platforms like Fastly to deploy these workloads.

Enhanced developer services - Fastly can expand its developer platform organically and through acquisitions like Glitch to drive more usage.

Security demand growth - Fastly is well positioned to capture growth in the cloud security market, expanding over 15% annually.

5G and IoT - The emergence of 5G and the expansion of enterprise IoT will drive more real-time applications well suited to Fastly's network.

Geographic expansion - Fastly can grow internationally by tailoring solutions to new regions and local verticals.

Fastly’s Threats

Increasing competition - Well-funded startups and large cloud vendors are expanding in the CDN and edge computing spaces.

Macro environment - Factors like rising inflation and recession risks could slow enterprise IT spending, impacting Fastly's growth.

Price sensitivity - Many buyers still prioritize low cost over performance in CDN purchasing decisions, hampering Fastly's premium pricing.

Security incidents - Any breach or outage impacting Fastly customers could significantly damage trust and adoption of Fastly's services.

Technology shifts - Major innovations in networking, cloud infrastructure, or content delivery could reduce demand for dedicated CDN and edge solutions over time.

Churn risk - If key accounts leave for cheaper CDN options, Fastly could face revenue declines and slower enterprise expansion.

Fastly SWOT Analysis Summary 2024

Internal Factors

Strengths

Fastly operates one of the fastest, most advanced global CDN and edge platforms explicitly optimized for security, speed, and developer flexibility. The company serves over 500 enterprise customers under long-term contracts and is expanding its platform to address new opportunities like edge computing.

Weaknesses

Fastly operates at a net loss as a relatively young public company investing aggressively for growth. It faces risks tied to its concentrated customer base and ongoing leadership team evolution under a newly appointed CEO.

External Factors

Opportunities

Numerous trends like 5G rollout, edge computing adoption, IoT expansion, and heightened security needs directly affect Fastly's strengths. The company can leverage its developer DNA and security leadership to capture share in large, fast-growing markets.

Threats

While innovation and customer trust have fueled Fastly's early growth, competitive threats from mega-cloud platforms and economic and technology uncertainty could impact results. Sustaining premium pricing and enterprise expansion rates will remain ongoing challenges.

fastly's strategies for success

Based on this analysis, key strategies Fastly should focus on include:

Prioritizing profitability - Improving gross margins and containing operating expenses will bolster Fastly's position as it pursues Rule of 40 profitability targets over the next several years.

Expanding security portfolio - Continuing to build out security offerings and capabilities will help Fastly differentiate on trust and capture share in the high-growth cloud security space.

Accelerating enterprise penetration - Leveraging account management and customer success teams to land new logos while expanding existing accounts will support stable growth.

Enhancing developer platform - Organic innovation and strategic acquisitions to empower more edge developers will drive more significant network usage and long-term stickiness.

Localizing solutions - Tailoring products, pricing, and partnerships to the needs of specific regions and verticals will unlock new markets for Fastly to penetrate.

Strengthening partner ecosystem - Working more closely with complementary technology vendors, cloud consultants, and channel partners will generate customer referrals and co-innovation.

Fastly can maintain its momentum while confronting external uncertainties and ever-advancing competitors by shoring up its finances, leading with security, obsessively supporting developers, and crafting targeted regional strategies.

Frequently Asked Questions

What are Fastly’s most significant strengths?

Fastly’s main strengths include its blazing fast edge network, developer-friendly programmable platform, long-term enterprise customer base, robust security capabilities, and experienced new leadership team.

What are the biggest threats and challenges facing Fastly?

Key threats Fastly faces are growing competition from CDN rivals and cloud platforms, tightening enterprise IT budgets, ongoing price sensitivity in the CDN market, potential security incidents, and technology shifts that reduce demand for dedicated edge solutions.

What is Fastly’s revenue model?

Fastly generates revenue primarily from usage-based fees from customers leveraging its edge cloud services. The company follows a land-and-expand model, growing spending from enterprise accounts over time.

How does Fastly’s technology work?

Fastly operates a software-defined edge cloud network, with powerful POPs closer to user populations than legacy CDNs. This allows Fastly to accelerate and optimize content and apps by reducing the distance data needs to travel.

How can Fastly sustain growth in a competitive market?

Fastly can sustain strong growth through geographic expansion, cross-selling additional on-platform services to its enterprise customer base, capturing share in growing markets like security, and continuing to empower the developer community.

Who are Fastly’s main competitors?

Fastly competes with large cloud platforms like AWS and Azure and CDN rivals like Akamai, Cloudflare, and Limelight Networks. New edge-focused players also threaten Fastly, especially in Asia-Pacific markets.

What is Fastly's strategy for international expansion?

Fastly can expand internationally by establishing local POPs and sales presences optimized for critical regions, crafting solutions tailored to individual country regulatory and data residency policies, and fostering partnerships with global SIs and technology vendors.

Fastly SWOT Analysis PowerPoint Template

free and fully editable PPT template

A SWOT analysis evaluates the strengths, weaknesses, opportunities, and threats impacting a company.

This free editable PowerPoint template provides a SWOT analysis framework to evaluate fastly' internal strengths and weaknesses and external opportunities and threats.

fastly SWOT Analysis Slide Deck

Fastly SWOT Analysis PowerPoint Template

Fastly SWOT Analysis PDF Template

Discover more

Clickworthy Resources

SWOT Analysis: Free PowerPoint Template

This PowerPoint slide deck contains five different layouts to complete a SWOT analysis.

New! SWOT Framework & Free PPT Template - 2024 Edition

Dive into the 2024 Edition of our SWOT Analysis guide, complete with a free PowerPoint template. This resource covers the essentials of conducting a SWOT analysis, its benefits, and practical application tips, including a case study on Mercedes Benz.

Salesforce SWOT Analysis: Free PPT Template and In-Depth Insights 2024

Unlock the potential of Salesforce in 2024 with our in-depth SWOT analysis. Explore a detailed examination of Salesforce's strengths, weaknesses, opportunities, and threats within the CRM and cloud computing arenas.

Strategic Insights 2024: A SWOT Analysis of SAP (incl. FREE PPT)

Explore SAP's future with our Strategic Insights 2024: SWOT Analysis. FREE PowerPoint template included. Gain key strategies for growth.